Albertsons 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Goodwill and Intangible Asset Impairment Charges

The Company applies a fair value based impairment test to the net book value of goodwill and intangible assets

with indefinite useful lives on an annual basis and on an interim basis if certain events or circumstances indicate

that an impairment loss may have occurred.

During fiscal 2014 and 2013, the Company performed reviews of goodwill and intangible assets with indefinite

useful lives for impairment. The fiscal 2014 reviews indicated that the carrying value of goodwill and intangible

assets with indefinite useful lives had fair values in excess of their carrying values. The fiscal 2013 reviews

indicated that goodwill had fair value in excess of its carrying value, but that an Independent Business indefinite-

lived tradename was impaired, which resulted in a non-cash impairment charge of $6.

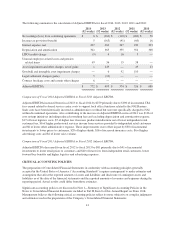

Operating Earnings (Loss)

Operating earnings for fiscal 2014 were $418, compared with an Operating loss of $157 last year, an increase of

$575 or 366 percent. Operating earnings for fiscal 2014 include net charges and costs of $61, comprised of

severance costs and accelerated stock-based compensation costs, asset impairment and other charges, contract

breakage and other costs, a legal settlement charge and a multi-employer pension plan withdrawal charge, offset

in part by a gain on sale of property. Operating earnings for fiscal 2013 included net charges and costs of $281,

comprised of asset impairment and other charges, severance costs and a multi-employer pension plan withdrawal

charge, store closure charges and an intangible asset impairment charge, offset in part by a cash settlement

received from credit card companies. When adjusted for these items, the remaining $355 increase in Operating

earnings is primarily due to $198 of incremental TSA fees earned related to administrative support of divested

NAI banner operations, $178 of benefits from cost reduction initiatives including lower occupancy costs,

employee-related costs and reduced consulting fees, $29 of lower logistics costs, $13 of a LIFO charge decrease,

$7 of higher fees from new product introductions net of lower independent retail customer fees, $6 of lower other

administrative expense and $6 of higher professional services income from services provided to independent

retail customers, offset in part by $30 of incremental investments to lower prices to customers, $28 of higher

shrink, $16 of increased insurance costs, $6 of higher advertising costs and $2 of lower sales volume.

Independent Business operating earnings for fiscal 2014 were $235, or 2.9 percent of Independent Business net

sales, compared with $199, or 2.4 percent of Independent Business net sales last year. Independent Business

operating earnings for fiscal 2014 include net charges and costs of $8, comprised of severance costs and

accelerated stock-based compensation costs of $17, a multi-employer pension plan withdrawal charges of $3,

asset impairment and other charges of $2 and contract breakage costs of $1, offset in part by a gain on sale of

property of $15. Independent Business operating earnings for fiscal 2013 included severance costs and

accelerated stock-based compensation charges of $12, non-cash intangible asset impairment charges of $6 and

asset impairment and other charges of $5. When adjusted for these items, the remaining $21 increase in

Independent Business operating earnings is primarily due to $21 of lower logistics and occupancy costs, $7 of

higher fees from new product introductions net of lower independent retail customer fees, $6 of higher

professional services income from services provided to independent retail customers, $3 of lower bad debt

expense and $2 of a LIFO charge decrease, offset in part by $14 of higher allocated corporate overhead costs,

including employee-related costs, and $4 of lower sales volume.

Save-A-Lot operating earnings for fiscal 2014 were $167, or 3.9 percent of Save-A-Lot net sales, compared with

$143, or 3.4 percent of Save-A-Lot net sales last year. Save-A-Lot operating earnings for fiscal 2014 include

charges and costs of $10, comprised of a legal settlement charge of $5, asset impairment charges of $3 and

severance costs of $2. Save-A-Lot operating earnings for fiscal 2013 included store closure and asset impairment

charges of $35. When adjusted for these items, the remaining $1 decrease in Save-A-Lot’s operating earnings is

primarily due to $12 of incremental investments to lower prices to customers, $8 of higher shrink and $3 of

higher advertising costs, offset in part by $13 of cost reduction initiatives, including reduced consulting fees, and

$9 of other lower administrative expenses.

34