Albertsons 2014 Annual Report Download - page 92

Download and view the complete annual report

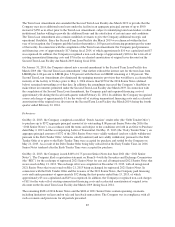

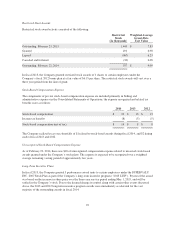

Please find page 92 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock Plan, 2002 Stock Plan, 1997 Stock Plan, Albertsons Amended and Restated 1995 Stock-Based Incentive

Plan and the Albertsons 2004 Equity and Performance Incentive Plan. The Company’s 2012 Stock Plan, as

approved by stockholders in fiscal 2013, is the only plan under which stock-based awards may be granted. The

2012 Stock Plan provides that the Board of Directors or the Leadership Development and Compensation

Committee of the Board (the “Compensation Committee”) may determine at the time of grant whether each

stock-based award granted will be a non-qualified or incentive stock-based award under the Internal Revenue

Code of 1986, as amended (the “Internal Revenue Code”). The terms of each stock-based award will be

determined by the Board of Directors or the Compensation Committee. Generally, stock-based awards granted

prior to fiscal 2006 have a term of 10 years from fiscal 2006 to fiscal 2012 stock-based awards granted generally

have a term of seven years, and starting in fiscal 2013 stock-based awards granted generally have a term of 10

years.

Stock options are granted to key salaried employees and have been granted to the Company’s non-employee

directors to purchase common stock at an exercise price not less than 100 percent of the fair market value of the

Company’s common stock on the date of grant. Prior to fiscal 2013, stock options vested over four years and

starting in fiscal 2013, stock options vest in three years. Restricted stock awards are also awarded to key salaried

employees. The vesting of restricted stock awards is determined at the discretion of the Board of Directors or its

Compensation Committee. The restrictions on the restricted stock awards generally lapse between one and five

years from the date of grant and the expense is recognized over the lapsing period. Performance awards as part of

the long-term incentive program are granted to key salaried employees.

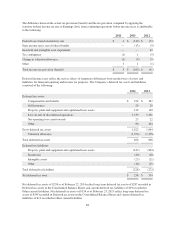

As of February 22, 2014, there were 12 reserved shares under the 2012 Stock Plan available for stock-based

awards. Common stock is delivered out of treasury stock upon the exercise of stock-based awards. The

provisions of future stock-based awards may change at the discretion of the Board of Directors or its

Compensation Committee.

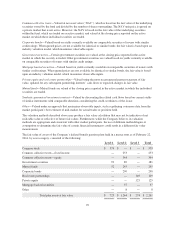

On March 20, 2013, the Company completed the Tender Offer and issued common stock to Symphony Investors,

which the Company’s Board of Directors deemed to be a change-in-control for purposes of the Company’s

outstanding stock-based awards, immediately accelerating the vesting of certain stock-based awards. The deemed

change-in-control in conjunction with certain other events resulted in the immediate acceleration of certain

additional stock-based awards. As a result of this action, the 2013 and 2012 long-term incentive program awards

were immediately accelerated for the vast majority of the outstanding awards resulting in the recognition of the

remaining unamortized stock-based compensation expense. However, as the exercise price for the vast majority

of these awards was greater than the market price of the Company’s common stock at such time, the cash pay-out

to management and employees was insignificant. Outstanding options granted prior to May of fiscal 2010 were

also immediately accelerated resulting in the recognition of the remaining unamortized costs. In addition, the

deemed change-in-control resulted in the acceleration of options and restricted stock awards granted after May of

fiscal 2010 for certain employees meeting qualifying criteria. The Company recognized $9 of accelerated stock-

based compensation charges in Selling and administrative expenses in fiscal 2014 as a result of the deemed

change-in-control, comprised of $5 from long-term incentive programs, $3 from restricted stock awards and $1

from stock options.

90