Albertsons 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

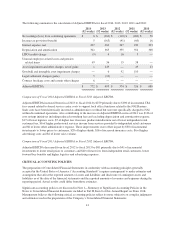

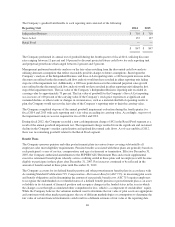

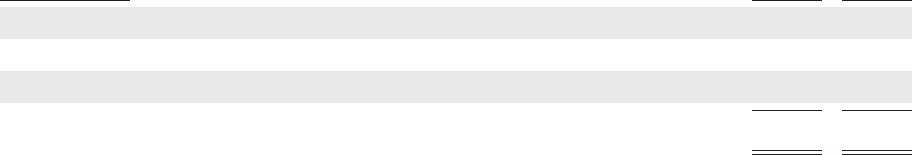

The Company’s goodwill attributable to each reporting unit consisted of the following:

Reporting Unit 2014 2013

Independent Business $ 710 $ 710

Save-A-Lot 137 137

Retail Food ——

$ 847 $ 847

The Company performed its annual test of goodwill during the fourth quarter of fiscal 2014, utilizing discount

rates ranging between 11 percent and 14 percent to discount projected future cash flows for each reporting unit

and perpetual growth rates that ranged between 2 percent and 5 percent.

Management performed sensitivity analyses on the fair values resulting from the discounted cash flow analysis

utilizing alternate assumptions that reflect reasonably possible changes to future assumptions. Based upon the

Company’s analysis of the Independent Business and Save-A-Lot reporting units, a 100 basis point increase in the

discount rate utilized in the discounted cash flow analysis would not have resulted in either reporting unit failing

step one of the impairment test. Additionally, a 100 basis point decrease in the estimated perpetual sales growth

rates utilized in the discounted cash flow analysis would not have resulted in either reporting unit failing the first

step of the impairment tests. The fair value of the Company’s Independent Business reporting unit exceeded its

carrying value by approximately 75 percent. The fair value of goodwill for the Company’s Save-A-Lot reporting

was in excess of 100 percent of the carrying value. If the Company’s stock price experiences a significant and

sustained decline, or other events or changes in circumstances, such as a material shortfall of operating results to

plan, the Company would reassess the fair value of the Company’s reporting units to their the carrying value.

The Company completed step one of the annual goodwill impairment evaluation during the fourth quarter for

fiscal 2014 and 2013 with each reporting unit’s fair value exceeding its carrying value. Accordingly, step two of

the impairment analysis was not required for fiscal 2014 and 2013.

During fiscal 2012, the Company recorded a non-cash impairment charge of $92 in the Retail Food segment as a

result of the annual goodwill impairment test. The impairment charge resulted from the significant and sustained

decline in the Company’s market capitalization and updated discounted cash flows. As of year-end fiscal 2012,

there was no remaining goodwill related to the Retail Food segment.

Benefit Plans

The Company sponsors pension and other postretirement plans in various forms covering substantially all

employees who meet eligibility requirements. Pension benefits associated with these plans are generally based on

each participant’s years of service, compensation, and age at retirement or termination. Effective December 31,

2007, the Company authorized amendments to the SUPERVALU Retirement Plan and certain supplemental

executive retirement benefit plans whereby service crediting ended in these plans and no employees will become

eligible to participate in these plans after December 31, 2007. Pay increases continued to be reflected in the

amount of benefit earned in these plans until December 31, 2012.

The Company accounts for its defined benefit pension and other postretirement benefit plans in accordance with

Accounting Standard Codification 715, Compensation—Retirement Benefits (ASC 715), in measuring plan assets

and benefit obligations and in determining the amount of net periodic benefit cost. ASC 715 requires employers

to recognize the underfunded or overfunded status of a defined benefit pension or postretirement plan as an asset

or liability in its statement of financial position and recognize changes in the funded status in the year in which

the changes occur through accumulated other comprehensive loss, which is a component of stockholders’ equity.

While the Company believes the valuation methods used to determine the fair value of plan assets are appropriate

and consistent with other market participants, the use of different methodologies or assumptions to determine the

fair value of certain financial instruments could result in a different estimate of fair value at the reporting date.

46