Xcel Energy 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

69

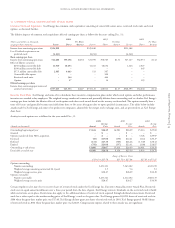

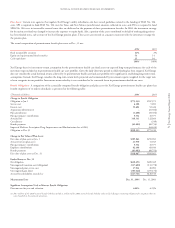

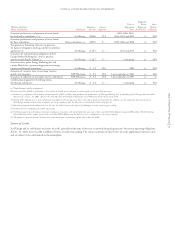

Projected Benefit Payments

The following table lists Xcel Energy’s projected benefit payments for the pension and postretirement benefit plans:

Gross Projected Expected Net Projected

Projected Postretirement Medicare Postretirement

Pension Health Care Part D Health Care

(Thousands of dollars) Benefit Payments Benefit Payments Subsidies Benefit Payments

2005 $ 199,117 $ 59,642 $ – $ 59,642

2006 $ 211,830 $ 61,652 $ 4,297 $ 57,355

2007 $ 217,582 $ 63,640 $ 4,591 $ 59,049

2008 $ 225,050 $ 65,393 $ 4,821 $ 60,572

2009 $ 231,704 $ 67,036 $ 5,008 $ 62,028

2010–2014 $1,202,161 $352,308 $27,192 $325,116

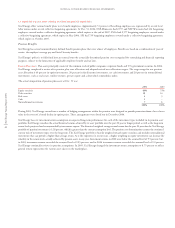

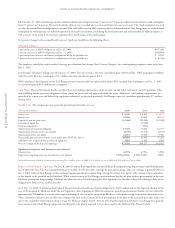

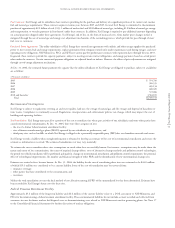

13. DETAIL OF INTEREST AND OTHER INCOME, NET OF NONOPERATING EXPENSES

Interest and other income, net of nonoperating expenses, for the years ended Dec. 31 comprises the following:

(Thousands of dollars) 2004 2003 2002

Interest income $22,688 $16,306 $29,237

Equity income in unconsolidated affiliates 7,956 5,628 1,835

Gain on disposal of assets 4,725 9,365 10,076

Other nonoperating income 4,048 3,160 14,170

Interest expense on corporate-owned life insurance

and other employee-related insurance policies (24,601) (21,320) (18,053)

Other nonoperating expense (8) (3,038) (462)

Total interest and other income, net of nonoperating expenses $14,808 $10,101 $36,803

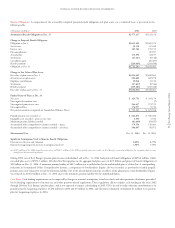

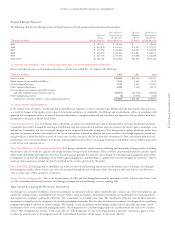

14. DERIVATIVE INSTRUMENTS

In the normal course of business, Xcel Energy and its subsidiaries are exposed to a variety of market risks. Market risk is the potential loss that may occur

as a result of changes in the market or fair value of a particular instrument or commodity. Xcel Energy and its subsidiaries utilize, in accordance with

approved risk management policies, a variety of derivative instruments to mitigate market risk and to enhance our operations. The use of these derivative

instruments is discussed in further detail below.

Utility Commodity Price Risk Xcel Energy and its subsidiaries are exposed to commodity price risk in their generation and retail distribution operations.

Commodity price risk is managed by entering into both long- and short-term physical purchase and sales contracts for electric power, natural gas, coal

and fuel oil. Commodity risk also is managed through the use of financial derivative instruments. Xcel Energy and its utility subsidiaries utilize these

derivative instruments to reduce the volatility in the cost of commodities acquired on behalf of our retail customers even though regulatory jurisdiction

may provide for a dollar-for-dollar recovery of actual costs. In these instances, the use of derivative instruments is done consistently with the local

jurisdictional cost-recovery mechanism. Xcel Energy’s risk-management policy allows it to manage market price risk within each rate-regulated operation

to the extent such exposure exists.

Short-Term Wholesale and Commodity Trading Risk Xcel Energy’s subsidiaries conduct various marketing and commodity trading activities, including

the purchase and sale of electric capacity and energy and other energy-related instruments. These activities are primarily focused on specific regions

where market knowledge and experience have been obtained and are generally less than one year in length. Xcel Energy’s risk-management policy allows

management to conduct the marketing activity within approved guidelines and limitations as approved by our risk-management committee, which is

made up of management personnel not directly involved in the activities governed by this policy.

Interest Rate Risk Xcel Energy and its subsidiaries are subject to the risk of fluctuating interest rates in the normal course of business. Xcel Energy’s

risk-management policy allows interest rate risk to be managed through the use of fixed-rate debt, floating-rate debt and interest-rate derivatives

such as swaps, caps, collars and put or call options.

Foreign Currency Exchange Risk Due to the discontinuance of NRG and Xcel Energy International’s operations in 2003, as discussed in Notes 3 and

4 to the Consolidated Financial Statements, Xcel Energy no longer has material foreign currency exchange risk.

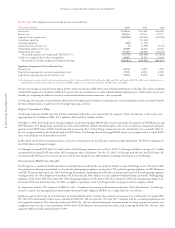

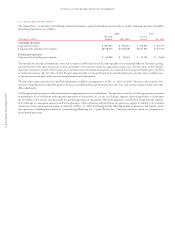

Types of and Accounting for Derivative Instruments

Xcel Energy uses a number of different derivative instruments in connection with its utility commodity price, interest rate, short-term wholesale and

commodity trading activities, including forward contracts, futures, swaps and options. All derivative instruments not qualifying for the normal purchases

and normal sales exception, as defined by SFAS No. 133, as amended, are recorded at fair value. The classification of the fair value for these derivative

instruments is dependent on the designation of a qualifying hedging relationship. The fair value of derivative instruments not designated in a qualifying

hedging relationship is reflected in current earnings. This includes certain instruments used to mitigate market risk for the utility operations and all

instruments related to the commodity trading operations. The designation of a cash flow hedge permits the classification of fair value to be recorded

within Other Comprehensive Income, to the extent effective. The designation of a fair value hedge permits a derivative instrument’s gains or losses

to offset the related results of the hedged item in the Consolidated Statements of Operations, to the extent effective.