Xcel Energy 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

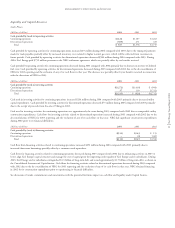

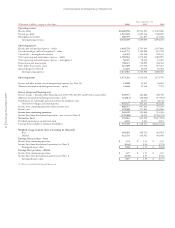

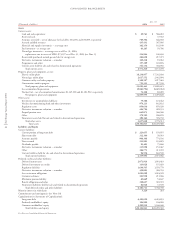

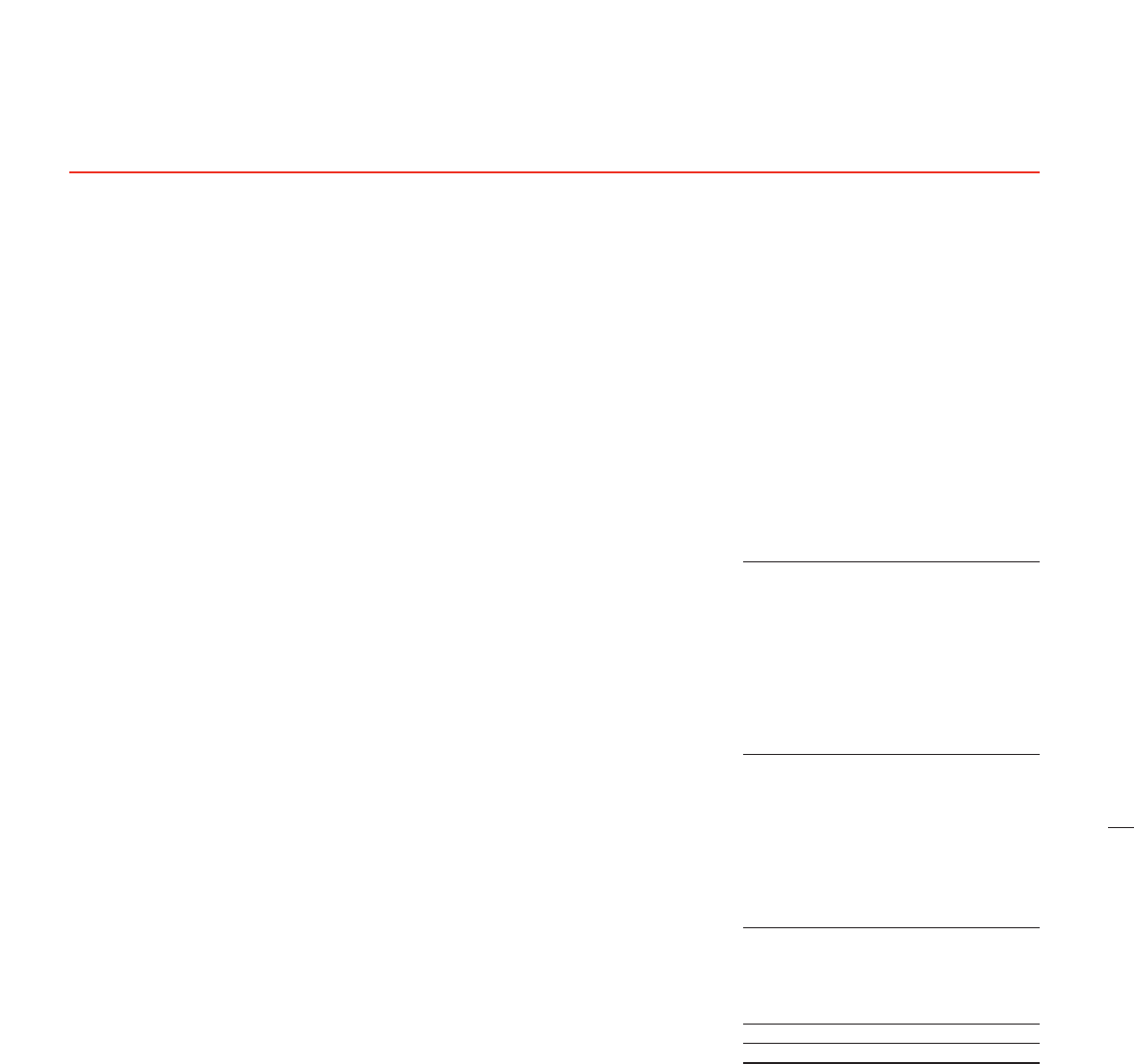

CONSOLIDATED STATEMENTS of CASH FLOWS

Xcel Energy Annual Report 2004

43

Year ended Dec. 31

(Thousands of dollars) 2004 2003 2002

Operating activities

Net (loss) income $ 355,961 $622,392 $(2,217,991)

Remove (income) loss from discontinued operations 170,968 (96,552) 2,769,379

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation and amortization 741,544 759,523 768,250

Nuclear fuel amortization 43,296 43,401 48,675

Deferred income taxes 45,488 101,672 143,880

Amortization of investment tax credits (12,189) (12,439) (13,212)

Allowance for equity funds used during construction (33,648) (25,338) (7,793)

Undistributed equity in earnings of unconsolidated affiliates (5,379) (5,628) 5,774

Write-downs and losses from investments –8,856 15,866

Unrealized gain (loss) on derivative financial instruments 5,794 (1,954) 17,779

Change in accounts receivable (123,257) (126,786) 21,214

Change in inventories (46,185) (994) (30,555)

Change in other current assets (188,935) (167,051) 111,947

Change in accounts payable 129,171 106,576 (131,716)

Change in other current liabilities 5,707 (10,524) (133,693)

Change in other noncurrent assets (5,391) (133,025) (224,153)

Change in other noncurrent liabilities 42,948 45,096 138,521

Operating cash flows provided by (used in) discontinued operations (308,788) 270,761 432,939

Net cash provided by operating activities 817,105 1,377,986 1,715,111

Investing activities

Utility capital/construction expenditures (1,274,290) (944,421) (903,974)

Allowance for equity funds used during construction 33,648 25,338 7,793

