Albertsons 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Due to the ongoing business transformation and highly competitive environment, the Company will continue to

evaluate its long-lived asset policy and current asset groups, to determine if additional modifications to the policy

are necessary. Future changes to the Company’s assessment of its long-lived asset policy and changes in

circumstances, operating results or other events may result in additional asset impairment testing and charges.

During fiscal 2013, the Company announced the closure of approximately 22 non-strategic stores within the

Save-A-Lot segment including the exit of a geographic market, resulting in an impairment of $16 related to these

stores’ long-lived assets. See Note 3—Reserves for Closed Properties and Property, Plant and Equipment-Related

Impairment Charges.

Deferred Rent

The Company recognizes rent holidays, including the time period during which the Company has access to the

property prior to the opening of the site, as well as construction allowances and escalating rent provisions, on a

straight-line basis over the term of the operating lease. The deferred rents are included in Other current liabilities

and Other long-term liabilities in the Consolidated Balance Sheets.

Self-Insurance Liabilities

The Company uses a combination of insurance and self-insurance for workers’ compensation, automobile and

general liability costs. It is the Company’s policy to record its insurance liabilities based on management’s

estimate of the ultimate cost of reported claims and claims incurred but not yet reported and related expenses,

discounted at a risk-free interest rate. The present value of such claims was calculated using discount rates

ranging from 0.3 percent to 5.1 percent for fiscal 2014 and 0.4 percent to 5.1 percent for fiscal 2013 and 2012.

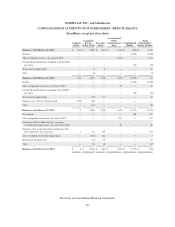

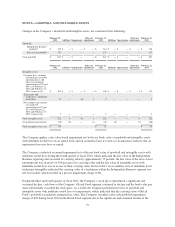

Changes in the Company’s insurance liabilities consisted of the following:

2014 2013 2012

Beginning balance $ 97 $ 93 $ 96

Expense 39 31 22

Claim payments (33) (27) (25)

Ending balance 103 97 93

Less current portion (33) (27) (26)

Long-term portion $ 70 $ 70 $ 67

The current portion of reserves for self-insurance is included in Other current liabilities and the long-term portion

is included in Other long-term liabilities in the Consolidated Balance Sheets. The insurance liabilities as of the

end of the fiscal year are net of discounts of $7 as of February 22, 2014 and February 23, 2013.

Benefit Plans

The Company recognizes the funded status of its Company sponsored defined benefit plans in its Consolidated

Balance Sheets and gains or losses and prior service costs or credits not yet recognized as a component of Other

comprehensive income (loss), net of tax, in the Consolidated Statements of Stockholders’ (Deficit) Equity. The

Company sponsors pension and other postretirement plans in various forms covering substantially all employees

who meet eligibility requirements. The determination of the Company’s obligation and related expense for

Company-sponsored pension and other postretirement benefits is dependent, in part, on management’s selection

of certain actuarial assumptions in calculating these amounts. These assumptions include, among other things,

the discount rate, the expected long-term rate of return on plan assets and the rates of increase in compensation

75