Xcel Energy 2004 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

86

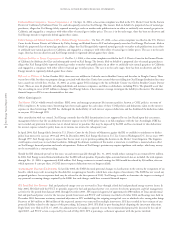

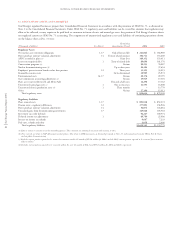

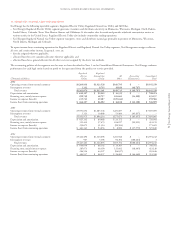

20. SUMMARIZED QUARTERLY FINANCIAL DATA (UNAUDITED)

Summarized quarterly unaudited financial data is as follows:

Quarter ended

March 31, 2004 June 30, 2004 Sept. 30, 2004 Dec. 31, 2004

(Thousands of dollars, except per share amounts) (a) (a) (a) (a)

Revenue $2,280,483 $1,796,803 $2,008,612 $2,259,361

Operating income 321,250 199,105 338,057 214,804

Income from continuing operations 148,797 85,361 166,183 126,589

Discontinued operations – income (loss) 1,114 945 (119,463) (53,564)

Net income 149,911 86,306 46,720 73,025

Earnings available for common shareholders 148,851 85,246 45,660 71,964

Earnings per share from continuing operations – basic $ 0.37 $ 0.21 $ 0.41 $ 0.31

Earnings (loss) per share from continuing operations – diluted $ 0.36 $ 0.21 $ 0.40 $ 0.30

Earnings (loss) per share from discontinued operations – basic $ – $ – $ (0.30) $ (0.13)

Earnings (loss) per share from discontinued operations – diluted $ – $ – $ (0.28) $ (0.13)

Earnings per share total – basic $ 0.37 $ 0.21 $ 0.11 $ 0.18

Earnings per share total – diluted $ 0.36 $ 0.21 $ 0.12 $ 0.17

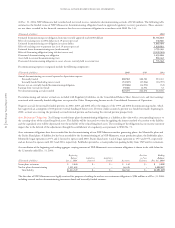

Quarter ended

March 31, 2003 June 30, 2003 Sept. 30, 2003 Dec. 31, 2003

(Thousands of dollars, except per share amounts) (b) (b) (b) (b)

Revenue $2,067,495 $1,703,739 $2,001,600 $2,086,171

Operating income 310,207 170,458 365,888 266,460

Income from continuing operations 128,637 59,625 184,648 152,930

Discontinued operations – income (loss) 11,375 (342,187) 102,847 324,517

Net income (loss) 140,012 (282,562) 287,495 477,447

Earnings (loss) available for common shareholders 138,952 (283,622) 286,435 476,386

Earnings per share from continuing operations – basic $ 0.32 $ 0.15 $ 0.46 $ 0.39

Earnings per share from continuing operations – diluted $ 0.31 $ 0.14 $ 0.44 $ 0.37

Earnings (loss) per share from discontinued operations – basic $ 0.03 $ (0.86) $ 0.26 $ 0.81

Earnings (loss) per share from discontinued operations – diluted $ 0.03 $ (0.82) $ 0.25 $ 0.77

Earnings (loss) per share total – basic $ 0.35 $ (0.71) $ 0.72 $ 1.20

Earnings (loss) per share total – diluted $ 0.34 $ (0.68) $ 0.69 $ 1.14

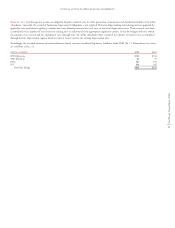

(a) 2004 results include special charges in fourth quarter, as discussed in Note 2 to the Consolidated Financial Statements, and unusual items as follows:

– Results from continuing operations were decreased by the accrual of legal settlements incurred by the holding company in the amount of $17.6 million in the fourth quarter.

– Third-quarter results from discontinued operations were decreased by $112 million, or 27 cents per share, due to the estimated impairment expected to result from the disposal

of Seren, as discussed in Note 3 to the Consolidated Financial Statements. During fourth quarter, an adjustment increasing the impairment by $31 million, or 7 cents per share,

was recorded.

– Fourth-quarter results from discontinued operations were decreased by $16 million, or 4 cents per share, related to a reduction of the NRG tax benefits previously booked, after

completion of an NRG tax basis study.

– Fourth-quarter results from continuing operations were increased by $36 million, or 8 cents per share, due to the accrual of income tax benefits, including $28.9 million related

to the successful resolution of various IRS audit issues and other adjustments to current and deferred taxes related to prior years, $4.4 million for the 2003 return-to-accrual

true-up and $2.7 million for revisions to benefits related to asset and foreign power sales.

– Fourth-quarter results from continuing operations were decreased by an accrual recorded to reflect SPS’ best estimate of any potential liability for the impact of its retail fuel cost

recovery proceeding in Texas.

(b) 2003 results include special charges in certain quarters, as discussed in Note 2 to the Consolidated Financial Statements, and unusual items as follows:

– Results from continuing operations were decreased for NRG-related restructuring costs incurred by the holding company in the amount of $1.4 million in the first quarter,

$7.3 million in the second quarter and $3.0 million in the third quarter.

– Fourth-quarter results from continuing operations were increased by $22 million, or 3 cents per share, for adjustments made to depreciation accruals for the year, due to a

regulatory decision approving the extension of NSP-Minnesota’s Prairie Island nuclear plant to operate over the license term.

– Fourth-quarter results from continuing operations were increased by $30 million, or 7 cents per share, from the resolution of income tax audit issues related to prior years.

– Fourth-quarter results from continuing operations were decreased by $7 million pretax, or 1 cent per share, for charges recorded related to the TRANSLink project due to

regulatory and operating uncertainties.

– Fourth-quarter results from discontinued operations were increased by $111 million, or 26 cents per share, for reversal of equity in prior NRG losses due to the divestiture of

NRG in December 2003, and increased by $288 million, or 68 cents per share, due to revisions to the estimated tax benefits related to Xcel Energy’s investment in NRG. See

Note 3 to the Consolidated Financial Statements for further discussion of these items.

– Fourth-quarter results from discontinued operations were decreased by $59 million, or 14 cents per share, due to the estimated impairment expected to result from the disposal

of Xcel Energy International’s Argentina assets, as discussed in Note 3 to the Consolidated Financial Statements, and by $16 million, or 4 cents per share, due to the accrual of

e prime’s cost to settle an investigation by the Commodity Futures Trading Commission.