Albertsons 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

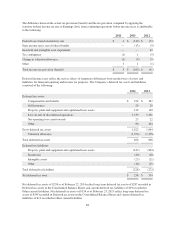

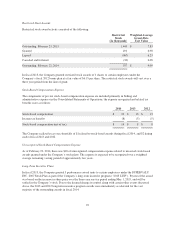

The Company has valuation allowances to reduce deferred tax assets to the amount that is more-likely-than-not

to be realized. The Company currently has state net operating loss (“NOL”) carryforwards of $475 for tax

purposes. The NOL carryforwards expire beginning in 2015 and continuing through 2033 and have a $16

valuation allowance. The sale of NAI resulted in an allocation of tax expense between continuing and

discontinued operations. Included in discontinued operations is the recognition of the additional tax basis in the

shares of NAI offset by a valuation allowance on the capital loss that resulted from the sale of shares. The

Company has recorded a valuation allowance against the projected capital loss because there is no current

evidence that the capital loss will be used prior to its expiration in fiscal 2019.

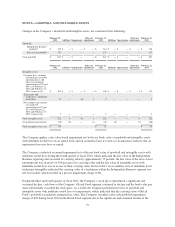

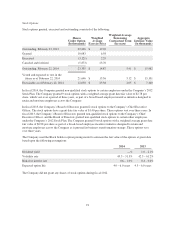

Changes in the Company’s unrecognized tax benefits consisted of the following:

2014 2013 2012

Beginning balance $ 187 $ 165 $ 182

Increase based on tax positions related to the current year 15 5 14

Decrease based on tax positions related to the current year — (1) (1)

Increase based on tax positions related to prior years 9 83 21

Decrease based on tax positions related to prior years (131) (62) (46)

Decrease due to lapse of statute of limitations (4) (3) (5)

Ending balance $ 76 $ 187 $ 165

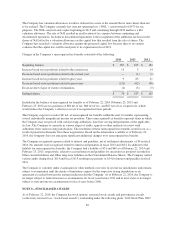

Included in the balance of unrecognized tax benefits as of February 22, 2014, February 23, 2013 and

February 25, 2012 are tax positions of $48 net of tax, $60 net of tax, and $67 net of tax, respectively, which

would reduce the Company’s effective tax rate if recognized in future periods.

The Company expects to resolve $8, net, of unrecognized tax benefits within the next 12 months, representing

several individually insignificant income tax positions. These unrecognized tax benefits represent items in which

the Company may not prevail with certain taxing authorities, based on varying interpretations of the applicable

tax law. The Company is currently in various stages of audits, appeals or other methods of review with

authorities from various taxing jurisdictions. The resolution of these unrecognized tax benefits would occur as a

result of potential settlements from these negotiations. Based on the information available as of February 22,

2014, the Company does not anticipate significant additional changes to its unrecognized tax benefits.

The Company recognized expense related to interest and penalties, net of settlement adjustments, of $4 in fiscal

2014. No amounts were recognized related to interest and penalties in fiscal 2013 and 2012. In addition to the

liability for unrecognized tax benefits, the Company had a liability of $31 and $60 as of February 22, 2014 and

February 23, 2013, respectively, related to accrued interest and penalties for uncertain tax positions recorded in

Other current liabilities and Other long-term liabilities in the Consolidated Balance Sheets. The Company settled

various audits during fiscal 2014 and fiscal 2013 resulting in payments of $14 for interest and penalties in fiscal

2014.

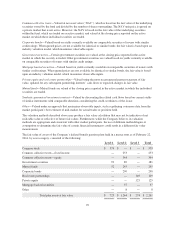

The Company is currently under examination or other methods of review in several tax jurisdictions and remains

subject to examination until the statute of limitations expires for the respective taxing jurisdiction or an

agreement is reached between the taxing jurisdiction and the Company. As of February 22, 2014, the Company is

no longer subject to federal income tax examinations for fiscal years before 2011 and in most states is no longer

subject to state income tax examinations for fiscal years before 2006.

NOTE 9—STOCK-BASED AWARDS

As of February 22, 2014, the Company has stock options, restricted stock awards and performance awards

(collectively referred to as “stock-based awards”) outstanding under the following plans: 2012 Stock Plan, 2007

89