Xcel Energy 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

73

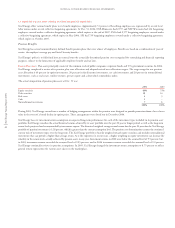

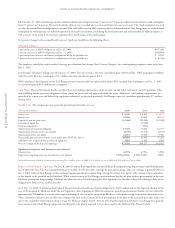

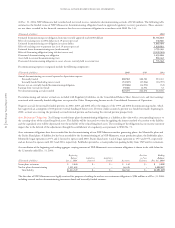

Triggering

Term or Event Assets

(Millions of dollars) Guarantee Current Expiration Requiring Held as

Nature of Guarantee Guarantor Amount Exposure Date Performance Collateral

Guarantee performance and payment of surety bonds 2005–2008, 2012,

for itself and its subsidiaries (c) (g) Xcel Energy $109.0 $7.4 2014, 2015 and 2022 (d) N/A

Guarantee performance and payment of surety bonds

for those subsidiaries Various subsidiaries (g) $292.9 $ – 2005, 2006 and 2008 (d) N/A

Two guarantees benefiting Cheyenne to guarantee

the payment obligations under gas and power purchase

agreements (h) Xcel Energy $ 26.5 $ – 2011 and 2013 (a) N/A

Guarantee the indemnification obligations of Xcel

Energy Markets Holdings Inc. under a purchase

agreement with Border Viking Co. Xcel Energy $ 30.7 $ – Continuing (b) N/A

Guarantees for e prime Energy Marketing Inc. and

e prime Florida Inc.’s guaranteeing payments of energy,

capacity and financial transactions Xcel Energy $ 5.0 $0.3 2005 (a) N/A

Guarantee of customer loans to encourage business

growth and expansion NSP-Wisconsin $ 0.4 $0.4 Latest expiration in 2006 (e) N/A

Guarantee of collection of receivables sold to a third party NSP-Minnesota $ 0.4 $0.4 Latest expiration in 2007 (a) (f)

Combination of guarantees benefiting various

Xcel Energy subsidiaries Xcel Energy $ 4.8 $ – Continuing (a) N/A

(a) Nonperformance and/or nonpayment.

(b) Losses caused by default in performance of covenants or breach of any warranty or representation in the purchase agreement.

(c) Includes one performance bond with a notional amount of $11.1 million that guarantee the performance of Planergy Housing Inc., a subsidiary of Xcel Energy that was sold to

Ameresco Inc. on Dec. 12, 2003. Ameresco Inc. has agreed to indemnify Xcel Energy for any liability arising out of any surety bond.

(d) Failure of Xcel Energy or one of its subsidiaries to perform under the agreement that is the subject of the relevant bond. In addition, per the indemnity agreement between

Xcel Energy and the various surety companies, the surety companies have the discretion to demand that collateral be posted.

(e) Non-timely payment of the obligations or at the time the debtor becomes the subject of bankruptcy or other insolvency proceedings.

(f) Security interest in underlying receivable agreements.

(g) Xcel Energy agreed to indemnify an insurance company in connection with surety bonds they may issue or have issued for Utility Engineering up to $80 million. The Xcel Energy

indemnification will be triggered only in the event that Utility Engineering has failed to meet its obligations to the surety company.

(h) The guarantees associated with Cheyenne were terminated upon consummation of the sale on Jan. 21, 2005.

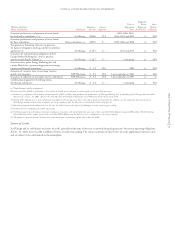

Letters of Credit

Xcel Energy and its subsidiaries use letters of credit, generally with terms of one year, to provide financial guarantees for certain operating obligations.

At Dec. 31, 2004, there was $82.2 million of letters of credit outstanding. The contract amounts of these letters of credit approximate their fair value

and are subject to fees determined in the marketplace.