Albertsons 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

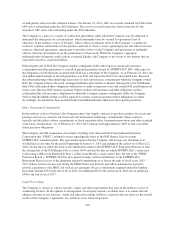

UNAUDITED QUARTERLY FINANCIAL INFORMATION

(In millions, except per share data)

Unaudited quarterly financial information for SUPERVALU INC. and subsidiaries is as follows:

2014

First

(16 weeks)

Second

(12 weeks)

Third

(12 weeks)

Fourth

(12 weeks)

Fiscal Year

(52 weeks)

Net sales (1) $ 5,242 $ 3,948 $ 4,012 $ 3,953 $ 17,155

Gross profit $ 796 $ 577 $ 569 $ 590 $ 2,532

Net (loss) earnings from continuing

operations (2) $ (105) $ 39 $ 32 $ 40 $ 6

Net earnings $ 85 $ 40 $ 31 $ 26 $ 182

Net (loss) earnings per share from

continuing operations—diluted (3) $ (0.43) $ 0.15 $ 0.12 $ 0.15 $ 0.02

Net earnings per share—diluted $ 0.34 $ 0.15 $ 0.12 $ 0.10 $ 0.70

Dividends declared per share $ — $ — $ — $ — $ —

Weighted average shares—diluted 250 261 262 261 258

2013

First

(16 weeks)

Second

(12 weeks)

Third

(12 weeks)

Fourth

(12 weeks)

Fiscal Year

(52 weeks)

Net sales (1) $ 5,250 $ 3,939 $ 4,051 $ 3,899 $ 17,139

Gross profit $ 720 $ 529 $ 530 $ 557 $ 2,336

Net loss from continuing operations (5) $ (18) $ (56) $ (15) $ (174) $ (263)

Net earnings (loss) $ 41 $ (111) $ 16 $ (1,412) $ (1,466)

Net loss per share from continuing

operations—diluted (3) $ (0.08) $ (0.26) $ (0.07) $ (0.82) $ (1.24)

Net earnings (loss) per share—diluted (4) $ 0.19 $ (0.52) $ 0.08 $ (6.65) $ (6.91)

Dividends declared per share $ 0.0875 $ — $ — $ — $ 0.0875

Weighted average shares—diluted 214 212 214 212 212

(1) During the second quarter of fiscal 2014, the Company revised its presentation of fees earned under its

transition services agreements. The Company historically presented fees earned under its transition services

agreements as a reduction of Selling and administrative expenses. The presentation of such fees earned has

been revised and they are now reflected as revenue, within Net sales of Corporate, for all periods. The

revision had the effect of increasing both Net sales and Gross profit, with a corresponding increase in

Selling and administrative expenses. These revisions did not impact Operating earnings (loss), Loss from

continuing operations before income taxes, Net earnings (loss), cash flows, or financial position for any

period reported.

(2) Results from continuing operations for the fiscal year ended February 22, 2014 include net costs and charges

of $235 before tax ($144 after tax, or $0.56 per diluted share), comprised of charges for the write-off of non-

cash unamortized financing costs and original issue discount acceleration of $99 before tax ($60 after tax, or

$0.24 per diluted share) and debt refinancing costs of $75 before tax ($47 after tax, or $0.18 per diluted

share) recorded in Interest expense, net, severance costs and accelerated stock-based compensation charges

of $46 before tax ($29 after tax, or $0.11 per diluted share), non-cash asset impairment and other charges of

113