Albertsons 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other

Prior to the completion of the Refinancing Transactions and at February 23, 2013, the Company had the ability to

borrow up to $200 on a revolving basis under its accounts receivable securitization facility, with borrowings

secured by eligible accounts receivable, which remained under the Company’s control. As of February 23, 2013,

there was $40 of outstanding borrowings under this facility at 1.98 percent. Facility fees on the unused portion

were 0.70 percent. As of February 23, 2013, there was $282 of accounts receivable pledged as collateral,

classified in Receivables, net, in the Consolidated Balance Sheet. As discussed above, this facility was repaid and

terminated on March 21, 2013 in connection with the Refinancing Transactions.

As of February 23, 2013, the Company had $18 of debt with current maturities that were classified as long-term

debt due to the Company’s intent to refinance such obligations with the Revolving ABL Credit Facility due

March 2018 or other long-term debt.

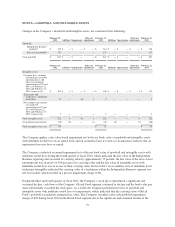

NOTE 7—LEASES

The Company leases most of its retail stores and certain distribution centers, office facilities and equipment from

third parties. Many of these leases include renewal options and, to a limited extent, include options to purchase.

Future minimum lease payments to be made by the Company for noncancellable operating leases and capital

leases as of February 22, 2014, consist of the following:

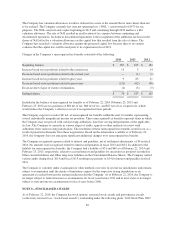

Lease Obligations

Fiscal Year

Operating

Leases

Capital

Leases

2015 $ 122 $ 51

2016 116 48

2017 99 44

2018 79 41

2019 60 39

Thereafter 150 169

Total future minimum obligations $ 626 392

Less interest (119)

Present value of net future minimum obligations 273

Less current capital lease obligations (27)

Long-term capital lease obligations $ 246

Total future minimum obligations have not been reduced for future minimum subtenant rentals of $69 under

certain operating subleases.

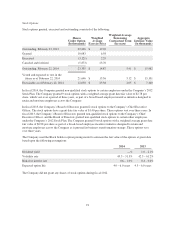

Rent expense and subtenant rentals under operating leases consisted of the following:

2014 2013 2012

Minimum rent $ 129 $ 127 $ 118

Contingent rent 5 6 2

Rent expense 134 133 120

Subtenant rentals (13) (13) (15)

Total net rent expense $ 121 $ 120 $ 105

86