Xcel Energy 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION and ANALYSIS

Xcel Energy Annual Report 2004

25

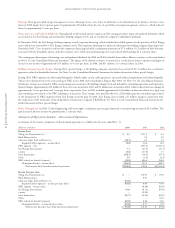

Regulated Utility Results – Discontinued Operations

During 2003, Xcel Energy completed the sale of two subsidiaries in its regulated natural gas utility segment: Viking, including its interest in Guardian

Pipeline, LLC, and BMG. After-tax disposal gains of $23.3 million, or 6 cents per share, were recorded for the natural gas utility segment, primarily

related to the sale of Viking.

Viking had minimal income in 2003, as it was sold in January of that year. Income from Viking was higher in 2002, compared with 2001, primarily due

to increased revenues.

During January 2004, Xcel Energy reached an agreement to sell its regulated electric and natural gas subsidiary Cheyenne. As a result of this agreement,

Xcel Energy is reporting Cheyenne results as a component of discontinued operations for all periods presented. The sale was completed in January 2005

and resulted in an after-tax loss of approximately $13 million, or 3 cents per share, which was accrued at Dec. 31, 2004.

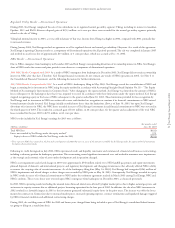

NRG Results – Discontinued Operations

Due to NRG’s emergence from bankruptcy in December 2003 and Xcel Energy’s corresponding divestiture of its ownership interest in NRG, Xcel Energy’s

share of NRG results for current and prior periods is now shown as a component of discontinued operations.

2004 NRG Results Compared with 2003 As a result of NRG’s emergence from bankruptcy in December 2003, Xcel Energy did not retain an ownership

interest in NRG after that date. Therefore, Xcel Energy financial statements do not contain any results of NRG operations in 2004. See Note 4 to

the Consolidated Financial Statements and the following discussion for further information.

2003 NRG Results Compared with 2002 As a result of NRG’s bankruptcy filing in May 2003, Xcel Energy ceased the consolidation of NRG and

began accounting for its investment in NRG using the equity method in accordance with Accounting Principles Board Opinion No. 18 – “The Equity

Method of Accounting for Investments in Common Stock.” After changing to the equity method, Xcel Energy was limited in the amount of NRG’s

losses subsequent to the bankruptcy date that it was required to record. In accordance with these limitations under the equity method, Xcel Energy

stopped recognizing equity in the losses of NRG subsequent to the quarter ended June 30, 2003. These limitations provided for loss recognition by

Xcel Energy until its investment in NRG was written off to zero, with further loss recognition to continue if its financial commitments to NRG existed

beyond amounts already invested. Xcel Energy initially recorded more losses than the limitations allow as of June 30, 2003, but upon Xcel Energy’s

divestiture of its interest in NRG, the NRG losses recorded in excess of Xcel Energy’s investment in and financial commitment to NRG were reversed in

the fourth quarter of 2003. This resulted in a noncash gain of $111 million, or 26 cents per share, for the quarter and an adjustment of the total NRG

losses recorded for the year 2003 to $251 million, or 60 cents per share.

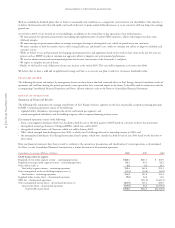

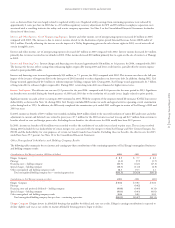

NRG’s results included in Xcel Energy’s earnings for 2003 were as follows:

Six months ended

(Millions of dollars) June 30, 2003

Total NRG loss $(621)

Losses not recorded by Xcel Energy under the equity method* 370

Equity in losses of NRG included in Xcel Energy results for 2003 $(251)

* These represent NRG losses incurred in the first and second quarters of 2003 that were in excess of the amounts recordable by Xcel Energy under the equity method of accounting

limitations discussed previously.

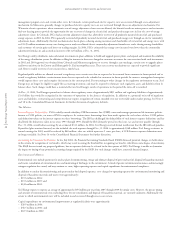

Following its credit downgrade in July 2002, NRG experienced credit and liquidity constraints and commenced a financial and business restructuring,

including a voluntary petition for bankruptcy protection. This restructuring created significant incremental costs and resulted in numerous asset impairments

as the strategic and economic value of assets under development and in operation changed.

NRG’s asset impairments and related charges in 2003 were approximately $540 million related to its NEO landfill gas projects and equity investments,

planned disposals of domestic and international projects, and regulatory developments and changing circumstances that adversely affected NRG’s ability

to recover the carrying value of certain investments. As of the bankruptcy filing date (May 14, 2003), Xcel Energy had recognized $263 million of

NRG’s impairments and related charges as these charges were recorded by NRG prior to May 14, 2003. Consequently, Xcel Energy recorded its equity

in NRG results in excess of its financial commitment to NRG under the settlement agreement reached in March 2003 among Xcel Energy, NRG and

NRG’s creditors. These excess losses were reversed upon NRG’s emergence from bankruptcy in December 2003, as discussed previously.

In 2003, NRG’s operating results (excluding the unusual items discussed above) were affected by higher market prices due to higher natural gas prices and

an increase in capacity revenues due to additional projects becoming operational in the later part of 2002. In addition, the sale of an NRG investment in

2002 resulted in a favorable impact in 2003 as the investment generated substantial equity losses in the prior years. The increase was offset by losses

incurred on contracts in Connecticut due to increased market prices, increased operating expenses, contract terminations and liquidated damages triggered

by NRG’s financial condition and additional restructuring charges.

During 2002, the tax filing status of NRG for 2002 and future years changed from being included as part of Xcel Energy’s consolidated federal income

tax group to filing on a stand-alone basis.