Xcel Energy 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xcel Energy Annual Report 2004

5

Colorado, the Minnesota plan balances cost, reliability and environmental protection,

and includes the possibility of new construction and signifi cant new environmental

goals. The Minnesota Public Utilities Commission should address the plan this year.

2004 saw other projects in full swing – or successfully completed – across our service

territory.

– Construction has begun on a $1 billion emission-reduction project to convert

two coal-fi red power plants in Minnesota to natural gas and refurbish a third with

advanced emission-control equipment.

– Three new natural-gas-fi red peaking units, at a cost of $125 million, should be on

line this summer, a time of high electric demand, at our Blue Lake facility in

Minnesota and our Angus Anson plant in South Dakota.

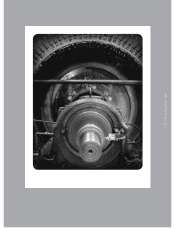

– At our Prairie Island nuclear plant, we completed a $132 million project to replace

steam generators on unit 1, which will enable the plant to continue its history of

safe, reliable operation. In fact, the operational excellence of both the Prairie Island

and Monticello nuclear plants prompted our decision in 2004 to take the necessary

steps to renew their operating licenses with the Nuclear Regulatory Commission

(NRC) for up to 20 years.

Getting electricity to market – and ensuring reliability for customers – drives our

investment in new and upgraded transmission and distribution lines.

– In the south, we completed a $154 million, 345-kilovolt transmission line project

from Amarillo, Texas, to Lamar, Colo., which strengthens our entire transmission

network, enhancing reliability and improving our ability to deliver 162 megawatts

of wind power from the Colorado Green wind farm near Lamar. The project, which

includes signifi cant substation improvements, also creates an additional tie linking

the nation’s eastern and western electrical grids.

– In Minnesota, we have a $160 million project under way to upgrade the region’s trans-

mission system and help deliver wind power from the Buffalo Ridge area of the state.

– We invested $440 million in improvements to our distribution system in 2004, and

plan to invest approximately $430 million in additional improvements in 2005.

earning our authorized return

With signifi cant investment in our generation, transmission and distribution systems,

we must recover and earn a return on the cost of that investment, which explains the

importance of our second value driver: earning our authorized return.

Although not as visible as a new power plant or transmission line, our work to ensure

a regulatory framework that allows us to earn a return suffi cient to retain and attract

capital to the business is equally important. To do this, we make certain the company

retain and attract capital to the business