Albertsons 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

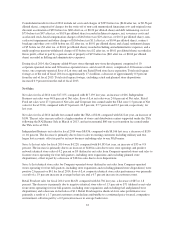

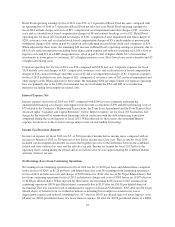

ITEM 6. SELECTED FINANCIAL DATA

(Dollars and shares in millions, except

percent and per share data)

2014

(52 weeks)

2013

(52 weeks)

2012

(52 weeks)

2011

(52 weeks)

2010

(52 weeks)

Results of Operations

Net sales (1) $ 17,155 $ 17,139 $ 17,383 $ 17,407 $ 18,274

Gross profit (1) 2,532 2,336 2,457 2,450 2,625

Goodwill and intangible asset impairment charges — 6 92 110 —

Operating earnings (loss) (2) 418 (157) 96 (30) 289

Net earnings (loss) from continuing operations (2)(3) 6 (263) (110) (200) 50

Net earnings (loss) 182 (1,466) (1,040) (1,510) 393

Net earnings (loss) from continuing operations per share—diluted (2)(3) 0.02 (1.24) (0.52) (0.94) 0.24

Financial Position of Continuing Operations

Working capital (4) 254 38 (169) (269) (461)

Total assets (5) 4,374 4,563 5,057 5,062 5,390

Total debt and capital lease obligations 2,777 2,889 3,226 3,654 3,620

Stockholders’ (deficit) equity (738) (1,415) 21 1,340 2,887

Other Statistics

Dividends declared per share $ — $ 0.0875 $ 0.3500 $ 0.3500 $ 0.6100

Weighted average shares outstanding—diluted (6) 258 212 212 212 213

Depreciation and amortization $ 302 $ 365 $ 355 $ 354 $ 368

Capital expenditures (7) $ 113 $ 241 $ 403 $ 323 $ 338

Adjusted EBITDA (8) $ 772 $ 493 $ 574 $ 526 $ 680

Stores Supplied and Operated:

Independent Business Primary Stores 1,819 1,901 1,948 1,902 1,944

Independent Business Secondary Stores 424 441 765 796 549

Save-A-Lot licensee stores 948 950 935 899 859

Save-A-Lot corporate stores 382 381 397 381 333

Retail Food stores 190 191 191 193 201

Total number of stores 3,763 3,864 4,236 4,171 3,886

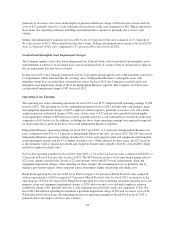

(1) The Company earned $42, $47, $50 and $66 of fees under a transition service agreement in fiscal 2013, 2012, 2011 and

2010, respectively, which were previously recorded as reductions of selling and administrative expenses, but are now

recorded within Net sales as presented above. Refer to Note 1 – Summary of Significant Accounting Policies within Part

II, Item 8 of this Annual Report on Form 10-K for additional information.

(2) Pre-tax items recorded in fiscal 2014 included $46 of severance costs and accelerated stock-based compensation charges,

$16 of non-cash asset impairment and other charges, $6 of contract breakage and other costs, a $5 legal settlement

charge, and a $3 multi-employer pension withdrawal charge, offset in part by a $15 gain on sale of property.

Pre-tax items recorded in fiscal 2013 included $227 of non-cash asset impairment and other charges, $36 of severance

costs and a multiemployer pension withdrawal charge, $22 of store closure impairment charges and costs and $6 of non-

cash intangible asset impairment charges, offset in part by $10 in a cash settlement received from credit card companies.

Pre-tax items recorded in fiscal 2012 included $92 of non-cash goodwill impairment charges and severance costs of $15.

Pre-tax items recorded in fiscal 2011 included $110 of non-cash goodwill impairment charges, $49 of store closures and

retail market exit charges and costs, and $38 of charges for severance, labor buyout and other costs.

Pre-tax items recorded in fiscal 2010 included $36 of charges for retail market exits in Cincinnati and fees received of

$13 from the early termination of a supply agreement.

(3) Pre-tax items recorded in fiscal 2014 included $99 of non-cash unamortized financing cost charges and original issue

discount acceleration and $75 of debt refinancing costs, both reflected within interest expense, net.

A pre-tax item recorded in fiscal 2013 included $22 of non-cash unamortized financing charges within interest expense,

net.

28