Investments in external decommissioning fund (80,582) (80,581) (57,830)

Nonregulated capital expenditures and asset acquisitions (2,160) (12,611) (3,488)

Equity investments, loans, deposits and sales of nonregulated projects (4,082) 13,300 (17,253)

Restricted cash 42,628 (38,488) (23,000)

Other investments 12,588 1,106 7,040

Investing cash flows provided by (used in) discontinued operations 37,043 110,261 (1,720,614)

Net cash used in investing activities (1,235,207) (926,096) (2,711,326)

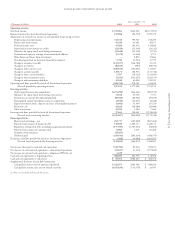

Financing activities

Short-term borrowings – net 253,737 (445,080) (867,466)

Proceeds from issuance of long-term debt 138,848 1,689,317 1,442,172

Repayment of long-term debt, including reacquisition premiums (157,595) (1,307,012) (32,802)

Proceeds from issuance of common stock 6,985 3,219 69,488

Common stock repurchase (32,023) ––

Dividends paid (320,444) (303,316) (496,375)

Financing cash flows provided by (used in) discontinued operations (200) (4,000) 1,465,070

Net cash (used in) provided by financing activities (110,692) (366,872) 1,580,087

Net increase (decrease) in cash and cash equivalents (528,794) 85,018 583,872

Net decrease in cash and cash equivalents – discontinued operations (13,167) (1,313) (237,882)

Net increase in cash and cash equivalents – adoption of FIN No. 46 3,439 ––

Cash and cash equivalents at beginning of year 568,283 484,578 138,588

Cash and cash equivalents at end of year $ 29,761 $568,283 $ 484,578

Supplemental disclosure of cash flow information

Cash paid for interest (net of amounts capitalized) $ 423,673 $402,506 $ 640,628

Cash paid for income taxes (net of refunds received) $(355,639) $ (6,379) $ 24,935

See Notes to Consolidated Financial Statements.