Albertsons 2014 Annual Report Download - page 108

Download and view the complete annual report

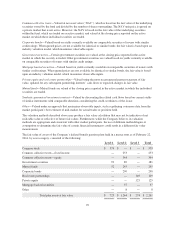

Please find page 108 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.second priority interest in the collateral balance. On January 24, 2014, ASC successfully tendered for $462 of the

$467 notes outstanding under the ASC indenture. The escrow account balance has been reduced to $5, the

amount of ASC notes still outstanding under the ASC indenture.

The Company is a party to a variety of contractual agreements under which the Company may be obligated to

indemnify the other party for certain matters, which indemnities may be secured by operation of law or

otherwise, in the ordinary course of business. These contracts primarily relate to the Company’s commercial

contracts, contracts entered into for the purchase and sale of stock or assets, operating leases and other real estate

contracts, financial agreements, agreements to provide services to the Company and agreements to indemnify

officers, directors and employees in the performance of their work. While the Company’s aggregate

indemnification obligation could result in a material liability, the Company is not aware of any matters that are

expected to result in a material liability.

Following the sale of NAI, the Company remains contingently liable with respect to certain self-insurance

commitments and other guarantees as a result of parental guarantees issued by SUPERVALU INC. with respect to

the obligations of NAI that were incurred while NAI was a subsidiary of the Company. As of February 22, 2014, the

total undiscounted amount of all such guarantees was $331 and represented $297 on a discounted basis. Based on

the settlement listing of the underlying claims data of such self-insurance commitments while the Company owned

NAI, the Company believes that such contingent liabilities will continue to decline. Subsequent to the NAI Banner

Sale, NAI collateralized these obligations with letters of credit to numerous states and certain NAI retail banner real

estate assets. Because NAI remains a primary obligor on these self-insurance and other obligations and has

collateralized the self-insurance obligations for which the Company remains contingently liable, the Company

believes that the likelihood that it will be required to assume a material amount of these obligations is remote.

Accordingly, no amount has been recorded in the Consolidated Balance Sheets for these parent guarantees.

Other Contractual Commitments

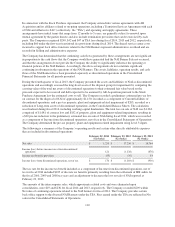

In the ordinary course of business, the Company enters into supply contracts to purchase products for resale and

purchase and service contracts for fixed asset and information technology commitments. These contracts

typically include either volume commitments or fixed expiration dates, termination provisions and other standard

contractual considerations. As of February 22, 2014, the Company had approximately $283 of non-cancelable

future purchase obligations.

The Company and AB Acquisition entered into a binding term sheet with the Pension Benefit Guaranty

Corporation (the “PBGC”) relating to issues regarding the effect of the NAI Banner Sale on certain

SUPERVALU retirement plans. The agreement requires that the Company will not pay any dividends to its

stockholders at any time for the period beginning on January 9, 2013 and ending on the earliest of (i) March 21,

2018, (ii) the date on which the total of all contributions made to the SUPERVALU Retirement Plan on or after

the closing date of the NAI Banner Sale is at least $450 and (iii) the date on which SUPERVALU’s unsecured

credit rating is BB+ from Standard & Poor’s or Ba1 from Moody’s (such earliest date, the end of the “PBGC

Protection Period”). SUPERVALU has also agreed to make certain contributions to the SUPERVALU

Retirement Plan in excess of the minimum required contributions at or before the ends of fiscal years 2015 –

2017 (where such fiscal years end during the PBGC Protection Period), and AB Acquisition has agreed to

provide a guarantee to the PBGC for such excess payments. Excess contributions required under this binding

term sheet include $25 by the end of fiscal 2015, an additional $25 by the end of fiscal 2016 and an additional

$50 by the end of fiscal 2017.

Legal Proceedings

The Company is subject to various lawsuits, claims and other legal matters that arise in the ordinary course of

conducting business. In the opinion of management, based upon currently-available facts, it is remote that the

ultimate outcome of any lawsuits, claims and other proceedings will have a material adverse effect on the overall

results of the Company’s operations, its cash flows or its financial position.

106