Xcel Energy 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION and ANALYSIS

Xcel Energy Annual Report 2004

36

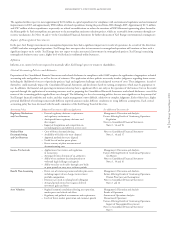

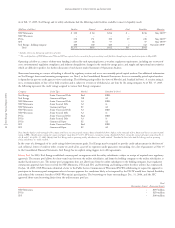

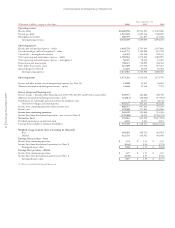

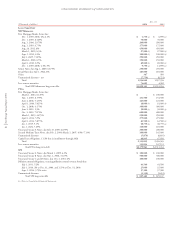

As of Feb. 17, 2005, Xcel Energy and its utility subsidiaries had the following credit facilities available to meet its liquidity needs:

(Millions of dollars) Facility Drawn*Available Cash Liquidity Maturity

NSP-Minnesota $ 300 $ 84 $216 $ – $216 May 2005

NSP-Wisconsin – ––––

PSCo 350 151 199 29 228 May 2005

SPS 125 68 57 – 57 May 2005

Xcel Energy – holding company 600 160 440 2 442 November 2009

Total $1,375 $463 $912 $31 $943

* Includes short-term borrowings and letters of credit.

** The credit facilities of NSP-Minnesota, PSCo and SPS are expected to be renewed as five-year revolving credit facilities through a pro-rata syndication prior to May 2005.

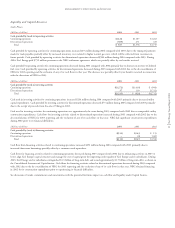

Operating cash flow as a source of short-term funding is affected by such operating factors as weather; regulatory requirements, including rate recovery of

costs; environmental regulation compliance and industry deregulation; changes in the trends for energy prices; and supply and operational uncertainties,

which are difficult to predict. See further discussion of such factors under Statement of Operations Analysis.

Short-term borrowing as a source of funding is affected by regulatory actions and access to reasonably priced capital markets. For additional information

on Xcel Energy’s short-term borrowing arrangements, see Note 5 to the Consolidated Financial Statements. Access to reasonably priced capital markets

is dependent in part on credit agency reviews and ratings. The following ratings reflect the views of Moody’s and Standard & Poor’s. A security rating is

not a recommendation to buy, sell or hold securities and is subject to revision or withdrawal at any time by the rating company. As of Feb. 17, 2005,

the following represents the credit ratings assigned to various Xcel Energy companies:

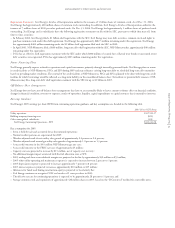

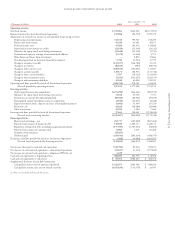

Company Credit Type Moody’s Standard & Poor’s

Xcel Energy Senior Unsecured Debt Baa1 BBB-

Xcel Energy Commercial Paper NP A2

NSP-Minnesota Senior Unsecured Debt A3 BBB-

NSP-Minnesota Senior Secured Debt A2 A-

NSP-Minnesota Commercial Paper P2 A2

NSP-Wisconsin Senior Unsecured Debt A3 BBB

NSP-Wisconsin Senior Secured Debt A2 A-

PSCo Senior Unsecured Debt Baa1 BBB-

PSCo Senior Secured Debt A3 A-

PSCo Commercial Paper P2 A2

SPS Senior Unsecured Debt Baa1 BBB

SPS Commercial Paper P2 A2

Note: Moody’s highest credit rating for debt is Aaa1 and lowest investment grade rating is Baa3. Standard & Poor’s highest credit rating for debt is AAA+ and lowest investment grade

rating is BBB-. Moody’s prime ratings for commercial paper range from P1 to P3. NP denotes a nonprime rating. Standard & Poor’s ratings for commercial paper range from A1 to

A3, B and C. As of Feb. 17, 2005, Moody’s had Xcel Energy and its operating utility subsidiaries on “stable outlook.” Standard & Poor’s also had Xcel Energy and its operating

utility subsidiaries on “stable outlook.”

In the event of a downgrade of its credit ratings below investment grade, Xcel Energy may be required to provide credit enhancements in the form of

cash collateral, letters of credit or other security to satisfy all or a part of its exposures under guarantees outstanding. See a list of guarantees at Note 15

to the Consolidated Financial Statements. Xcel Energy has no explicit rating triggers in its debt agreements.

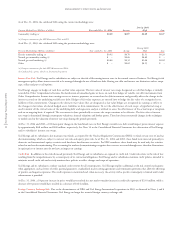

Money Pool In 2003, Xcel Energy established a money pool arrangement with the utility subsidiaries, subject to receipt of required state regulatory

approvals. The money pool allows for short-term loans between the utility subsidiaries and from the holding company to the utility subsidiaries at

market-based interest rates. The money pool arrangement does not allow loans from the utility subsidiaries to the holding company. State regulatory

commission approvals have been received for NSP-Minnesota, PSCo and SPS, and borrowing and lending activity for these utilities has commenced.

On Jan. 18, 2005, NSP-Wisconsin submitted a letter to the Public Service Commission of Wisconsin (PSCW) withdrawing its request for approval to

participate in the money pool arrangement after it became apparent the conditions likely to be imposed by the PSCW would have limited flexibility

and reduced the economic benefits of NSP-Wisconsin’s participation. The borrowings or loans outstanding at Dec. 31, 2004, and the SEC

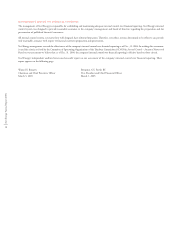

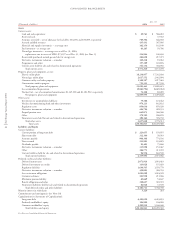

approved short-term borrowing limits from the utility money pool are:

Total

Borrowings (Loans) Borrowing Limits

NSP-Minnesota – $250 million

PSCo – $250 million

SPS – $100 million

**

**

**