Albertsons 2014 Annual Report Download - page 37

Download and view the complete annual report

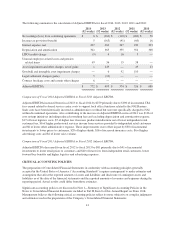

Please find page 37 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Retail Food operating earnings for fiscal 2014 were $72, or 1.6 percent of Retail Food net sales, compared with

an operating loss of $160 or 3.4 percent of Retail Food net sales last year. Retail Food operating earnings for

fiscal 2014 include charges and costs of $19, comprised of asset impairment and other charges of $9, severance

costs and accelerated stock-based compensation charges of $8 and contract breakage costs of $2. Retail Food

operating loss for fiscal 2013 included net charges of $202, comprised of asset impairment and other charges of

$203, severance costs and accelerated stock-based compensation charges of $5, a multi-employer pension plan

withdrawal charge of $4, offset in part by a gain on cash settlement received from credit card companies of $10.

When adjusted for these items, the remaining $49 increase in Retail Food’s operating earnings is primarily due to

$83 of cost reduction initiatives including lower depreciation expense and reduced consulting fees, $14 of lower

logistics costs and $11 of a LIFO charge decrease, offset in part by $20 of higher shrink, $17 of incremental

investments to lower prices to customers, $11 of higher insurance costs, $8 of lower lease reserve benefits and $3

of higher advertising costs.

Corporate operating loss for fiscal 2014 was $56, compared with $339 last year. Corporate expenses for fiscal

2014 include costs and charges of $24, comprised of severance costs and accelerated stock-based compensation

charges of $19, contract breakage and other costs of $3 and asset impairment charges of $2. Corporate expenses

for fiscal 2013 included costs and charges of $21, comprised of severance costs of $15 and asset impairment and

other charges of $6. When adjusted for these items, the remaining $286 net improvement in Corporate operating

loss was primarily due to the $198 of incremental fees received under the TSA and $89 of cost reduction

initiatives including lower employee-related costs.

Interest Expense, Net

Interest expense, net for fiscal 2014 was $407, compared with $269 last year, primarily reflecting the

unamortized financing cost charges and original issue discount acceleration of $99 and debt refinancing costs of

$75 related to the Company’s Refinancing Transactions, the Term Loan Amendment and the Debt Tender Offer

discussed under “Liquidity and Capital Resources” below. Interest expense, net for fiscal 2013 included a $22

charge for the write-off of unamortized financing costs in connection with the debt refinancing transaction

completed during the second quarter of fiscal 2013. When adjusted for these items, the remaining Interest

expense, net decrease is due to lower average interest rates on outstanding borrowings.

Income Tax Provision (Benefit)

Income tax expense for fiscal 2014 was $5, or 50.6 percent of income before income taxes, compared with an

income tax benefit of $163, or 38.4 percent of loss before income taxes, last year. The tax rate for fiscal 2014

included certain insignificant discrete tax items that together gave rise to the difference between the combined

federal and state statutory tax rates and the effective tax rate. Income tax benefit for fiscal 2013 reflects the

operating losses arising during the period and an overall effective tax rate approximating the combined federal

and state statutory tax rate.

Net Earnings (Loss) from Continuing Operations

Net earnings from continuing operations for fiscal 2014 was $6, or $0.02 per basic and diluted share, compared

with a net loss of $263, or $1.24 per basic and diluted share last year. Net earnings from continuing operations

for fiscal 2014 includes net costs and charges of $235 before tax ($144 after tax, or $0.56 per diluted share). Net

loss from continuing operations for fiscal 2013 included net charges and costs of $303 before tax ($187 after tax,

or $0.88 per diluted share). When adjusted for these items, the remaining $226 increase in Net earnings from

continuing operations ($0.94 per diluted share) is primarily due to $117 after tax ($0.50 per diluted share) of

incremental TSA fees earned related to administrative support of divested NAI banners, $105 after tax ($0.44 per

diluted share) of benefits from cost reduction initiatives including lower employee-related costs, lower

depreciation expense and reduced consulting fees, $17 after tax ($0.07 per diluted share) of lower logistics costs,

$8 after tax ($0.03 per diluted share) of a lower interest expense, $8 after tax ($0.03 per diluted share) of a LIFO

35