Xcel Energy 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

65

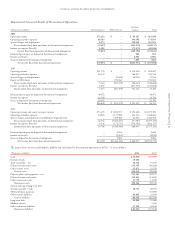

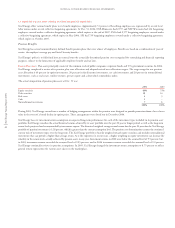

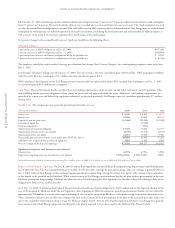

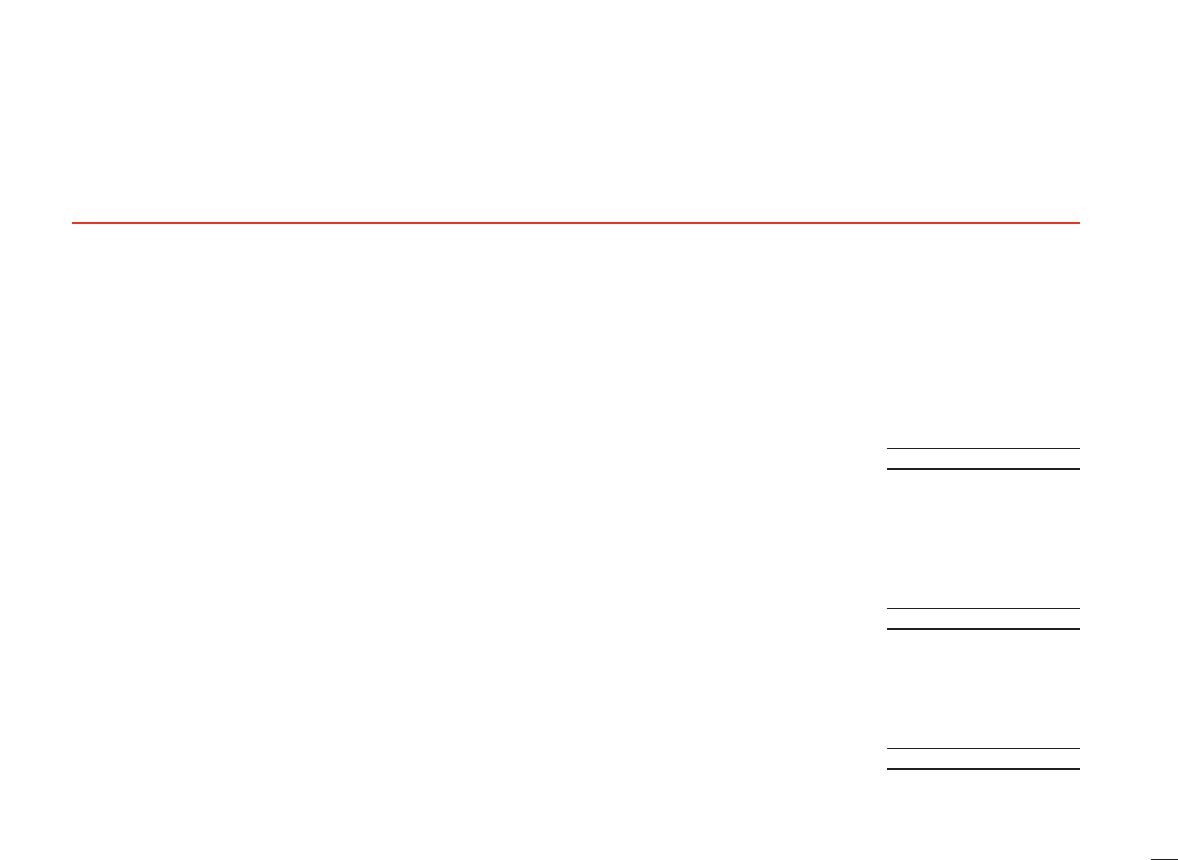

Benefit Obligations A comparison of the actuarially computed pension-benefit obligation and plan assets, on a combined basis, is presented in the

following table:

(Thousands of dollars) 2004 2003

Accumulated Benefit Obligation at Dec. 31 $2,575,317 $2,512,138

Change in Projected Benefit Obligation

Obligation at Jan. 1 $2,632,491 $2,505,576

Service cost 58,150 67,449

Interest cost 165,361 170,731

Plan amendments –85,937

Actuarial loss 133,552 82,197

Settlements (27,627) (9,546)

Curtailment gain –(26,407)

Benefit payments (229,664) (243,446)

Obligation at Dec. 31 $2,732,263 $2,632,491

Change in Fair Value of Plan Assets

Fair value of plan assets at Jan. 1 $3,024,661 $2,639,963

Actual return on plan assets 284,600 605,978

Employer contributions 10,046 31,712

Settlements (27,627) (9,546)

Benefit payments (229,664) (243,446)

Fair value of plan assets at Dec. 31 $3,062,016 $3,024,661

Funded Status of Plans at Dec. 31

Net asset $ 329,753 $ 392,170

Unrecognized transition asset –(7)

Unrecognized prior service cost 244,437 273,725

Unrecognized loss 176,957 9,710

Net pension amounts recognized on Consolidated Balance Sheets $ 751,147 $ 675,598

Prepaid pension asset recorded (a) $ 642,873 $ 566,568

Intangible asset recorded – prior service costs 4,594 5,724

Minimum pension liability recorded (62,669) (54,647)

Accumulated other comprehensive income recorded – pretax 170,554 158,083

Accumulated other comprehensive income recorded – net of tax 106,007 98,072

Measurement Date Dec. 31, 2004 Dec. 31, 2003

Significant Assumptions Used to Measure Benefit Obligations

Discount rate for year-end valuation 6.00% 6.25%

Expected average long-term increase in compensation level 3.50% 3.50%

(a) $18.5 million of the 2004 prepaid pension asset and $18.7 million of the 2003 prepaid pension asset relates to Xcel Energy’s remaining obligation for companies that are now

classified as discontinued operations.

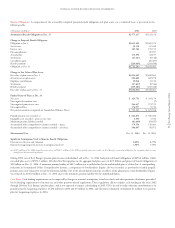

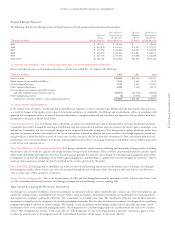

During 2002, one of Xcel Energy’s pension plans became underfunded, and at Dec. 31, 2004, had projected benefit obligations of $694.4 million, which

exceeded plan assets of $590.1 million. All other Xcel Energy plans in the aggregate had plan assets of $2.5 billion and projected benefit obligations of

$2.0 billion on Dec. 31, 2004. A minimum pension liability of $62.7 million was recorded related to the underfunded plan as of that date. A corresponding

reduction in Accumulated Other Comprehensive Income, a component of Stockholders’ Equity, also was recorded, as previously recorded prepaid

pension assets were reduced to record the minimum liability. Net of the related deferred income tax effects of the adjustments, total Stockholders’ Equity

was reduced by $106.0 million at Dec. 31, 2004, due to the minimum pension liability for the underfunded plan.

Cash Flows Cash funding requirements can be impacted by changes to actuarial assumptions, actual asset levels and other pertinent calculations prescribed

by the funding requirements of income tax and other pension-related regulations. These regulations did not require cash funding in the years 2002

through 2004 for Xcel Energy’s pension plans, and is not expected to require cash funding in 2005. PSCo elected to make voluntary contributions to its

pension plan for bargaining employees of $30 million in 2003 and $9 million in 2004, and Cheyenne voluntarily contributed $1 million to its pension

plan for bargaining employees in 2004.