Albertsons 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

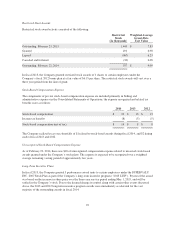

The grant date fair value used to determine compensation expense associated with the performance grant was

calculated utilizing a Monte Carlo simulation. The grant date fair value of the 2013 LTIP award was $1.38 per

award unit. The amount of the awards outstanding was insignificant as of February 22, 2014. The assumptions

related to the valuation of the Company’s 2013 LTIP consisted of the following:

2013

Dividend yield 4.1%

Volatility rate 45.8%

Risk-free interest rate 0.4%

Expected life 3.0 years

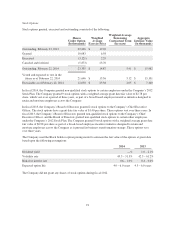

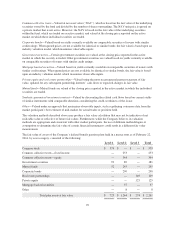

NOTE 10—NET EARNINGS (LOSS) PER SHARE

The following table reflects the calculation of basic and diluted net earnings (loss) per share:

2014 2013 2012

Net earnings (loss) per share—basic:

Net earnings (loss) from continuing operations available to

common stockholders $ 6 $ (263) $ (110)

Weighted average shares outstanding—basic 255 212 212

Net earnings (loss) from continuing operations per share—basic $ 0.02 $ (1.24) $ (0.52)

Income (loss) from discontinued operations, net of tax, available

to common stockholders $ 176 $ (1,203) $ (930)

Weighted average shares outstanding—basic 255 212 212

Net earnings (loss) from discontinued operations per share—basic $ 0.69 $ (5.67) $ (4.39)

Net earnings (loss) available to common stockholders $ 182 $ (1,466) $ (1,040)

Weighted average shares outstanding—basic 255 212 212

Net earnings (loss) per share—basic $ 0.71 $ (6.91) $ (4.91)

Net earnings (loss) per share—diluted:

Net earnings (loss) from continuing operations available to

common stockholders $ 6 $ (263) $ (110)

Weighted average shares outstanding—basic 255 212 212

Dilutive impact of stock-based awards 3 — —

Weighted average shares outstanding—diluted 258 212 212

Net earnings (loss) from continuing operations per share—diluted $ 0.02 $ (1.24) $ (0.52)

Income (loss) from discontinued operations, net of tax, available

to common stockholders $ 176 $ (1,203) $ (930)

Weighted average shares outstanding—basic 255 212 212

Dilutive impact of stock-based awards 3 — —

Weighted average shares outstanding—diluted 258 212 212

Net earnings (loss) from discontinued operations per share—diluted $ 0.68 $ (5.67) $ (4.39)

93