Albertsons 2014 Annual Report Download - page 86

Download and view the complete annual report

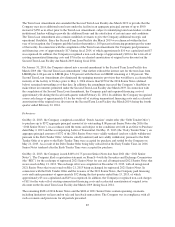

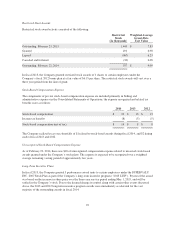

Please find page 86 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Balance Sheets. The maturity date of the Revolving ABL Credit Facility due March 2018 is subject to a springing

maturity date that is 90 days prior to May 1, 2016, if more than $250 of the 8.00 percent Senior Notes due 2016

remain outstanding as of that date. Refer to Note 15—Subsequent Events for information regarding the

Company’s subsequent amendment to the Revolving ABL Credit Facility due March 2018.

The revolving loans under the Revolving ABL Credit Facility due March 2018 may be voluntarily prepaid in

certain minimum principal amounts, in whole or in part, without premium or penalty, subject to breakage or

similar costs. The Company and those subsidiaries named as borrowers under the Revolving ABL Credit Facility

due March 2018 are required to repay the revolving loans in cash and provide cash collateral under this facility to

the extent that the revolving loans and letters of credit exceed the lesser of the borrowing base then in effect or

the aggregate amount of the lenders’ commitments under the Revolving ABL Credit Facility due March 2018.

During fiscal 2014, the Company borrowed $3,803 and repaid $4,010 under its Revolving ABL Credit Facility

due August 2017 and Revolving ABL Credit Facility due March 2018. During fiscal 2013, the Company

borrowed $2,291 and repaid $2,111 under its previous revolving credit facility, which was refinanced in August

2012, and its Revolving ABL Credit Facility due August 2017.

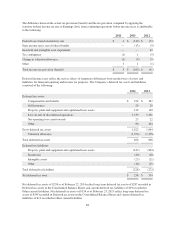

The Secured Term Loan Facility due March 2019 is also guaranteed by the Company’s material subsidiaries

(together with the Company, the “Term Loan Parties”). To secure their obligations under the Secured Term Loan

Facility due March 2019, the Company granted a perfected first-priority security interest for the benefit of the

facility lenders in the Term Loan Parties’ equity interest in Moran Foods, LLC, the parent entity of the

Company’s Save-A-Lot business, and the Term Loan Parties granted a perfected first priority security interest in

substantially all of their intellectual property and a first priority mortgage lien and security interest in certain

owned or ground leased real estate and certain additional equipment. As of February 22, 2014, there was $704 of

owned or ground-leased real estate and associated equipment pledged as collateral, classified as Property, plant

and equipment, net in the Consolidated Balance Sheets. In addition, the obligations of the Term Loan Parties

under the Secured Term Loan Facility due March 2019 are secured by second-priority security interests in the

collateral securing the Revolving ABL Credit Facility due March 2018.

The loans under the Secured Term Loan Facility due March 2019 may be voluntarily prepaid in certain minimum

principal amounts, subject to the payment of breakage or similar costs and, in certain circumstances, a

prepayment fee. Pursuant to the Secured Term Loan Facility due March 2019, the Company must, subject to

certain customary reinvestment rights, apply 100 percent of Net Cash Proceeds (as defined in the facility) from

certain types of asset sales (excluding proceeds of the collateral security of the Revolving ABL Credit Facility

due March 2018 and other secured indebtedness) to prepay the loans outstanding under the Secured Term Loan

Facility due March 2019. Beginning with the fiscal year ended February 22, 2014, the Company must prepay

loans outstanding under the facility no later than 90 days after the fiscal year end in an aggregate principal

amount equal to a percentage (which percentage ranges from 0 to 50 percent depending on the Company’s Total

Secured Leverage Ratio (as defined in the facility) as of the last day of such fiscal year) of Excess Cash Flow (as

defined in the facility) for the fiscal year then ended minus any voluntary prepayments made during such fiscal

year with Internally Generated Cash (as defined in the facility). Based on the Company’s Excess Cash Flow for

the fiscal year ended February 22, 2014, no prepayment will be required. The potential amount of prepayment

from Excess Cash Flow that will be required for fiscal 2015 is not reasonably estimable. As of February 22,

2014, the loans outstanding under the Secured Term Loan Facility due March 2019 had a remaining principal

balance of $1,474, none of which was classified as current.

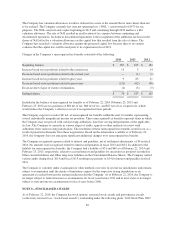

In connection with the Refinancing Transactions, the Company paid financing costs of approximately $76 during

fiscal 2014, of which approximately $61 was capitalized and $15 was expensed. In addition, the Company

recognized a non-cash charge of approximately $38 for the write-off of existing unamortized financing costs and

$22 for the accelerated amortization of original issue discount on the refinanced debt instruments.

On May 16, 2013, the Company entered into an amendment to the Secured Term Loan Facility due March 2019

(the “Term Loan Amendment”) that reduced the interest rate for the term loan from LIBOR plus 5.00 percent

with a floor on LIBOR set at 1.25 percent to LIBOR plus 4.00 percent with a floor on LIBOR set at 1.00 percent.

84