Albertsons 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Under the replacement cost method applied on a LIFO basis, the most recent purchase cost is used to calculate

the current cost of inventory before application of any LIFO reserve. The replacement cost approach results in

inventories being valued at the lower of cost or market because of the high inventory turnover and the resulting

low inventory days supply on hand combined with infrequent vendor price changes for these items of inventory.

The Company uses one of either cost, weighted average cost, RIM or replacement cost to value certain discrete

inventory items under the first-in, first-out method (“FIFO”). The replacement cost approach under the FIFO

method is predominantly utilized in determining the value of high turnover perishable items, including Produce,

Deli, Bakery, Meat and Floral.

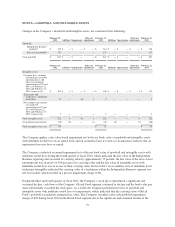

As of February 22, 2014 and February 23, 2013, approximately 25 percent and 23 percent, respectively, of the

Company’s inventories were valued using the cost, weighted average cost and RIM methods under the FIFO

method of inventory accounting. The remaining 18 percent and 17 percent of the Company’s inventories as of

February 22, 2014 and February 23, 2013, respectively, were valued using the replacement cost approach under

the FIFO method of inventory accounting. The replacement cost approach applied under the FIFO method results

in inventories recorded at the lower of cost or market because of the very high inventory turnover and the

resulting low inventory days supply for these items of inventory.

During fiscal 2014, 2013 and 2012, inventory quantities in certain LIFO layers were reduced. These reductions

resulted in a liquidation of LIFO inventory quantities carried at lower costs prevailing in prior years as compared

with the cost of fiscal 2014, 2013 and 2012 purchases. As a result, Cost of sales decreased by $14, $6 and $9 in

fiscal 2014, 2013 and 2012, respectively. If the FIFO method had been used to determine cost of inventories for

which the LIFO method is used, the Company’s inventories would have been higher by approximately $202 and

$211 as of February 22, 2014 and February 23, 2013, respectively.

The Company evaluates inventory shortages throughout each fiscal year based on actual physical counts in its

facilities. Allowances for inventory shortages are recorded based on the results of these counts to provide for

estimated shortages as of the end of each fiscal year.

Reserves for Closed Properties

The Company maintains reserves for costs associated with closures of retail stores, distribution centers and other

properties that are no longer being utilized in current operations. The Company provides for closed property

lease liabilities based on the present value of the remaining noncancellable lease payments after the closing date,

reduced by estimated subtenant rentals that could be reasonably obtained for the property.

The closed property lease liabilities usually are paid over the remaining lease terms, which generally range from

one to 15 years. Adjustments to closed property reserves primarily relate to changes in subtenant income or

actual exit costs differing from original estimates. Adjustments are made for changes in estimates in the period in

which the changes become known.

Business Dispositions

The Company reviews the presentation of planned business dispositions in the Consolidated Financial Statements

based on the available information and events that have occurred.

The review consists of evaluating whether the business meets the definition as a component for which the

operations and cash flows are clearly distinguishable from the other components of the business, and if so,

whether it is anticipated that after the disposal the cash flows of the component would be eliminated from

continuing operations and whether the Company will have any significant continuing involvement with the

business. In addition, the Company evaluates whether the business has met the criteria to be classified as a

business held for sale. In order for a planned disposition to be classified as a business held for sale, the

established criteria must be met as of the reporting date, including an active program to market the business and

the expected disposition of the business within one year.

72