Albertsons 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

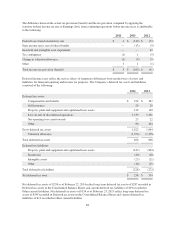

Company’s market capitalization and updated discounted cash flows. The calculation of the impairment charges

contains significant judgments and estimates including weighted average cost of capital, future revenue,

profitability, cash flows and fair values of assets and liabilities.

Amortization expense of intangible assets with definite useful lives of $8 was recorded in fiscal 2014, 2013 and

2012. Future amortization expense will average approximately $5 per year for the next five years.

NOTE 3—RESERVES FOR CLOSED PROPERTIES AND PROPERTY, PLANT AND EQUIPMENT-

RELATED IMPAIRMENT CHARGES

Reserves for Closed Properties

The Company maintains reserves for costs associated with closures of retail stores, distribution centers and other

properties that are no longer being utilized in current operations. The Company provides for closed property

operating lease liabilities using a discount rate to calculate the present value of the remaining noncancellable

lease payments after the closing date, reduced by estimated subtenant rentals that could be reasonably obtained

for the property. Adjustments to closed property reserves primarily relate to changes in subtenant income or

actual exit costs differing from original estimates.

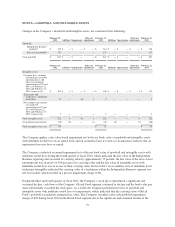

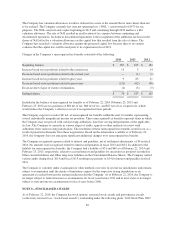

Changes in the Company’s reserves for closed properties consisted of the following:

2014 2013 2012

Beginning balance $ 61 $ 72 $ 96

Additions 416 9

Payments (16) (22) (26)

Adjustments (2) (5) (7)

Ending balance $ 47 $ 61 $ 72

Property, Plant and Equipment and Lease Reserve Impairment Charges

Property, plant and equipment and lease reserve impairment charges are recorded as a component of Selling and

administrative expenses in the Consolidated Statements of Operations. The calculation of the closed property

charges requires significant judgments and estimates including estimated subtenant rentals, discount rates, and

future cash flows based on the Company’s experience and knowledge of the market in which the closed property

is located, and previous efforts to dispose of similar assets and existing market conditions.

In fiscal 2014, property, plant and equipment-related assets with a carrying amount of $45 were written down to

their fair value of $21, resulting in impairment charges of $24. Fiscal 2014 impairment charges primarily related

to software projects primarily within the Retail Food segment, distribution centers within Independent Business

and previously impaired Save-A-Lot stores. In fiscal 2013, property, plant and equipment-related assets with a

carrying amount of $291 were written down to their fair value of $40, resulting in impairment charges of $251.

Fiscal 2013 impairment charges primarily related to certain capital projects in process, mainly related to software

under development, and certain other software support tools that the executive management team determined the

Company would abandon, all within the Retail Food segment and Corporate, and the announced closing of

approximately 22 non-strategic Save-A-Lot stores. In fiscal 2012, property, plant and equipment-related assets

with a carrying amount of $10 were written down to their fair value of $7, resulting in impairment charges of $3.

Property, plant and equipment and favorable operating lease intangible related impairment charges were

measured at fair value on a nonrecurring basis using Level 3 inputs and are a component of Selling and

administrative expenses in the Consolidated Statements of Operations.

80