Xcel Energy 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION and ANALYSIS

Xcel Energy Annual Report 2004

16

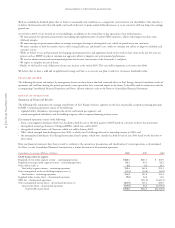

BUSINESS SEGMENTS AND ORGANIZATIONAL OVERVIEW

Xcel Energy Inc. (Xcel Energy), a Minnesota corporation, is a registered holding company under the Public Utility Holding Company Act of 1935

(PUHCA). In 2004, Xcel Energy continuing operations included the activity of four utility subsidiaries that serve electric and natural gas customers in

10 states. These utility subsidiaries are Northern States Power Co., a Minnesota corporation (NSP-Minnesota); Northern States Power Co., a Wisconsin

corporation (NSP-Wisconsin); Public Service Company of Colorado (PSCo) and Southwestern Public Service Co. (SPS). These utilities serve customers

in portions of Colorado, Kansas, Michigan, Minnesota, New Mexico, North Dakota, Oklahoma, South Dakota, Texas and Wisconsin. Along with

WestGas InterState Inc. (WGI), an interstate natural gas pipeline, these companies comprise our continuing regulated utility operations. Discontinued

utility operations include the activity of Viking Gas Transmission Co. (Viking), an interstate natural gas pipeline company that was sold in January 2003;

Black Mountain Gas Co. (BMG), a regulated natural gas and propane distribution company that was sold in October 2003; and Cheyenne Light,

Fuel and Power Co. (Cheyenne), a regulated electric and natural gas utility that was sold in January 2005.

Xcel Energy’s nonregulated subsidiaries in continuing operations include Utility Engineering Corp. (engineering, construction and design) and Eloigne Co.

(investments in rental housing projects that qualify for low-income housing tax credits). During 2003, Planergy International, Inc. (energy management

solutions) closed and began selling a majority of its business operations with final dissolution occurring in 2004. On March 2, 2005, Xcel Energy agreed

to sell its non-regulated subsidiary UE to Zachry Group, Inc. Zachry agreed to acquire all of the outstanding shares of UE, including three UE subsidiaries:

Precision Resource Co., a professional staffing company; Proto-Power Corp., an engineering and project management company dedicated to the nuclear

power industry; and Universal Utility Services, LLC, a full-service industrial maintenance group. Quixx Corp., a subsidiary of UE that partners in

cogeneration projects is not included in the transaction. Xcel Energy expects to record a small loss as a result of the transaction; however, the transaction

is not expected to have a material effect on the financial condition of Xcel Energy. The transaction is subject to customary terms and conditions as to

closing and is expected to be completed in April 2005.

During 2004, Xcel Energy’s board of directors approved management’s plan to pursue the sale of Seren Innovations, Inc. (Seren), a broadband

telecommunications services company. During 2003, Xcel Energy also divested its ownership interest in NRG Energy, Inc. (NRG), an independent

power producer. On May 14, 2003, NRG filed for bankruptcy to restructure its debt. As a result of the reorganization, Xcel Energy relinquished its

ownership interest in NRG. During 2003, the board of directors of Xcel Energy also approved management’s plan to exit businesses conducted by the

nonregulated subsidiaries Xcel Energy International Inc. (Xcel Energy International), an international independent power producer, operating primarily

in Argentina, and e prime inc. (e prime), a natural gas marketing and trading company. NRG, Xcel Energy International, e prime and Seren are presented

as a component of discontinued operations.

See Note 3 to the Consolidated Financial Statements for further discussion of discontinued operations.

FORWARD-LOOKING STATEMENTS

Except for the historical statements contained in this report, the matters discussed in the following discussion and analysis are forward-looking statements

that are subject to certain risks, uncertainties and assumptions. Such forward-looking statements are intended to be identified in this document by the

words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “objective,” “outlook,” “plan,” “project,” “possible,” “potential,” “should” and similar

expressions. Actual results may vary materially. Factors that could cause actual results to differ materially include, but are not limited to: general economic

conditions, including the availability of credit and its impact on capital expenditures and the ability of Xcel Energy and its subsidiaries to obtain financing

on favorable terms; business conditions in the energy industry; actions of credit rating agencies; competitive factors, including the extent and timing of

the entry of additional competition in the markets served by Xcel Energy and its subsidiaries; unusual weather; effects of geopolitical events, including

war and acts of terrorism; state, federal and foreign legislative and regulatory initiatives that affect cost and investment recovery, have an impact on rates

or have an impact on asset operation or ownership; structures that affect the speed and degree to which competition enters the electric and natural gas

markets; the higher risk associated with Xcel Energy’s nonregulated businesses compared with its regulated businesses; costs and other effects of legal and

administrative proceedings, settlements, investigations and claims; actions of accounting regulatory bodies; risks associated with the California power

market; the items described under Factors Affecting Results of Continuing Operations; and the other risk factors listed from time to time by Xcel Energy

in reports filed with the Securities and Exchange Commission (SEC), including Exhibit 99.01 to Xcel Energy’s Annual Report on Form 10-K for the

year ended Dec. 31, 2004.

MANAGEMENT’S STRATEGIC PLANS

The structure of the utility industry is continually changing, which is driven, in part, by the many different types of government regulation over the

industry. Generally, the states in which a utility operates determine the rates that the utility charges its retail customers. The Federal Energy Regulatory

Commission (FERC) establishes the rates that utilities charge for power sold at the wholesale level. The FERC also develops and administers various

rules that govern how utilities operate. Utilities also face a wide range of environmental regulations from various government agencies, at both the state

and federal level.

The mix of state and federal regulations result in numerous rules and regulations, which are not always consistent and are subject to continual change.

Clearly, compliance with all of the regulatory requirements increases the complexity and uncertainty of our business.

In the last decade or so, the FERC and many states developed rules to encourage competition and deregulation of the utility sector. As a result of these

regulatory changes, many utilities have taken steps to prepare for competition and the changing rules. These actions included:

– completion of mergers and acquisitions to increase economies of scale;

– efficiency improvements and cost cutting to avoid rate cases and improve competitive position;