Albertsons 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

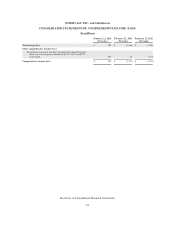

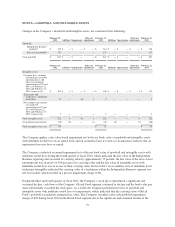

Food costs as a part of the Company’s segment reclassification described above. The revision had the effect of

decreasing Retail Food’s operating earnings by $20 as reported in the Company’s Quarterly Reports on Form 10-

Q for the first quarter of fiscal 2014 and the year-to-date presentation of the results in the second and third

quarters of fiscal 2014. A corresponding increase in Corporate operating earnings of $20 also occurred. The

revision did not have an impact on consolidated Operating earnings for any period. Management has determined

that the change in presentation is not material to any period reported.

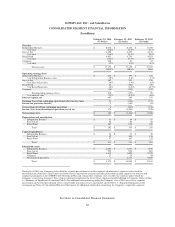

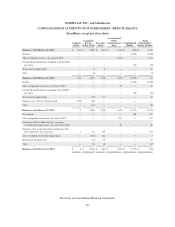

The following table represents the effect of the segment revision of certain administrative costs in the Company’s

Consolidated Segment Financial for the Quarterly Report on Form 10-Q for the period ended June 15, 2013.

First Quarter Ended

June 15, 2013

Year-to-Date Ended

September 7, 2013

Year-to-Date Ended

November 30, 2013

As

Originally

Reported Revision

As

Revised

As

Originally

Reported Revision

As

Revised

As

Originally

Reported Revision

As

Revised

Operating earnings

Independent Business $ 55 $ — $ 55 $ 128 $ — $ 128 $ 181 $ — $ 181

% of Independent

Business sales 2.3% —% 2.3% 3.0% —% 3.0% 2.9% —% 2.9%

Save-A-Lot 52 — 52 84 — 84 124 — 124

% of Save-A-Lot sales 4.1% —% 4.1% 3.7% —% 3.7% 3.8% —% 3.8%

Retail Food 25 (20) 5 32 (20) 12 56 (20) 36

% of Retail Food sales 1.7% (1.4)% 0.3% 1.3% (0.8)% 0.5% 1.6% (0.6)% 1.0%

Corporate (50) 20 (30) (50) 20 (30) (62) 20 (42)

Total operating

earnings $ 82 $ — $ 82 $ 194 $ — $ 194 $ 299 $ — $ 299

% of total net sales 1.6% —% 1.6% 2.1% —% 2.1% 2.3% —% 2.3%

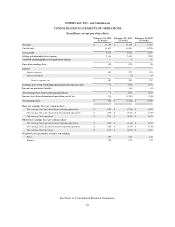

Revenue Recognition

Revenues from product sales are recognized upon delivery for the Independent Business segment, at the point of

sale for Save-A-Lot’s retail operations, and upon delivery for Save-A-Lot’s independent licensees, and at the

point of sale for the Retail Food segment. Typically, invoicing, shipping, delivery and customer receipt of

Independent Business product occur on the same business day. Revenues from services rendered are recognized

immediately after such services have been provided. Discounts and allowances provided to customers by the

Company at the time of sale, including those provided in connection with loyalty cards, are recognized as a

reduction in Net sales as the products are sold to customers. Sales tax is excluded from Net sales.

Revenues and costs from third-party logistics operations are recorded gross when the Company is the primary

obligor in a transaction, is subject to inventory or credit risk, has latitude in establishing price and selecting

suppliers, or has several, but not all of these indicators. If the Company is not the primary obligor and amounts

earned have little or no inventory or credit risk, revenue is recorded net as management fees when earned.

Cost of Sales

Cost of sales in the Consolidated Statements of Operations includes cost of inventory sold during the period,

including purchasing, receiving, warehousing and distribution costs, and shipping and handling fees.

Save-A-Lot and Retail Food advertising expenses are a component of Cost of sales and are expensed as incurred.

Save-A-Lot and Retail Food advertising expenses, net of cooperative advertising reimbursements, were $63, $86

and $69 for fiscal 2014, 2013 and 2012, respectively.

70