Xcel Energy 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION and ANALYSIS

Xcel Energy Annual Report 2004

26

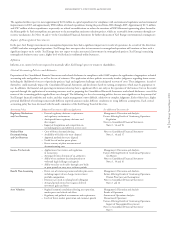

Other Nonregulated Results – Discontinued Operations

On Sept. 27, 2004, Xcel Energy’s board of directors approved management’s plan to pursue the sale of Seren, a wholly owned broadband communications

services subsidiary. Seren delivers cable television, high-speed Internet and telephone service over an advanced network to approximately 45,000 customers

in St. Cloud, Minn., and Concord and Walnut Creek, Calif. As a result of the decision, Seren is accounted for as discontinued operations. The sale of such

investment is expected to be completed by mid-2005.

During 2003, Xcel Energy’s board of directors approved management’s plan to exit businesses conducted by e prime and Xcel Energy International. e prime

ceased conducting business in 2004. Also during 2004, Xcel Energy completed the sales of the Argentina subsidiaries of Xcel Energy International.

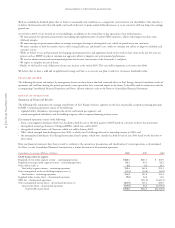

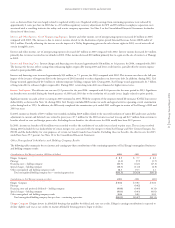

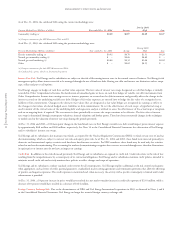

2004 Nonregulated Results Compared with 2003 Results of discontinued nonregulated operations in 2004 include the impact of the sales of the Argentina

subsidiaries of Xcel Energy International. The sales were completed in three transactions with a total sales price of approximately $31 million, including

certain adjustments that reached finalization in the fourth quarter of 2004. Approximately $15 million was placed in escrow, which is expected to remain

in place until at least the end of the first quarter of 2005, to support customary indemnity obligations under the sales agreement. In addition to the sales

price, Xcel Energy also received approximately $21 million at the closing of one transaction as redemption of its capital investment. The sales resulted in

a gain of approximately $8 million, including the realization of approximately $7 million of income tax benefits realizable upon sale of the Xcel Energy

International assets.

In addition, 2004 results from discontinued operations include the impact of an after-tax impairment charge for Seren, including disposition costs, of

$143 million, or 34 cents per share. The impairment charge was recorded based on operating results, market conditions and preliminary feedback

from prospective buyers.

2003 Nonregulated Results Compared with 2002 Results of discontinued nonregulated operations, other than NRG, include an after-tax loss of $59 million,

or 14 cents per share, for the disposal of Xcel Energy International’s assets, based on the estimated fair value of such assets. These losses from discontinued

nonregulated operations also include a charge of $16 million for costs of settling a Commodity Futures Trading Commission trading investigation of e prime.

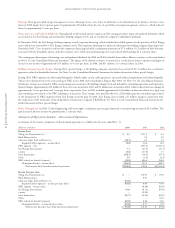

Tax Benefits Related to Investment in NRG Xcel Energy has recognized tax benefits related to the divestiture of NRG. These tax benefits, since related

to Xcel Energy’s investment in discontinued NRG operations, also are reported as discontinued operations.

During 2002, Xcel Energy recognized an initial estimate of the expected tax benefits of $706 million. Based on the results of a 2003 preliminary tax

basis study of NRG, Xcel Energy recorded $404 million of additional tax benefits in 2003. In 2004, the NRG basis study was updated and previously

recognized tax benefits were reduced by $16 million.

Based on current forecasts of taxable income and tax liabilities, Xcel Energy expects to realize approximately $1.1 billion of cash savings from these tax

benefits through a refund of taxes paid in prior years and reduced taxes payable in future years. Xcel Energy used $405 million and $116 million of

these tax benefits in 2004 and 2003, respectively, and expects to use $145 million in 2005. The remainder of the tax benefit carry forward is expected

to be used over subsequent years.

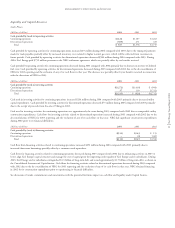

Factors Affecting Results of Continuing Operations

Xcel Energy’s utility revenues depend on customer usage, which varies with weather conditions, general business conditions and the cost of energy services.

Various regulatory agencies approve the prices for electric and natural gas service within their respective jurisdictions and affect our ability to recover our

costs from customers. In addition, Xcel Energy’s nonregulated businesses have had an adverse impact on Xcel Energy’s earnings in 2004, 2003 and 2002.

The historical and future trends of Xcel Energy’s operating results have been, and are expected to be, affected by a number of factors, including the following:

General Economic Conditions

Economic conditions may have a material impact on Xcel Energy’s operating results. The United States economy continues to show evidence of recovery

as measured by growth in the gross domestic product. However, certain operating costs, such as those for insurance and security, have increased during

the past three years due to economic uncertainty, terrorist activity and war or the threat of war. Management cannot predict the impact of a future

economic slowdown, fluctuating energy prices, terrorist activity, war or the threat of war. However, Xcel Energy could experience a material adverse

impact to its results of operations, future growth or ability to raise capital resulting from a slowdown in future economic growth.

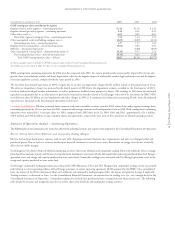

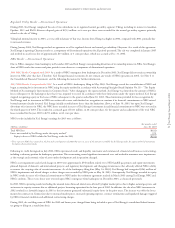

Sales Growth

In addition to the impact of weather, customer sales levels in Xcel Energy’s regulated utility businesses can vary with economic conditions, energy prices,

customer usage patterns and other factors. Weather-normalized sales growth for retail electric utility customers was estimated to be 1.8 percent in 2004

compared with 2003, and 1.5 percent in 2003 compared with 2002. Weather-normalized sales growth for firm natural gas utility customers was estimated

to be approximately (1.9) percent in 2004 compared with 2003 and 1.6 percent in 2003 compared with 2002. Projections indicate that weather-normalized

sales growth in 2005 compared with 2004 will be approximately 2.2 percent for retail electric utility customers and 1.1 percent for firm gas utility customers.

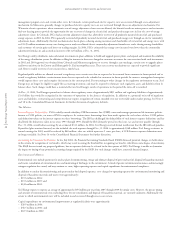

Pension Plan Costs and Assumptions

Xcel Energy’s pension costs are based on an actuarial calculation that includes a number of key assumptions, most notably the annual return level that

pension investment assets will earn in the future and the interest rate used to discount future pension benefit payments to a present value obligation for

financial reporting. In addition, the actuarial calculation uses an asset-smoothing methodology to reduce the volatility of varying investment performance