Xcel Energy 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

84

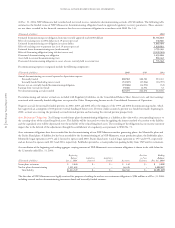

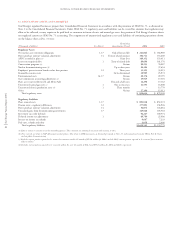

18. REGULATORY ASSETS AND LIABILITIES

Xcel Energy’s regulated businesses prepare their Consolidated Financial Statements in accordance with the provisions of SFAS No. 71, as discussed in

Note 1 to the Consolidated Financial Statements. Under SFAS No. 71, regulatory assets and liabilities can be created for amounts that regulators may

allow to be collected, or may require to be paid back to customers in future electric and natural gas rates. Any portion of Xcel Energy’s business that is

not regulated cannot use SFAS No. 71 accounting. The components of unamortized regulatory assets and liabilities of continuing operations shown

on the balance sheet at Dec. 31 were:

Remaining

(Thousands of dollars) See Note(s) Amortization Period 2004 2003

Regulatory Assets

Net nuclear asset retirement obligations 1, 17 End of licensed life $ 221,864 $ 186,989

Power purchase contract valuation adjustments 14 Term of related contract 102,741 154,260

AFDC recorded in plant (a) Plant lives 169,352 153,411

Losses on reacquired debt 1 Term of related debt 89,694 101,176

Conservation programs (a) Various 88,253 76,087

Nuclear decommissioning costs (b) Up to three years 20,494 37,654

Employees’ postretirement benefits other than pension 12 Three years 31,125 35,015

Renewable resource costs To be determined 38,985 25,972

Environmental costs 16, 17 Various 28,176 29,195

State commission accounting adjustments (a) Various 15,945 17,301

Plant asset recovery (Pawnee II and Metro Ash) Two-and-a-half years 12,258 17,162

Unrecovered natural gas costs (c) 1 One to two years 14,553 16,008

Unrecovered electric production costs (d) 1 Three months –13,779

Other Various 17,196 15,311

Total regulatory assets $ 850,636 $ 879,320

Regulatory Liabilities

Plant removal costs 1, 17 $ 891,018 $ 852,272

Pension costs – regulatory differences 12 377,893 338,926

Power purchase contract valuation adjustments 14 56,874 126,884

Unrealized gains from decommissioning investments 17 129,028 105,518

Investment tax credit deferrals 92,227 100,574

Deferred income tax adjustments 1 69,780 25,906

Interest on income tax refunds 9,667 7,233

Fuel costs, refunds and other 4,058 2,466

Total regulatory liabilities $1,630,545 $1,559,779

(a) Earns a return on investment in the ratemaking process. These amounts are amortized consistent with recovery in rates.

(b) These costs do not relate to NSP-Minnesota’s nuclear plants. They relate to DOE assessments, as discussed previously in Note 17, and unamortized costs for PSCo’s Fort St. Vrain

nuclear plant decommissioning.

(c) Excludes current portion expected to be returned to customers within 12 months of $12.4 million for 2004, and the 2003 current portion expected to be recovered from customers

of $3.1 million.

(d) Excludes current portion expected to be recovered within the next 12 months of $16.1 and $55.8 million for 2004 and 2003, respectively.