Albertsons 2014 Annual Report Download - page 116

Download and view the complete annual report

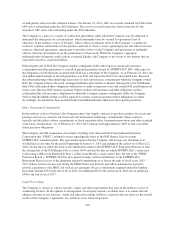

Please find page 116 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$16 before tax ($11 after tax, or $0.04 per diluted share), contract breakage and other costs of $6 before tax

($2 after tax, or $0.01 per diluted share) and a legal settlement charge of $5 before tax ($3 after tax, or $0.01

per diluted share) recorded in Selling and administrative expenses, and a multi-employer pension

withdrawal charge of $3 before tax ($2 after tax, or $0.01 per diluted share) recorded in Gross profit, offset

in part by a gain on sale of property of $15 before tax ($10 after tax, or $0.04 per diluted share) recorded in

Selling and administrative expenses.

(3) As a result of the net loss for the first quarter during fiscal 2014 and four quarters of fiscal 2013, all

potentially dilutive shares were antidilutive and therefore excluded from the calculation of Net loss per

share from continuing operations—diluted for these periods.

(4) As a result of the net loss for the second and fourth quarters during fiscal 2013, all potentially dilutive shares

were antidilutive and therefore excluded from the calculation of Net loss per share—diluted for these

periods.

(5) Results from continuing operations for the fiscal year ended February 23, 2013 included net charges and

costs of $303 before tax ($187 after tax, or $0.88 per diluted share), comprised of non-cash asset impairment

and other charges of $227 before tax ($140 after tax, or $0.66 per diluted share) and multi-employer pension

withdrawal liability and severance costs of $36 before tax ($23 after tax, or $0.10 per diluted share)

recorded in Selling and administrative expenses, a non-cash charge for the write-off unamortized financing

costs of $22 before tax ($14 after tax, or $0.07 per diluted share) recorded in Interest expense, net, and store

closure impairment charges of $22 before tax ($13 after tax, or $0.06 per diluted share) and intangible asset

impairment charges of $6 before tax ($3 after tax, or $0.02 per diluted share), offset in part by a cash

settlement received from credit card companies of $10 before tax ($6 after tax or, $0.03 per diluted share)

recorded in Selling and administrative expenses.

114