Albertsons 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

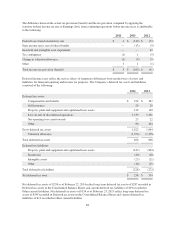

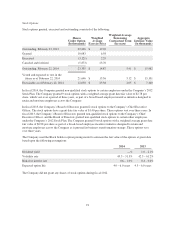

The difference between the actual tax provision (benefit) and the tax provision computed by applying the

statutory federal income tax rate to Earnings (loss) from continuing operations before income taxes is attributable

to the following:

2014 2013 2012

Federal taxes based on statutory rate $ 4 $ (149) $ (53)

State income taxes, net of federal benefit — (13) (9)

Goodwill and intangible asset impairment — — 32

Tax contingency (1) 1 (5)

Change in valuation allowance (1) (3) (5)

Other 3 1 (1)

Total income tax provision (benefit) $ 5 $ (163) $ (41)

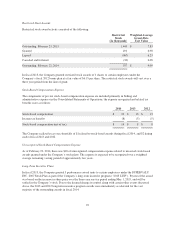

Deferred income taxes reflect the net tax effects of temporary differences between the bases of assets and

liabilities for financial reporting and income tax purposes. The Company’s deferred tax assets and liabilities

consisted of the following:

2014 2013

Deferred tax assets:

Compensation and benefits $ 224 $ 367

Self-insurance 24 20

Property, plant and equipment and capitalized lease assets 132 110

Loss on sale of discontinued operations 1,339 1,341

Net operating loss carryforwards 23 22

Other 80 104

Gross deferred tax assets 1,822 1,964

Valuation allowance (1,356) (1,358)

Total deferred tax assets 466 606

Deferred tax liabilities:

Property, plant and equipment and capitalized lease assets (147) (204)

Inventories (40) (28)

Intangible assets (25) (21)

Other (16) (19)

Total deferred tax liabilities (228) (272)

Net deferred tax asset $ 238 $ 334

Net deferred tax assets of $238 as of February 22, 2014 reflect long-term deferred tax assets of $287 recorded in

Deferred tax assets in the Consolidated Balance Sheets and current deferred tax liabilities of $49 recorded in

Other current liabilities. Net deferred tax assets of $334 as of February 23, 2013 reflect long-term deferred tax

assets of $345 recorded in Deferred tax assets in the Consolidated Balance Sheets and current deferred tax

liabilities of $11 recorded in Other current liabilities.

88