Albertsons 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

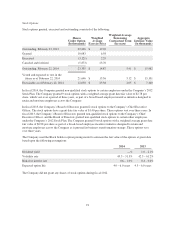

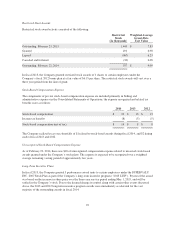

Stock Options

Stock options granted, exercised and outstanding consisted of the following:

Shares

Under Option

(In thousands)

Weighted

Average

Exercise Price

Weighted Average

Remaining

Contractual Term

(In years)

Aggregate

Intrinsic Value

(In thousands)

Outstanding, February 23, 2013 22,246 $ 19.20

Granted 10,083 6.58

Exercised (3,121) 2.29

Canceled and forfeited (5,873) 23.70

Outstanding, February 22, 2014 23,335 $ 14.87 5.41 $ 15,982

Vested and expected to vest in the

future as of February 22, 2014 21,646 $ 15.56 5.12 $ 15,101

Exercisable as of February 22, 2014 12,050 $ 23.38 2.05 $ 7,340

In fiscal 2014, the Company granted non-qualified stock options to certain employees under the Company’s 2012

Stock Plan. The Company granted 9 stock options with a weighted average grant date fair value of $2.78 per

share, which vest over a period of three years, as part of a broad-based employee incentive initiative designed to

retain and motivate employees across the Company.

In fiscal 2013, the Company’s Board of Directors granted 2 stock options to the Company’s Chief Executive

Officer. The stock options have a grant date fair value of $1.40 per share. These options vest over three years. In

fiscal 2013, the Company’s Board of Directors granted non-qualified stock options to the Company’s Chief

Executive Officer, and the Board of Directors granted non-qualified stock options to certain other employees,

under the Company’s 2012 Stock Plan. The Company granted 8 stock options with a weighted average grant date

fair value of $0.98 per share as part of a broad-based employee incentive initiative designed to retain and

motivate employees across the Company as it pursued its business transformation strategy. These options vest

over three years.

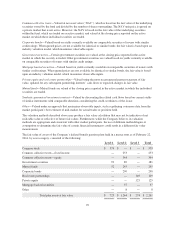

The Company used the Black Scholes option pricing model to estimate the fair value of the options at grant date

based upon the following assumptions:

2014 2013

Dividend yield —% 1.0 – 2.1%

Volatility rate 49.3 – 51.3% 42.3 – 61.2%

Risk-free interest rate 0.6 – 1.0% 0.4 – 0.6%

Expected option life 4.0 – 6.0 years 4.5 – 6.0 years

The Company did not grant any shares of stock options during fiscal 2012.

91