Xcel Energy 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

51

Stock-Based Employee Compensation Xcel Energy has several stock-based compensation plans. Those plans are accounted for using the intrinsic-value

method. Compensation expense is not recorded for stock options because there is no difference between the market price and the purchase price at

grant date. Compensation expense is recorded for restricted stock and stock units awarded to certain employees, which are held until the restriction lapses

or the stock is forfeited. For more information on stock compensation impacts, see Note 11 to the Consolidated Financial Statements.

Intangible Assets Intangible assets with finite lives are amortized over their economic useful lives and periodically reviewed for impairment. Beginning

in 2002, goodwill is no longer being amortized, but is tested for impairment annually and on an interim basis if an event occurs or a circumstance

changes between annual tests that may reduce the fair value of a reporting unit below its carrying value.

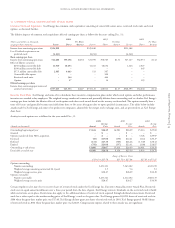

Xcel Energy’s goodwill consisted primarily of project-related goodwill at Utility Engineering for 2004 and 2003. During 2004 and 2003, impairment

testing resulted in write-downs to this goodwill of $0.8 million and $4.8 million, respectively.

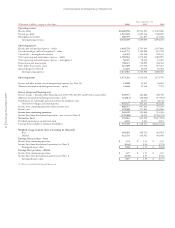

Intangible assets with finite lives continue to be amortized, and the aggregate amortization expense recognized in both years ended Dec. 31, 2004 and

2003, were approximately $0.2 million and $0.2 million, respectively. The annual aggregate amortization expense for each of the five succeeding years

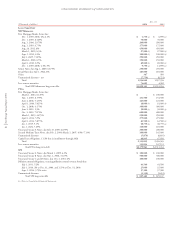

is expected to approximate $0.1 million. Intangible assets consisted of the following:

Dec. 31, 2004 Dec. 31, 2003

Gross Carrying Accumulated Gross Carrying Accumulated

(Millions of dollars) Amount Amortization Amount Amortization

Not amortized:

Goodwill $2.7 $0.6 $3.5 $0.6

Amortized:

Trademarks $5.1 $0.8 $5.1 $0.7

Prior service costs $4.6 $ – $5.8 $ –

Other (primarily project development costs in 2004 and franchises in 2003) $3.3 $1.4 $2.3 $0.6

Asset Valuation On Jan. 1, 2002, Xcel Energy adopted SFAS No. 144 – “Accounting for the Impairment or Disposal of Long-Lived Assets,” which

supercedes previous guidance for measurement of asset impairments. Xcel Energy did not recognize any asset impairments as a result of the adoption.

The method used in determining fair value was based on a number of valuation techniques, including present value of future cash flows.

Deferred Financing Costs Other assets also included deferred financing costs, net of amortization, of approximately $44 million at Dec. 31, 2004.

Xcel Energy is amortizing these financing costs over the remaining maturity periods of the related debt.

Reclassifications Certain items in the statements of operations and the balance sheets have been reclassified from prior period presentation to conform

to the 2004 presentation. These reclassifications had no effect on net income or earnings per share. The reclassifications were primarily related to

organizational changes, such as the sale of Cheyenne and the planned divestiture of Seren and the related reclassification to discontinued operations.