Xcel Energy 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION and ANALYSIS

Xcel Energy Annual Report 2004

34

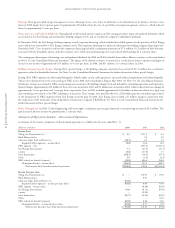

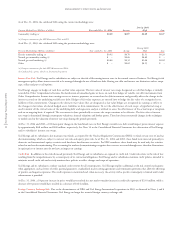

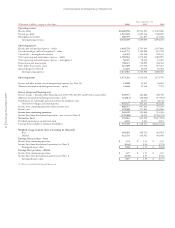

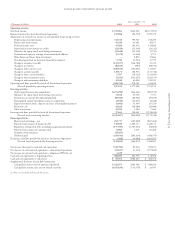

Capital Requirements

Utility Capital Expenditures, Nonregulated Investments and Long-Term Debt Obligations The estimated cost of the capital expenditure programs of

Xcel Energy and its subsidiaries, excluding discontinued operations, and other capital requirements for the years 2005, 2006 and 2007 are shown in the

table below.

(Millions of dollars) 2005 2006 2007

Electric utility $ 1,039 $1,293 $1,283

Natural gas utility 114 107 120

Common utility 87 96 94

Total utility 1,240 1,496 1,497

Other nonregulated 148

Total capital expenditures 1,241 1,500 1,505

Debt maturities 224 839 341

Total capital requirements $1,465 $2,339 $1,846

The capital expenditure forecast includes the 750-megawatt Comanche 3 coal-fired plant in Colorado and the MERP project, which will reduce the

emissions of three NSP-Minnesota’s generating plants. The MERP project is expected to cost approximately $1 billion, with major construction starting

in 2005 and finishing in 2009. Xcel Energy expects to recover the costs of the emission-reduction project through customer rate increases beginning in

2006. Comanche 3 is expected to cost approximately $1.35 billion, with major construction starting in 2006 and finishing in 2010. The Colorado

commission has approved sharing one-third ownership of this plant with other parties. Consequently, Xcel Energy’s capital expenditure forecast includes

$1 billion, approximately two-thirds of the total cost.

Xcel Energy is evaluating a potential investment in a wind generation project of approximately $165 million, currently not included in the capital

expenditure forecast. A decision to move forward with this type of investment will be dependent on the extension of federal tax credits related to

wind generation, favorable regulatory recovery and other business considerations.

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility construction expenditures may vary

from the estimates due to changes in electric and natural gas projected load growth, the desired reserve margin and the availability of purchased power,

as well as alternative plans for meeting Xcel Energy’s long-term energy needs. In addition, Xcel Energy’s ongoing evaluation of restructuring requirements,

compliance with future requirements to install emission-control equipment, and merger, acquisition and divestiture opportunities to support corporate

strategies may impact actual capital requirements. For more information, see Note 16 to the Consolidated Financial Statements.

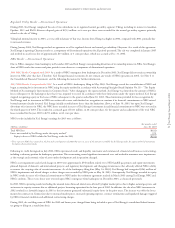

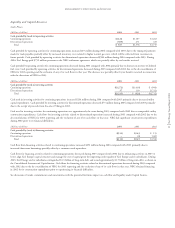

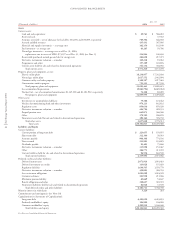

Contractual Obligations and Other Commitments Xcel Energy has contractual obligations and other commercial commitments that will need to be

funded in the future, in addition to its capital expenditure programs. The following is a summarized table of contractual obligations and other commercial

commitments at Dec. 31, 2004. See additional discussion in the Consolidated Statements of Capitalization and Notes 5, 6, 15 and 16 to the Consolidated

Financial Statements.

Payments Due by Period

(Thousands of dollars) Total Less than 1 Year 1 to 3 Years 4 to 5 Years After 5 Years

Long-term debt principal and interest payments $10,369,734 $ 631,129 $1,904,191 $1,849,040 $5,985,374

Capital lease obligations 105,356 6,672 12,734 12,123 73,827

Operating leases (a) 358,695 55,103 117,678 114,237 71,677

Unconditional purchase obligations (b) 11,608,993 2,282,749 2,564,718 1,936,891 4,824,635

Other long-term obligations 147,237 40,419 41,669 33,240 31,909

Payments to vendors in process 106,144 106,144–––

Short-term debt 312,300 312,300–––

Total contractual cash obligations (c) $23,008,459 $3,434,516 $4,640,990 $3,945,531 $10,987,422

(a) Under some leases, Xcel Energy would have to sell or purchase the property that it leases if it chose to terminate before the scheduled lease expiration date. Most of Xcel Energy’s

railcar, vehicle and equipment and aircraft leases have these terms. At Dec. 31, 2004, the amount that Xcel Energy would have to pay if it chose to terminate these leases was

approximately $130.5 million.

(b) Obligations to purchase fuel for electric generating plants, and electricity and natural gas for resale. Certain contractual purchase obligations are adjusted based on indexes.

However, the effects of price changes are mitigated through cost-of-energy adjustment mechanisms.

(c) Xcel Energy also has outstanding authority under contracts and blanket purchase orders to purchase up to approximately $500 million of goods and services through the year 2020,

in addition to the amounts disclosed in this table and in the forecasted capital expenditures.

Common Stock Dividends Future dividend levels will be dependent upon the statutory limitations discussed below, as well as Xcel Energy’s results of

operations, financial position, cash flows and other factors, and will be evaluated by the Xcel Energy board of directors. Xcel Energy’s objective is to

deliver the financial results that will enable the board of directors to grant annual dividend increases at a rate consistent with our long-term earnings

growth rate. Xcel Energy’s dividend policy balances:

– projected cash generation from utility operations;

– projected capital investment in the utility businesses;

– reasonable rate of return on shareholder investment; and

– impact on Xcel Energy’s capital structure and credit ratings.