Albertsons 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

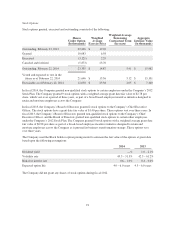

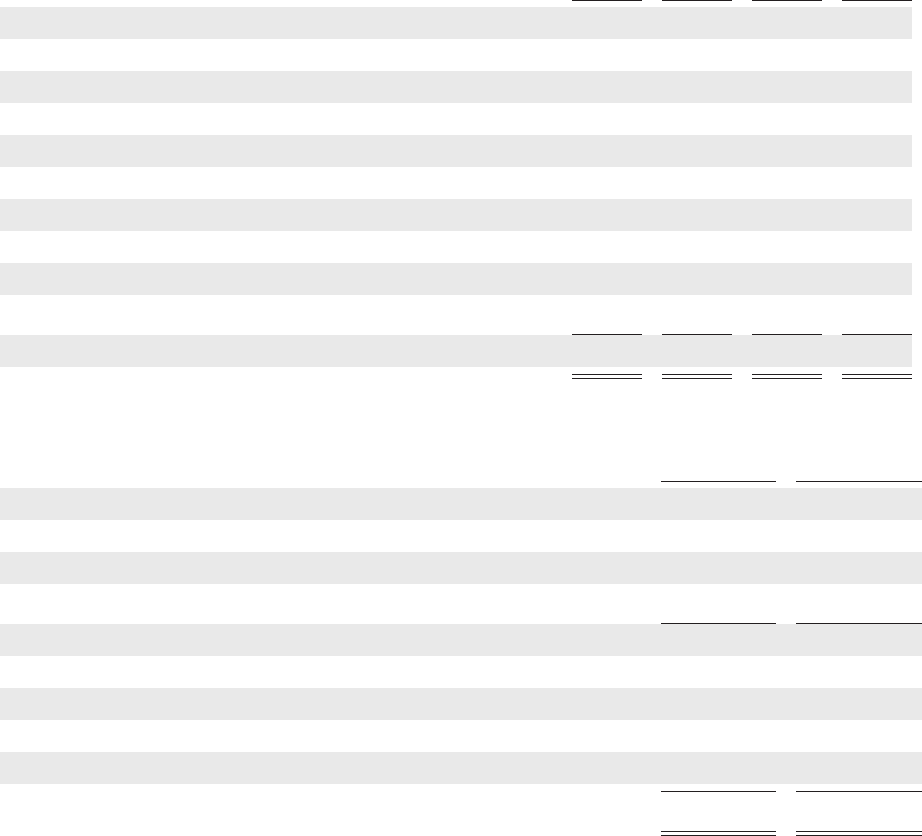

The fair value of assets of the Company’s defined benefit pension plans held in a master trust as of February 23,

2013, by asset category, consisted of the following:

Level 1 Level 2 Level 3 Total

Common stock $ 554 $ — $ — $ 554

Common collective trusts—fixed income — 247 — 247

Common collective trusts—equity — 335 — 335

Government securities 60 92 — 152

Mutual funds 51 221 — 272

Corporate bonds — 183 — 183

Real estate partnerships — — 136 136

Private equity — — 110 110

Mortgage-backed securities — 35 — 35

Other 3 4 — 7

Total plan assets at fair value $ 668 $ 1,117 $ 246 $ 2,031

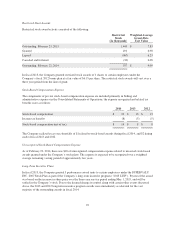

The following is a summary of changes in the fair value for Level 3 investments for 2014 and 2013:

Real Estate

Partnerships Private Equity

Ending balance, February 25, 2012 $ 113 $ 88

Purchases 15 20

Sales — (7)

Unrealized gains 8 9

Ending balance, February 23, 2013 136 110

Purchases 22 34

Sales (26) (24)

Unrealized gains 10 5

Realized gains and losses 7 —

Ending balance, February 22, 2014 $ 149 $ 125

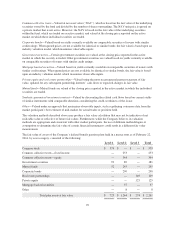

Contributions

The Company expects to contribute approximately $130 to $140 to its defined benefit pension plans and

postretirement benefit plans in fiscal 2015. The Company’s funding policy for the defined benefit pension plans

is to contribute the minimum contribution required under the Employee Retirement Income Security Act of 1974,

as amended, the Pension Protection Act of 2006 and other applicable laws, as determined by the Company’s

external actuarial consultant and its agreement with the PBGC described in Note 12—Commitments,

Contingencies and Off—Balance Sheet Arrangements with consideration given to contributing larger amounts.

The Company will recognize contributions in accordance with applicable regulations, with consideration given to

recognition for the earliest plan year permitted.

At the Company’s discretion, additional funds may be contributed to the pension plan. The Company may

accelerate contributions or undertake contributions in excess of the minimum requirements from time to time

100