Xcel Energy 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

63

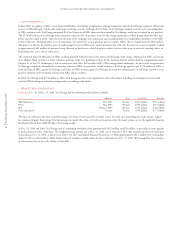

Dividend and Other Capital-Related Restrictions Under the PUHCA, unless there is an order from the SEC, a holding company or any subsidiary may

declare and pay dividends only out of retained earnings. In May 2003, Xcel Energy received authorization from the SEC to pay an aggregate amount of

$152 million of common and preferred dividends out of capital and unearned surplus. Xcel Energy used this authorization to declare and pay approximately

$150 million for its first and second quarter dividends in 2003. At Dec. 31, 2004, Xcel Energy’s retained earnings were approximately $396.6 million.

The Articles of Incorporation of Xcel Energy place restrictions on the amount of common stock dividends it can pay when preferred stock is outstanding.

Under the provisions, dividend payments may be restricted if Xcel Energy’s capitalization ratio (on a holding company basis only and not on a consolidated

basis) is less than 25 percent. For these purposes, the capitalization ratio is equal to (i) common stock plus surplus divided by (ii) the sum of common

stock plus surplus plus long-term debt. Based on this definition, the capitalization ratio at Dec. 31, 2004, was 81 percent. Therefore, the restrictions do

not place any effective limit on Xcel Energy’s ability to pay dividends because the restrictions are only triggered when the capitalization ratio is less than

25 percent or will be reduced to less than 25 percent through dividends (other than dividends payable in common stock), distributions or acquisitions

of Xcel Energy common stock.

In addition, NSP-Minnesota’s first mortgage indenture places certain restrictions on the amount of cash dividends it can pay to Xcel Energy, the holder

of its common stock. Even with these restrictions, NSP-Minnesota could have paid more than $833 million in additional cash dividends on common

stock at Dec. 31, 2004.

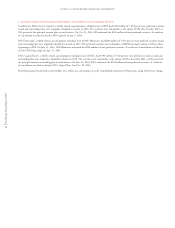

Registered holding companies and certain of their subsidiaries, including Xcel Energy and its utility subsidiaries, are limited, under PUHCA, in their ability

to issue securities. Such registered holding companies and their subsidiaries may not issue securities unless authorized by an exemptive rule or order of the

SEC. Because Xcel Energy does not qualify for any of the main exemptive rules, it sought and received financing authority from the SEC under PUHCA

for various financing arrangements. Xcel Energy’s current financing authority permits it, subject to satisfaction of certain conditions, to issue through

June 30, 2005, up to $2.5 billion of common stock and long-term debt and $1.5 billion of short-term debt at the holding company level. Xcel Energy

has $2.2 billion of long-term debt outstanding and common stock at the holding company level, including the $600 million multi-year credit facility

that was entered into during November 2004.

On Dec. 17, 2004, Xcel Energy filed an application with the SEC requesting additional financing authorization beyond June 30, 2005. If approved, the

new financing authority would extend through June 30, 2008. The new application requests the authority for Xcel Energy to issue up to $1.8 billion of new

long-term debt, common equity and equity-linked securities and $1.0 billion of short-term debt securities during the new authorization period, provided

that the aggregate amount of long-term debt, common equity, equity-linked and short-term debt securities issued during the new authorization period

does not exceed $2.0 billion. Xcel Energy expects the SEC to issue an order prior to the expiration of the existing authorization.

Xcel Energy’s ability to issue securities under the financing authority is subject to a number of conditions. One of the conditions of the financing authority

is that Xcel Energy’s ratio of common equity to total capitalization, on a consolidated basis, be at least 30 percent. As of Dec. 31, 2004, such common

equity ratio was approximately 42 percent. Additional conditions require that a security to be issued that is rated, be rated investment grade by at least

one nationally recognized rating agency. Finally, all outstanding securities that are rated must be rated investment grade by at least one nationally recognized

rating agency. As of Dec. 31, 2004, Xcel Energy’s senior unsecured debt was considered investment grade by at least one nationally recognized rating agency.

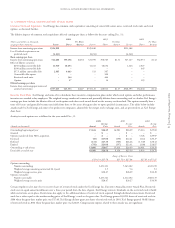

Stockholder Protection Rights Agreement In June 2001, Xcel Energy adopted a Stockholder Protection Rights Agreement. Each share of Xcel Energy’s

common stock includes one shareholder protection right. Under the agreement’s principal provision, if any person or group acquires 15 percent or

more of Xcel Energy’s outstanding common stock, all other shareholders of Xcel Energy would be entitled to buy, for the exercise price of $95 per

right, common stock of Xcel Energy having a market value equal to twice the exercise price, thereby substantially diluting the acquiring person’s or

group’s investment. The rights may cause substantial dilution to a person or group that acquires 15 percent or more of Xcel Energy’s common stock.

The rights should not interfere with a transaction that is in the best interests of Xcel Energy and its shareholders because the rights can be redeemed

prior to a triggering event for $0.01 per right.