Xcel Energy 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION and ANALYSIS

Xcel Energy Annual Report 2004

17

– sales of power plants;

– use of purchase power contracts to meet growth in electric requirements; and

– development of nonregulated ventures.

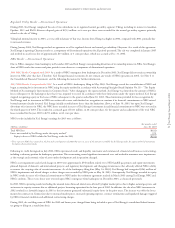

On the federal level, the FERC is still very active in promoting wholesale competition. Wholesale operations account for approximately 16 percent

of our revenue. FERC has authority to withhold market-based rates on wholesale sales in certain areas where a utility is determined to have “market

power control.” However, Xcel Energy believes that it will continue to have the ability to make sales under its market-based tariff.

As part of its agenda to encourage competition, the FERC has also been very active in promoting regional transmission organizations (RTOs). In the

past, each individual utility controlled its transmission lines. Based on certain FERC initiatives, RTOs will control the operations of transmission lines

for an entire region to ensure that all parties that want to sell power have access to the lines. We currently participate in the Midwest Independent

Transmission System Operator, Inc. (MISO) and the Southwest Power Pool (SPP). We are supportive of RTO participation, provided that they offer

benefits to our customers and we have clear cost-recovery mechanisms. In 2005, the MISO will begin its Day 2 operations. This will result in uncertainty,

which may have a positive or negative impact on our wholesale margins.

However, at the state level, many states have stopped utility restructuring activity due to the failure of the California power markets, the collapse of the

independent power producers and other factors.

For Xcel Energy, no significant retail regulatory restructuring has occurred or is expected to occur in any of the states in which we have major utility

operations. In some parts of Texas, retail customers can choose their energy provider. However, due to legislation that extends through 2007, the panhandle

of Texas, where we have utility operations, remains under traditional regulation. We believe that the panhandle will remain under traditional regulation

after 2007.

Our retail operations represent approximately 82 percent of our revenues. Retail rates are set by state commissions and are intended to provide the utility

the opportunity to earn an authorized return on equity. Whether the utility actually earns its authorized return on equity is dependent on many factors

including the level of sales growth, changes in a company’s cost structure, capital investment, interest rates and other items.

Until recently, we have avoided the need to file rate cases by experiencing relatively robust growth in our service territories as well as aggressively managing

the costs of our business. Through two mergers, we have realized cost savings and operational efficiencies. These steps have helped us to avoid filing rate

cases, but at the same time, we have made significant investments. While we will continue to look for ways to reduce costs, the opportunities are no longer

large enough to further delay rate cases.

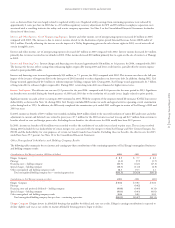

Our regulatory strategy is to ensure that we have the opportunity to earn our authorized return on equity in each state. We are currently not earning our

authorized return on equity in the majority of the states where we have our regulated utility operations. As a result, we have begun or in the near-term

will begin filing general rate increases in the majority of our jurisdictions as follows.

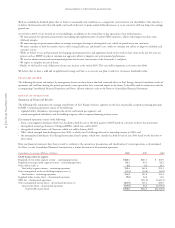

– In September 2004, we filed for an approximately $10 million natural gas rate increase in Minnesota. The request assumes an 11.5 percent return on

equity. Interim rates, subject to refund, went into effect in December 2004 and we expect a decision this summer.

– Also in 2004, we filed for a $5 million transmission increase at FERC.

– In Wisconsin, we are required to file a rate case every other year. Therefore, NSP-Wisconsin will file a case during 2005.

– In Minnesota, we plan to file an electric rate case in the fourth quarter of this year with interim rates, subject to refund, effective in early 2006. We

expect a final commission decision in late summer or early fall of 2006.

– Finally, we intend to file an electric rate case in Colorado in 2006, with rates expected to be in effect during 2007.

While recovery of costs cannot be assured, we are optimistic we will receive fair treatment. We believe that we have fair regulation as demonstrated by

the successful agreement reached on projects like the metropolitan emissions reduction project (MERP) in Minnesota and the new construction of the

Comanche 3 electric generating unit in Colorado. Our ability to maintain a constructive regulatory framework is a critical component of our strategy

and ultimate success.

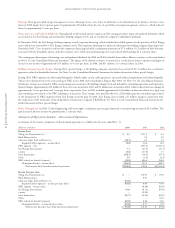

Though we remain open to all opportunities to increase shareholder value, our strategy is to invest in our core electric and natural gas businesses to meet

the growing energy needs of our customers, while earning a fair return on our investments. We refer to our strategy as Building the Core. We have no

plans or interest in deviating from our core business.

We see four critical factors to create incremental value for our shareholders and view these factors as building blocks. They are largely independent of

each other, but taken together, they have the potential to create significant additional value.

– The first is service territory growth. With the strength and diversity of our service territory, growth provides a solid foundation year after year.

– The second driver is incremental investment in our core businesses. Certain incremental investment has already started at a modest level and will grow

quickly in the coming years. Key projects include the MERP project and the Comanche 3 coal plant.

– The third driver is to increase the level of equity that we have invested in our operating companies. Additional equity will increase our financial

strength, support a higher credit rating and add to earnings and cash flow. We will work with our regulators to gain support for this initiative.

– Lastly, we will strive to earn our regulated authorized returns, which will require filing for rate increases in our largest jurisdictions over the next few years.

Execution of our strategy will allow us to meet or exceed our financial objective of delivering an average total return of 7 percent to 9 percent per year. Our

total return objective is based on our expectations of long-term earnings growth of 2 percent to 4 percent and a dividend yield of approximately 5 percent.