Albertsons 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

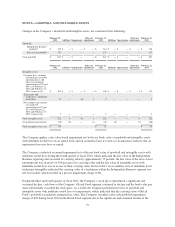

Comprehensive Income (Loss) and Accumulated Other Comprehensive Income (Loss)

The Company reports comprehensive income (loss) in the Consolidated Statements of Comprehensive Income

(Loss). Comprehensive income (loss) includes all changes in stockholders’ deficit during the applicable reporting

period, other than those resulting from investments by and distributions to stockholders. The Company’s

comprehensive income (loss) is calculated as net earnings (loss) plus or minus adjustments for pension and other

postretirement benefit obligations, net of tax.

Accumulated other comprehensive loss represents the cumulative balance of other comprehensive income (loss),

net of tax, as of the end of the reporting period and relates to pension and other postretirement benefit obligation

adjustments, net of tax. Changes in Accumulated other comprehensive loss by component follows below:

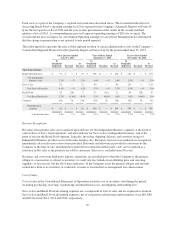

2014 2013 2012

Pension and postretirement benefit plan accumulated other comprehensive loss at

beginning of the fiscal year, net of tax $ (612) $ (657) $ (446)

Other comprehensive income (loss) before reclassifications, net of tax (expense)

benefit of $(85), $18 and $161, respectively 202 (20) (262)

Amortization of amounts included in net periodic benefit cost, net of tax

(expense) of $(38), $(40) and $(32), respectively 55 65 51

Net current-period Other comprehensive income (loss), net of tax (expense)

benefit of $(123), $(22) and $129, respectively 257 45 (211)

Divestiture of NAI pension plan accumulated other comprehensive loss, net of tax

(expense) of $(31) 48 — —

Pension and postretirement benefit plan accumulated other comprehensive loss at

the end of period, net of tax $ (307) $ (612) $ (657)

Upon completion of the NAI Banner Sale in the first quarter of fiscal 2014, the Company disposed approximately

$48 of Accumulated other comprehensive loss, which was a component of Stockholders’ deficit in the

Consolidated Balance Sheets as of February 23, 2013, due to NAI’s assumption of a defined benefit pension plan

established and operated under NAI. The accumulated other comprehensive loss assumed by NAI was a

component of the preliminary estimated loss on the sale of NAI accrued in Current liabilities of discontinued

operations in the Consolidated Balance Sheet as of February 23, 2013 and recognized in Income (loss) from

discontinued operations, net of tax in fiscal 2013. Amortization of amounts included in net periodic benefit cost

before tax were reclassified out of Accumulated other comprehensive loss into Selling and administrative

expense in the Consolidated Statements of Operations. See Note 11—Benefit Plans for information regarding the

recognition of pension and other postretirement benefit obligation activity within the Consolidated Statements of

Comprehensive Income (Loss).

Common and Treasury Stock

Concurrent with the execution of the Stock Purchase Agreement, the Company entered into a Tender Offer

Agreement (the “Tender Offer Agreement”) with Symphony Investors LLC, which is owned by a Cerberus

Capital Management, L.P. (“Cerberus”)-led investor consortium (“Symphony Investors”), and Cerberus, pursuant

to which, upon the terms and subject to the conditions of the Tender Offer Agreement, and contingent upon the

NAI Banner Sale, Symphony Investors tendered for up to 30 percent of the issued and outstanding common stock

of the Company at a purchase price of $4.00 per share in cash (the “Tender Offer”). Approximately 12 shares

were validly tendered, representing approximately 5.5 percent of the issued and outstanding shares at the time of

the Tender Offer expiration on March 20, 2013. All shares that were validly tendered and not properly withdrawn

were accepted as tendered in accordance with the terms of Tender Offer.

77