Xcel Energy 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

68

Effective Dec. 31, 2004, Xcel Energy raised its initial medical trend assumption from 6.5 percent to 9.0 percent and lowered the ultimate trend assumption

from 5.5 percent to 5.0 percent. The period until the ultimate rate is reached also was increased from two years to six years. This trend assumption was used

to value the actuarial benefit obligations at year-end 2004, and will be used in 2005 retiree medical cost determinations. Xcel Energy bases its medical trend

assumption on the long-term cost inflation expected in the health care market, considering the levels projected and recommended by industry experts, as

well as recent actual medical cost increases experienced by Xcel Energy’s retiree medical plan.

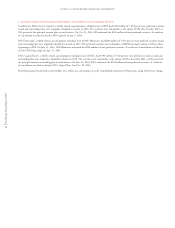

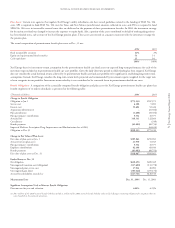

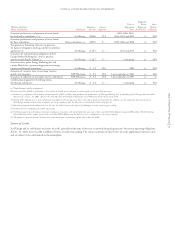

A 1-percent change in the assumed health care cost trend rate would have the following effects:

(Thousands of dollars)

1-percent increase in APBO components at Dec. 31, 2004 $107,208

1-percent decrease in APBO components at Dec. 31, 2004 $ (88,864)

1-percent increase in service and interest components of the net periodic cost $ 8,052

1-percent decrease in service and interest components of the net periodic cost $ (6,543)

The employer subsidy for retiree medical coverage was eliminated for former New Century Energies, Inc. nonbargaining employees who retire after

July 1, 2003.

Xcel Energy’s subsidiary, Viking, was sold on Jan. 17, 2003. The sale created a one-time curtailment gain of $0.8 million. NRG participants withdrew

from the retiree life plan, resulting in a $1.3 million one-time curtailment gain in 2003.

NRG employees’ participation in the Xcel Energy postretirement health care plan ended when NRG emerged from bankruptcy on Dec. 5, 2003.

A settlement gain of $0.9 million was recognized.

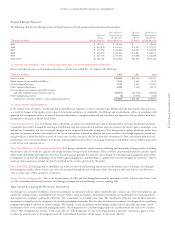

Cash Flows The postretirement health care plans have no funding requirements under income tax and other retirement-related regulations other

than fulfilling benefit payment obligations, when claims are presented and approved under the plans. Additional cash funding requirements are

prescribed by certain state and federal rate regulatory authorities, as discussed previously. Xcel Energy expects to contribute approximately $73 million

during 2005.

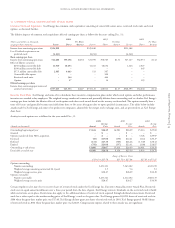

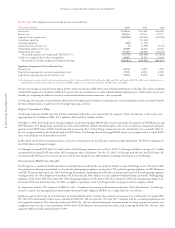

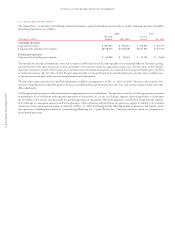

Benefit Costs The components of net periodic postretirement benefit costs are:

(Thousands of dollars) 2004 2003 2002

Service cost $ 6,100 $ 5,893 $ 7,173

Interest cost 52,604 52,426 50,135

Expected return on plan assets (23,066) (22,185) (21,030)

Curtailment (gain) loss –(2,128) –

Settlement (gain) loss –(916) –

Amortization of transition obligation 14,578 15,426 16,771

Amortization of prior service cost (credit) (2,179) (1,533) (1,130)

Amortization of net loss (gain) 21,651 15,409 5,380

Net periodic postretirement benefit cost (credit) under SFAS No. 106 (a) 69,688 62,392 57,299

Additional cost recognized due to effects of regulation 3,891 3,883 4,043

Net cost recognized for financial reporting $73,579 $66,275 $61,342

Significant assumptions used to measure costs (income)

Discount rate 6.25% 6.75% 7.25%

Expected average long-term rate of return on assets (pretax) 5.50%–8.50% 8.00%–9.00% 9.00%

(a) Includes amounts related to discontinued operations of $1.3 million of cost in 2004, $(1.9) million of cost in 2003 and $3.6 million of cost in 2002.

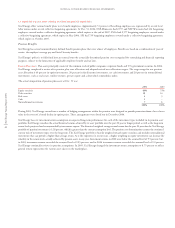

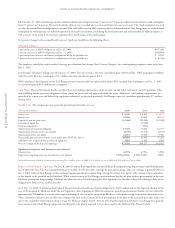

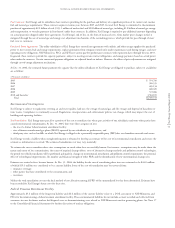

Impact of 2003 Medicare Legislation On Dec. 8, 2003, President Bush signed into law the Medicare Prescription Drug, Improvement and Modernization

Act of 2003 (the Act). The Act expanded Medicare to include, for the first time, coverage for prescription drugs. This new coverage is generally effective

Jan. 1, 2006. Many of Xcel Energy’s retiree medical programs provide prescription drug coverage for retirees over age 65 with coverage at least equivalent

to the benefit to be provided under Medicare. While retirees remain in Xcel Energy’s postretirement health care plan without participating in the new

Medicare prescription drug coverage, Medicare will share the cost of Xcel Energy’s plan. This legislation has therefore reduced Xcel Energy’s share of the

obligation for future retiree medical benefits.

As of Dec. 31, 2003, Xcel Energy had reduced the postretirement health care benefit obligation by $64.6 million due to the expected sharing of the

cost of the program by Medicare under the new legislation. Also, beginning in 2004, the annual net periodic postretirement benefit cost was reduced by

approximately $10 million as a result of the expected sharing of the cost of the program by Medicare, with similar savings expected in subsequent years.

These estimated reductions do not reflect any changes that may result in future levels of participation in the plan or the associated per-capita claims cost

due to the availability of prescription drug coverage for Medicare-eligible retirees. Also, in reflecting this legislation, Medicare cost sharing for a plan has

been assumed only if Xcel Energy’s projected contribution to the plan is expected to be at least equal to the Medicare Part D basic benefit.