Xcel Energy 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION and ANALYSIS

Xcel Energy Annual Report 2004

30

Xcel Energy continually makes informed judgments and estimates related to these critical accounting policy areas, based on an evaluation of the varying

assumptions and uncertainties for each area. For example:

– Probable outcomes of regulatory proceedings are assessed in cases of requested cost recovery or other approvals from regulators.

– The ability to operate plant facilities and recover the related costs over their useful operating lives, or such other period designated by our regulators,

is assumed.

– Probable outcomes of reviews and challenges raised by tax authorities, including appeals and litigation where necessary, are assessed.

– Projections are made regarding earnings on pension investments, and the salary increases provided to employees over their periods of service.

– Future cash inflows of operations are projected in order to assess whether they will be sufficient to recover future cash outflows, including the impacts

of product price changes and market penetration to customer groups.

The information and assumptions underlying many of these judgments and estimates will be affected by events beyond the control of Xcel Energy, or

otherwise change over time. This may require adjustments to recorded results to better reflect the events and updated information that becomes available.

The accompanying financial statements reflect management’s best estimates and judgments of the impacts of these factors as of Dec. 31, 2004.

Recently Implemented Accounting Changes

For a discussion of significant accounting policies, see Note 1 to the Consolidated Financial Statements.

Pending Accounting Changes

Statement of Financial Accounting Standards (SFAS) No. 123 (Revised 2004) “Share Based Payment” (SFAS No. 123R) – In December 2004, FASB

issued SFAS No. 123R related to equity-based compensation. This statement replaces the original SFAS No. 123 – “Accounting for Stock-Based

Compensation.” Under SFAS No. 123R, companies are no longer allowed to account for their share-based payment awards using the intrinsic value

allowed by previous accounting requirements, which did not require any expense to be recorded on stock options granted with an equal to or greater

than fair market value exercise price. Instead, equity-based compensation arrangements will be measured and recognized based on the grant-date fair

value using an option-pricing model (such as Black-Scholes or Binomial) that considers at least six factors identified in SFAS No. 123R. An expense

related to the difference between the grant-date fair value and the purchase price would be recognized over the vesting period of the options. Under

previous guidance, companies were allowed to initially estimate forfeitures or recognize them as they actually occurred. SFAS No. 123R requires

companies to estimate forfeitures on the date of grant and to adjust that estimate when information becomes available that suggests actual forfeitures

will differ from previous estimates. Revisions to forfeiture estimates will be recorded as a cumulative effect of a change in accounting estimate in the

period in which the revision occurs.

Previous accounting guidance allowed for compensation expense related to performance share plans to be reversed if the target was not met. However,

under SFAS No. 123R, compensation expense for performance share plans that expire unexercised due to the company’s failure to reach a certain target stock

price cannot be reversed. Any accruals made for Xcel Energy’s restricted stock unit plan could not be reversed if the target was not met. Implementation

of SFAS No. 123R is required for interim or annual periods beginning after June 15, 2005. Xcel Energy is required to adopt the provisions in the third

quarter of 2005. Implementation is not expected to have a material impact on net income or earnings per share.

Derivatives, Risk Management and Market Risk

In the normal course of business, Xcel Energy and its subsidiaries are exposed to a variety of market risks. Market risk is the potential loss that may

occur as a result of changes in the market or fair value of a particular instrument or commodity. All financial and commodity related instruments,

including derivatives, are subject to market risk. These risks, as applicable to Xcel Energy and its subsidiaries, are discussed in further detail below.

Commodity Price Risk Xcel Energy and its subsidiaries are exposed to commodity price risk in their generation and retail distribution operations.

Commodity price risk is managed by entering into both long- and short-term physical purchase and sales contracts for electric power, natural gas, coal

and fuel oil. Commodity price risk is also managed through the use of financial derivative instruments. Xcel Energy’s risk management policy allows

it to manage commodity price risk within each rate-regulated operation to the extent such exposure exists.

Short-Term Wholesale and Commodity Trading Risk Xcel Energy’s subsidiaries conduct various commodity-marketing activities, including the purchase

and sale of capacity, energy and energy-related instruments. These marketing activities are primarily focused on specific regions where market knowledge

and experience have been obtained and are generally less than one year in length. Xcel Energy’s risk management policy allows management to

conduct the marketing activities within approved guidelines and limitations as approved by the company’s risk management committee, which is made

up of management personnel not directly involved in the activities governed by the policy.

Certain contracts within the scope of these activities qualify for hedge accounting treatment under SFAS No. 133 – “Accounting for Derivative Instruments

and Hedging Activities,” as amended, while others are subject to the fair value requirements of this pronouncement.

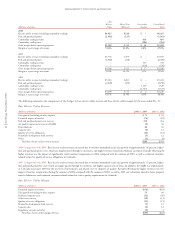

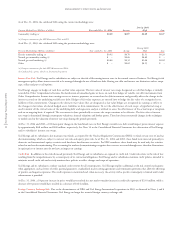

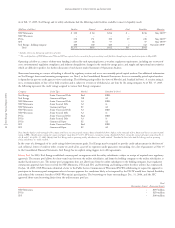

The fair value of the commodity trading contracts for continuing operations as of Dec. 31, 2004, was as follows:

(Millions of dollars)

Fair value of trading contracts outstanding at Jan. 1, 2004 $ 4.2

Contracts realized or settled during the year (21.6)

Fair value of trading contract additions and changes during the year 17.4

Fair value of contracts outstanding at Dec. 31, 2004 $–