Albertsons 2014 Annual Report Download - page 70

Download and view the complete annual report

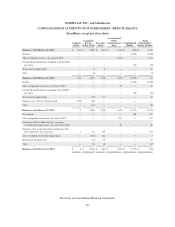

Please find page 70 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars and shares in millions, except per share data, unless otherwise noted)

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business Description

SUPERVALU INC. (“SUPERVALU” or the “Company”) operates primarily in the United States grocery

channel. SUPERVALU provides supply chain services, primarily wholesale distribution, operates hard discount

retail stores and licenses stores to independent operators under the Save-A-Lot banner, and operates five

competitive, regionally-based traditional format grocery banners under the Cub Foods, Shoppers Food &

Pharmacy, Shop ‘n Save, Farm Fresh and Hornbacher’s banners.

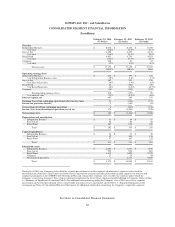

Principles of Consolidation

The Consolidated Financial Statements include the accounts of the Company and all its wholly and majority-

owned subsidiaries. All significant intercompany accounts and transactions have been eliminated in

consolidation. References to the Company refer to SUPERVALU INC. and Subsidiaries.

During fiscal 2013, the Company entered into a stock purchase agreement (the “Stock Purchase Agreement”) to

sell the Company’s New Albertson’s, Inc. subsidiary (“New Albertsons” or “NAI”), including the Acme,

Albertsons, Jewel-Osco, Shaw’s and Star Market retail banners and the associated Osco and Sav-on in-store

pharmacies (the “NAI Banner Sale”) to AB Acquisition LLC (“AB Acquisition”). The NAI Banner Sale was

completed effective March 21, 2013, during the Company’s first quarter of fiscal 2014. The NAI operations

disposed of under the NAI Banner Sale are reported as discontinued operations in the Consolidated Statements of

Operations for all periods presented. The assets and liabilities of the NAI disposal group are presented as assets

and liabilities of discontinued operations separately in the Consolidated Balance Sheets for all periods presented.

Unless otherwise indicated, references to the Consolidated Statements of Operations and the Consolidated

Balance Sheets in the Notes to the Consolidated Financial Statements exclude all amounts related to discontinued

operations. See Note 14—Discontinued Operations and Divestitures for additional information regarding these

discontinued operations.

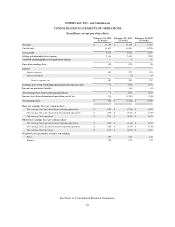

Fiscal Year

The Company’s fiscal year ends on the last Saturday in February. The Company’s first quarter consists of

16 weeks while the second, third and fourth quarters each consist of 12 weeks. Because of differences in the

accounting calendars of the Company and its former wholly-owned subsidiary NAI, the February 23, 2013

Consolidated Balance Sheets include the assets and liabilities of the NAI disposal group as of February 21, 2013.

The last three fiscal years consist of 52 week periods ended February 22, 2014, February 23, 2013 and

February 25, 2012.

Use of Estimates

The preparation of the Company’s Consolidated Financial Statements in conformity with accounting principles

generally accepted in the United States requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenues and expenses for the reporting periods presented.

Actual results could differ from those estimates.

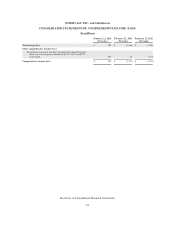

Segment Reclassification

During the first quarter of fiscal 2014, the Company reclassified the segment presentation of certain corporate

administrative expenses and related fees earned under the Company’s transition services agreements, pension and

68