Albertsons 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

other postretirement plan expenses for inactive and corporate participants in the SUPERVALU Retirement Plan

and certain other corporate costs to reflect the structure under which the Company is now managed. These

changes primarily resulted in the recast of net expenses from the Company’s Retail Food segment to Corporate

for all periods presented and as previously reported in the Company’s Annual Report on Form 10-K for the fiscal

year ended February 23, 2013 and February 25, 2012. These changes did not revise or restate information

previously reported in the Company’s Consolidated Financial Statements for any period, except for the

Consolidated Segment Financial Information.

Transition Services Agreement Revision

During the second quarter of fiscal 2014, the Company revised its presentation of fees earned under its transition

services agreements. The Company historically presented fees earned under its transition services agreements as

a reduction of Selling and administrative expenses in the Consolidated Statements of Operations. The

presentation of such fees earned has been revised and they are now reflected as revenue, within Net sales of

Corporate in the Consolidated Statements of Operations and Consolidated Segment Financial Information, for all

periods. The revision had the effect of increasing both Net sales and Gross profit, with a corresponding increase

in Selling and administrative expenses. These revisions did not impact Operating earnings (loss), Earnings (loss)

from continuing operations before income taxes, Net earnings (loss), cash flows, or financial position for any

period reported. Management has determined that the change in presentation is not material to any period

reported. Prior period amounts shown below have been revised to conform to the current period presentation.

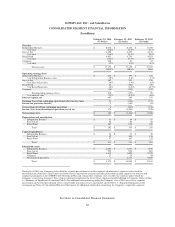

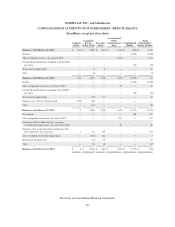

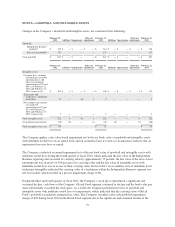

The following table represents the effect of the reclassification of fees earned under transition services

agreements on the Company’s Consolidated Statements of Operations for the comparative periods being

presented in the Consolidated Statements of Operations.

Year Ended February 23, 2013 Year Ended February 25, 2012

As Originally

Reported

% of Net

sales Revision As Revised

% of Net

sales

As Originally

Reported

% of Net

sales Revision

As

Revised

% of Net

sales

Net sales $ 17,097 100.0% $ 42 $ 17,139 100.0% $ 17,336 100.0% $ 47 $17,383 100.0%

Cost of sales 14,803 86.6% — 14,803 86.4% 14,926 86.1% — 14,926 85.9%

Gross profit 2,294 13.4% 42 2,336 13.6% 2,410 13.9% 47 2,457 14.1%

Selling and

administrative

expenses 2,445 14.3% 42 2,487 14.5% 2,222 12.8% 47 2,269 13.1%

Goodwill and

intangible

asset

impairment

charges 6 — — 6 — 92 0.5% — 92 0.5%

Operating (loss)

earnings $ (157) (0.9)% $ — $ (157) (0.9)% $ 96 0.6% $ — $ 96 0.6%

The Company earned $42 and $47 of fees under a previous transition services agreement during fiscal 2013 and

2012, respectively. The Company’s previous transition services agreement with Albertson’s LLC was replaced

with transition services agreements with each of NAI and Albertson’s LLC at the close of the NAI Banner Sale.

See Note 14—Discontinued Operations and Divestitures for additional information regarding the Company’s

transition services agreements. Fees earned under the transition services agreements are recognized as the

administrative services are rendered, which align with the recognition of administrative expenses required to

support the transition services agreements.

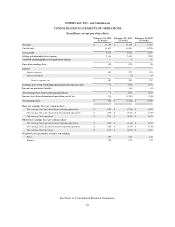

Segment Revision

The Company revised its segment presentation of Operating earnings for Retail Food and Corporate for results

previously reported in the first quarter of fiscal 2014 to reflect certain allocated administrative costs as Retail

69