Albertsons 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

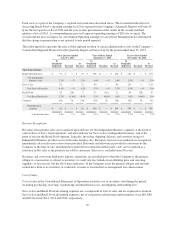

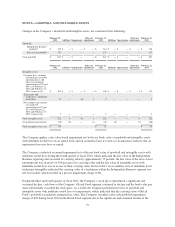

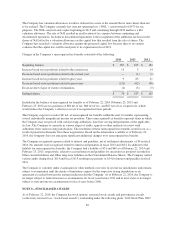

NOTE 2—GOODWILL AND INTANGIBLE ASSETS

Changes in the Company’s Goodwill and Intangible assets, net consisted of the following:

February 25,

2012 Additions Impairments

Other net

adjustments

February 23,

2013 Additions Impairments

Other net

adjustments

February 22,

2014

Goodwill:

Independent Business

goodwill $ 710 $ — $ — $ — $ 710 $ — $ — $ — $ 710

Save-A-Lot goodwill 137 — — — 137 — — — 137

Total goodwill $ 847 $ — $ — — $ 847 $ — $ — — $ 847

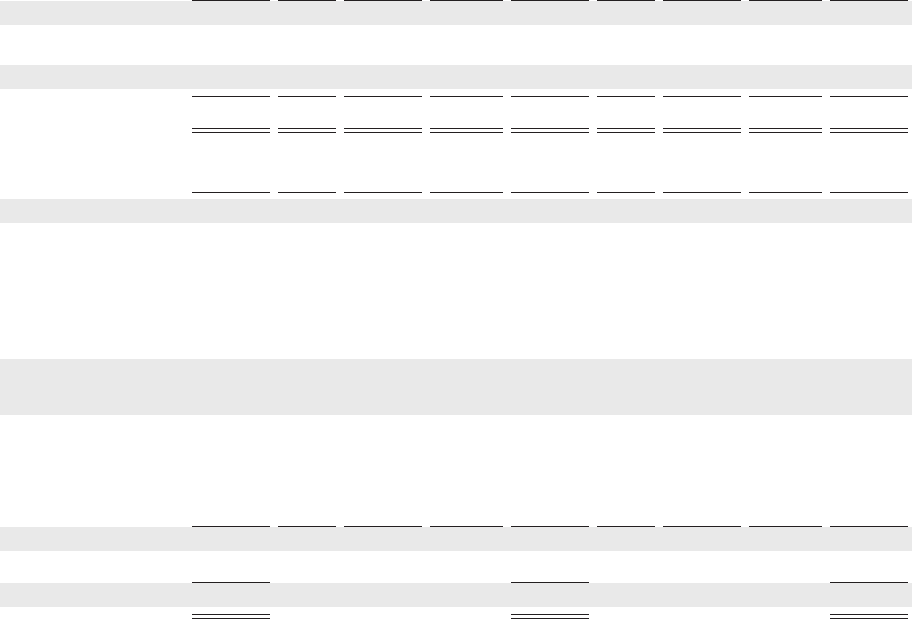

February 25,

2012 Additions Impairments

Other net

adjustments

February 23,

2013 Additions Impairments

Other net

adjustments

February 22,

2014

Intangible assets:

Customer lists, customer

relationships, favorable

operating leases and

other (accumulated

amortization of $78 and

$65 as of February 22,

2014 and February 23,

2013, respectively) $ 105 $ 1 $ — $ — $ 106 $ — $ — $ 5 $ 111

Trademarks and

tradenames—indefinite

useful lives 14 — (6) 1 9 — — — 9

Non-compete agreements

(accumulated

amortization of $2 and

$2 as of February 22,

2014 and February 23,

2013, respectively) 3 — — — 3 — — — 3

Total intangible assets 122 1 (6) 1 118 — — 5 123

Accumulated amortization (58) (8) — (1) (67) (8) — (5) (80)

Total intangible assets, net $ 64 $ 51 $ 43

The Company applies a fair value based impairment test to the net book value of goodwill and intangible assets

with indefinite useful lives on an annual basis and on an interim basis if events or circumstances indicate that an

impairment loss may have occurred.

The Company conducted an annual impairment test of the net book value of goodwill and intangible assets with

indefinite useful lives during the fourth quarter of fiscal 2014, which indicated the fair value of the Independent

Business reporting unit exceeded its carrying value by approximately 75 percent, the fair value of the Save-A-Lot

reporting unit was in excess of 100 percent of its carrying value and the fair value of intangible assets with

indefinite useful lives was in excess of their carrying value. In fiscal 2013, recoverability tests of indefinite-lived

tradename intangibles indicated the carrying value of a tradename within the Independent Business segment was

not recoverable, which resulted in a pre-tax impairment charge of $6.

During the third and fourth quarter of fiscal 2012, the Company’s stock price experienced a significant and

sustained decline, cash flows of the Company’s Retail Food segment continued to decline and the book value per

share substantially exceeded the stock price. As a result, the Company performed reviews of goodwill and

intangible assets with indefinite useful lives for impairment, which indicated that the carrying value of Retail

Food’s goodwill exceeded its estimated fair value. The Company recorded a non-cash goodwill impairment

charge of $92 during fiscal 2012 in the Retail Food segment due to the significant and sustained decline in the

79