Xcel Energy 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION and ANALYSIS

Xcel Energy Annual Report 2004

27

over time. Note 12 to the Consolidated Financial Statements discusses the rate of return and discount rate used in the calculation of pension costs and

obligations in the accompanying financial statements.

Pension costs have been increasing in recent years, and are expected to increase further over the next several years, due to lower-than-expected investment

returns experienced in prior years and decreases in interest rates used to discount benefit obligations. While investment returns exceeded the assumed level

of 9.25 percent in 2003 and 9.0 percent in 2004, investment returns in 2001 and 2002 were below the assumed level of 9.5 percent and discount

rates have declined from the 7.25-percent to 8-percent levels used in 1999 through 2002 cost determinations to 6.25 percent used in 2004. Xcel Energy

continually reviews its pension assumptions and, in 2005, expects to change the investment return assumption to 8.75 percent and the discount rate

assumption to 6.0 percent.

The investment gains or losses resulting from the difference between the expected pension returns assumed on smoothed or “market-related” asset levels

and actual returns earned is deferred in the year the difference arises and recognized over the subsequent five-year period. This gain or loss recognition

occurs by using a five-year, moving-average value of pension assets to measure expected asset returns in the cost-determination process, and by amortizing

deferred investment gains or losses over the subsequent five-year period. Based on the use of average market-related asset values, and considering the

expected recognition of past investment gains and losses over the next five years, achieving the assumed rate of asset return of 8.75 percent in each

future year and holding other assumptions constant, Xcel Energy currently projects that the pension costs recognized for financial reporting purposes in

continuing operations will increase from a credit, or negative expense, of $27 million in 2004 to an expense of $8 million in 2005 and $20 million in

2006. Pension costs are currently a credit due to the recognized investment asset returns exceeding the other pension cost components, such as benefits

earned for current service and interest costs for the effects of the passage of time on discounted obligations.

Xcel Energy bases its discount rate assumption on benchmark interest rates quoted by an established credit rating agency, Moody’s Investors Service

(Moody’s), and has consistently benchmarked the interest rate used to derive the discount rate to the movements in the long-term corporate bond indices

for bonds rated Aaa through Baa by Moody’s, which have a period to maturity comparable to our projected benefit obligations. At Dec. 31, 2003, the

annualized Moody’s Baa index rate was 6.61 percent and the Aaa index rate was 5.63 percent. The corresponding pension discount rate was 6.25 percent.

At Dec. 31, 2004, the annualized Moody’s Baa index rate had declined 51 basis points to 6.10 percent, and the Aaa index rate had declined 20 basis

points to 5.43 percent. Accordingly, the discount rate as of Dec. 31, 2004, was lowered 25 basis points to 6.00 percent. This rate was used to value

the actuarial benefit obligations at that date, and will be used in 2005 pension cost determinations.

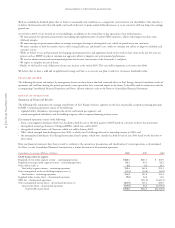

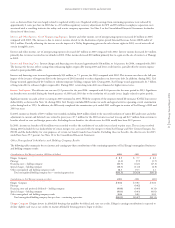

If Xcel Energy were to use alternative assumptions for pension cost determinations, a 1-percent change would result in the following impacts on the

estimated pension costs recognized by Xcel Energy for financial reporting purposes:

– a 100 basis point higher rate of return, 9.75 percent, would decrease 2005 pension costs by $17.9 million;

– a 100 basis point lower rate of return, 7.75 percent, would increase 2005 pension costs by $17.9 million;

– a 100 basis point higher discount rate, 7.0 percent, would decrease 2005 pension costs by $8.3 million; and

– a 100 basis point lower discount rate, 5.0 percent, would increase 2005 pension costs by $6.2 million.

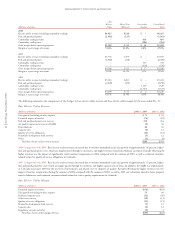

Alternative Employee Retirement Income Security Act of 1974 (ERISA) funding assumptions would also change the expected future cash funding

requirements for the pension plans. Cash funding requirements can be affected by changes to actuarial assumptions, actual asset levels and other

calculations prescribed by the funding requirements of income tax and other pension-related regulations. These regulations did not require cash funding

in recent years for Xcel Energy’s pension plans, and do not require funding in 2005. Assuming that future asset return levels equal the actuarial assumption

of 8.75 percent for the years 2005 and 2006, Xcel Energy projects, under current funding regulations, that no cash funding would be required for

2005 and cash funding of $9 million would be required for 2006. Actual performance can affect these funding requirements significantly. Current fund-

ing regulations are under legislative review in 2005 and, if not retained in their current form, could change these funding requirements materially.

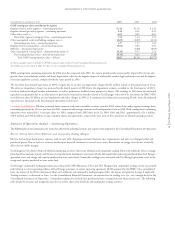

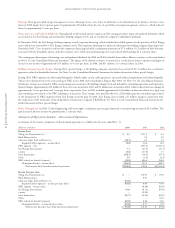

Regulation

Xcel Energy, its utility subsidiaries and certain of its nonutility subsidiaries are subject to extensive regulation by the SEC under the PUHCA with respect to

issuances and sales of securities, acquisitions and sales of certain utility properties and intra-system sales of certain non-power goods and services. In addition,

the PUHCA generally limits the ability of registered holding companies to acquire additional public utility systems and to acquire and retain businesses

unrelated to the utility operations of the holding company. See further discussion of financing restrictions under Liquidity and Capital Resources.

Xcel Energy’s utility subsidiaries also are regulated by the FERC and state regulatory commissions. Decisions by these regulators can significantly

impact Xcel Energy’s results of operations. Xcel Energy expects to periodically file for rate changes based on changing energy market and general

economic conditions.

The electric and natural gas rates charged to customers of Xcel Energy’s utility subsidiaries are approved by the FERC and the regulatory commissions in

the states in which they operate. The rates are generally designed to recover plant investment, operating costs and an allowed return on investment. Xcel

Energy requests changes in rates for utility services through filings with the governing commissions. Because comprehensive rate changes are requested

infrequently in some states, changes in operating costs can affect Xcel Energy’s financial results. In addition to changes in operating costs, other factors

affecting rate filings are new investment, sales growth, conservation and demand-side management efforts, and the cost of capital. In addition, the

return on equity authorized is set by regulatory commissions in rate proceedings. The most recently authorized electric utility returns are 11.47 percent

for NSP-Minnesota, 11.9 percent for NSP-Wisconsin, 10.75 percent for PSCo and 11.5 percent for SPS.

Most of the retail rates for Xcel Energy’s utility subsidiaries provide for periodic adjustments to billings and revenues to allow for recovery of changes

in the cost of fuel for electric generation, purchased energy, purchased natural gas for resale and, in Minnesota and Colorado, conservation, energy-