Xcel Energy 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION and ANALYSIS

Xcel Energy Annual Report 2004

28

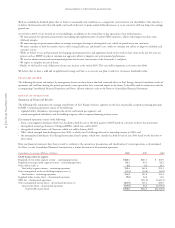

management program costs and certain other costs. In Colorado, certain purchased electric capacity costs are recovered through a rate-adjustment

mechanism. In Minnesota, generally changes in purchased electric capacity costs are not recovered through these rate-adjustment mechanisms. For

Wisconsin electric operations, where automatic cost-of-energy adjustment clauses are not allowed, the biennial retail rate review process and an interim

fuel-cost hearing process provide the opportunity for rate recovery of changes in electric fuel and purchased energy costs in lieu of a cost-of-energy

adjustment clause. In Colorado, PSCo had an interim adjustment clause that allowed for recovery of all prudently incurred electric fuel and purchased

energy expenses in 2003. In 2004, PSCo generally recovered all prudently incurred electric fuel and purchased energy costs through an electric commodity

adjustment clause. Additionally, this fuel mechanism also has in place a sharing among customers and shareholders of certain fuel and energy costs, with

an $11.25 million maximum on any cost sharing over or under an allowed electric commodity adjustment formula rate, and a sharing among shareholders

and customers of certain gains and losses on trading margins. In 2004, PSCo estimated that energy costs incurred were lower than the commodity

adjustment formula rate and accrued an incentive of $11.25 million at Dec. 31, 2004.

Xcel Energy’s utility subsidiaries make substantial investments in plant additions to build and upgrade power plants, and expand and maintain the reliability

of the energy distribution system. In addition to filing for increases in base rates charged to customers to recover the costs associated with such investments,

in 2002 and 2003 approval was obtained from Colorado and Minnesota regulators to recover, through a rate surcharge, certain costs to upgrade plants

and lower emissions in the Denver and Minneapolis-St. Paul metropolitan areas. These rate recovery mechanisms are expected to provide significant

cash flows to enable recovery of costs incurred on a timely basis.

Regulated public utilities are allowed to record as regulatory assets certain costs that are expected to be recovered from customers in future periods and to

record as regulatory liabilities certain income items that are expected to be refunded to customers in future periods. In contrast, nonregulated enterprises

would expense these costs and recognize the income in the current period. If restructuring or other changes in the regulatory environment occur, Xcel

Energy may no longer be eligible to apply this accounting treatment, and may be required to eliminate such regulatory assets and liabilities from its

balance sheet. Such changes could have a material effect on Xcel Energy’s results of operations in the period the write-off is recorded.

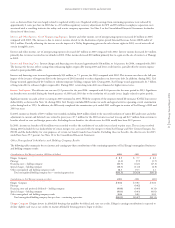

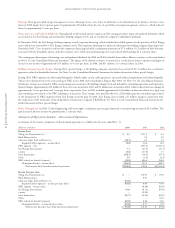

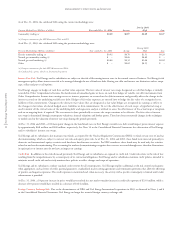

At Dec. 31, 2004, Xcel Energy reported on its balance sheet regulatory assets of approximately $851 million and regulatory liabilities of approximately

$1.6 billion that would be recognized in the statement of operations in the absence of regulation. In addition to a potential write-off of regulatory

assets and liabilities, restructuring and competition may require recognition of certain stranded costs not recoverable under market pricing. See Notes 1

and 18 to the Consolidated Financial Statements for further discussion of regulatory deferrals.

Tax Matters

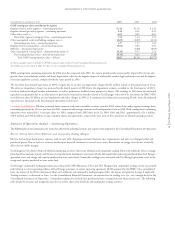

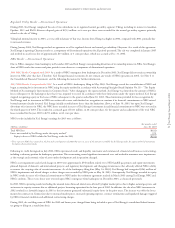

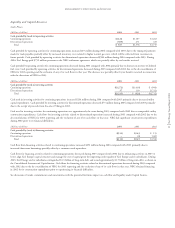

Interest Expense Deductibility PSCo’s wholly owned subsidiary, PSR Investments, Inc. (PSRI), owns and manages permanent life insurance policies,

known as COLI policies, on some of PSCo’s employees. At various times, borrowings have been made against the cash values of these COLI policies

and deductions taken on the interest expense on these borrowings. The IRS has challenged the deductibility of such interest expense deductions and has

disallowed the deductions taken in tax years 1993 through 1999. Should the IRS ultimately prevail on this issue, tax and interest payable through

Dec. 31, 2004, would reduce earnings by an estimated $311 million. In 2004, Xcel Energy received formal notification that the IRS will seek penalties.

If penalties (plus associated interest) are also included, the total exposure through Dec. 31, 2004, is approximately $368 million. Xcel Energy estimates its

annual earnings for 2005 would be reduced by $40 million, after tax, which represents 9 cents per share, if COLI interest expense deductions were

no longer available. See Note 16 to the Consolidated Financial Statements for further discussion.

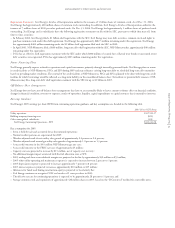

Accounting for Uncertain Tax Positions In late July 2004, the Financial Accounting Standards Board (FASB) discussed potential changes or clarifications

in the criteria for recognition of tax benefits, which may result in raising the threshold for recognizing tax benefits, which have some degree of uncertainty.

The FASB has not issued any proposed guidance, but an exposure draft may be released in the first quarter of 2005. Xcel Energy is unable to determine

the impact or timing of any potential accounting changes required by the FASB, but such changes could have a material financial impact.

Environmental Matters

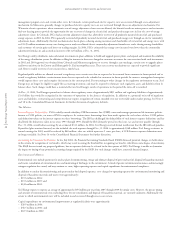

Environmental costs include payments for nuclear plant decommissioning, storage and ultimate disposal of spent nuclear fuel, disposal of hazardous materials

and wastes, remediation of contaminated sites and monitoring of discharges to the environment. A trend of greater environmental awareness and increasingly

stringent regulation has caused, and may continue to cause, higher operating expenses and capital expenditures for environmental compliance.

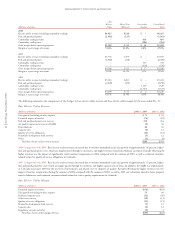

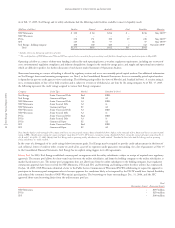

In addition to nuclear decommissioning and spent nuclear fuel disposal expenses, costs charged to operating expenses for environmental monitoring and

disposal of hazardous materials and wastes were approximately:

– $133 million in 2004;

– $133 million in 2003; and

– $138 million in 2002.

Xcel Energy expects to expense an average of approximately $154 million per year from 2005 through 2009 for similar costs. However, the precise timing

and amount of environmental costs, including those for site remediation and disposal of hazardous materials, are currently unknown. Additionally, the

extent to which environmental costs will be included in and recovered through rates is not certain.

Capital expenditures on environmental improvements at regulated facilities were approximately:

– $20.9 million in 2004;

– $58.5 million in 2003; and

– $107.8 million in 2002.