Albertsons 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Multiemployer Postretirement Benefit Plans Other than Pensions

The Company also makes contributions to multiemployer health and welfare plans in amounts set forth in the

related collective bargaining agreements. These plans provide medical, dental, pharmacy, vision, and other

ancillary benefits to active employees and retirees as determined by the trustees of each plan. The vast majority

of the Company’s contributions benefit active employees and as such, may not constitute contributions to a

postretirement benefit plan. However, the Company is unable to separate contribution amounts to postretirement

benefit plans from contribution amounts paid to benefit active employees.

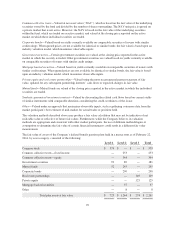

The Company contributed $87, $90 and $90 for fiscal 2014, 2013 and 2012, respectively, to multiemployer

health and welfare plans. If healthcare provisions within these plans cannot be renegotiated in a manner that

reduces the prospective healthcare cost as the Company intends, the Company’s Selling and administrative

expenses could increase in the future.

Collective Bargaining Agreements

As of February 22, 2014, the Company had approximately 35,800 employees. Approximately 15,300 employees

are covered by collective bargaining agreements. During fiscal 2014, 20 collective bargaining agreements

covering 8,200 employees were renegotiated and two collective bargaining agreements covering approximately

100 employees expired without their terms being renegotiated. Negotiations are expected to continue with the

bargaining units representing the employees subject to those agreements. During fiscal 2015, 23 collective

bargaining agreements covering approximately 11,800 employees are scheduled to expire.

NOTE 12—COMMITMENTS, CONTINGENCIES AND OFF-BALANCE SHEET ARRANGEMENTS

Guarantees

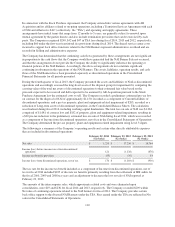

The Company has outstanding guarantees related to certain leases, fixture financing loans and other debt obligations

of various retailers as of February 22, 2014. These guarantees were generally made to support the business growth

of independent retail customers. The guarantees are generally for the entire terms of the leases or other debt

obligations with remaining terms that range from less than one year to 16 years, with a weighted average remaining

term of approximately nine years. For each guarantee issued, if the independent retail customer defaults on a

payment, the Company would be required to make payments under its guarantee. Generally, the guarantees are

secured by indemnification agreements or personal guarantees of the independent retail customer.

The Company reviews performance risk related to its guarantees of independent retail customers based on

internal measures of credit performance. As of February 22, 2014, the maximum amount of undiscounted

payments the Company would be required to make in the event of default of all guarantees was $78 and

represented $57 on a discounted basis. Based on the indemnification agreements, personal guarantees and results

of the reviews of performance risk, the Company believes the likelihood that it will be required to assume a

material amount of these obligations is remote. Accordingly, no amount has been recorded in the Consolidated

Balance Sheets for these contingent obligations under the Company’s guarantee arrangements.

The Company is contingently liable for leases that have been assigned to various third parties in connection with

facility closings and dispositions. The Company could be required to satisfy the obligations under the leases if

any of the assignees are unable to fulfill their lease obligations. Due to the wide distribution of the Company’s

assignments among third parties, and various other remedies available, the Company believes the likelihood that

it will be required to assume a material amount of these obligations is remote.

The Company has guaranteed certain debt obligations of American Stores Company (“ASC”) on ASC’s $467

notes outstanding. In connection with the NAI Banner Sale, AB Acquisition assumed the ASC debt but the

existing guarantee as provided by the Company was not released, and the Company continues as

guarantor. Concurrently with the NAI Banner Sale, AB Acquisition entered into an agreement with the Company

to indemnify the Company for any consideration used to satisfy the guarantee by depositing $467 in cash into an

escrow account, which provides the Company first priority interest and the trustee of the ASC bondholders’

105