Xcel Energy 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

64

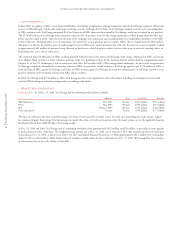

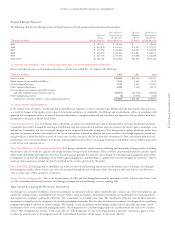

12. BENEFIT PLANS AND OTHER POSTRETIREMENT BENEFITS

Xcel Energy offers various benefit plans to its benefit employees. Approximately 51 percent of benefiting employees are represented by several local

labor unions under several collective-bargaining agreements. At Dec. 31, 2004, NSP-Minnesota had 2,197 and NSP-Wisconsin had 414 bargaining

employees covered under a collective-bargaining agreement, which expires at the end of 2007. PSCo had 2,177 bargaining employees covered under

a collective-bargaining agreement, which expires in May 2006. SPS had 739 bargaining employees covered under a collective-bargaining agreement,

which expires in October 2005.

Pension Benefits

Xcel Energy has several noncontributory, defined benefit pension plans that cover almost all employees. Benefits are based on a combination of years of

service, the employee’s average pay and Social Security benefits.

Xcel Energy’s policy is to fully fund into an external trust the actuarially determined pension costs recognized for ratemaking and financial reporting

purposes, subject to the limitations of applicable employee benefit and tax laws.

Pension Plan Assets Plan assets principally consist of the common stock of public companies, corporate bonds and U.S. government securities. In 2004,

Xcel Energy completed a review of its pension plan asset allocation and adopted revised asset allocation targets. The target range for our pension

asset allocation is 60 percent in equity investments, 20 percent in fixed income investments, no cash investments and 20 percent in nontraditional

investments, such as real estate, timber ventures, private equity and a diversified commodities index.

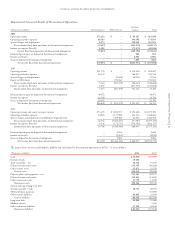

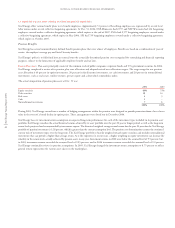

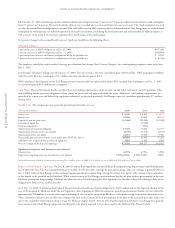

The actual composition of pension plan assets at Dec. 31 was:

2004 2003

Equity securities 69% 75%

Debt securities 19 14

Real estate 43

Cash 1–

Nontraditional investments 78

100% 100%

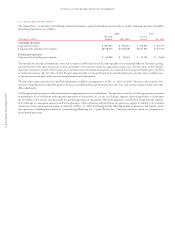

During 2003, Xcel Energy entered into a number of hedging arrangements within the pension trust designed to provide protection from a loss of asset

value in the event of a broad decline in equity prices. These arrangements were closed out in December 2004.

Xcel Energy bases its investment-return assumption on expected long-term performance for each of the investment types included in its pension asset

portfolio. Xcel Energy considers the actual historical returns achieved by its asset portfolio over the past 20-year or longer period, as well as the long-term

return levels projected and recommended by investment experts. The historical weighted average annual return for the past 20 years for the Xcel Energy

portfolio of pension investments is 12.8 percent, which is greater than the current assumption level. The pension cost determinations assume the continued

current mix of investment types over the long term. The Xcel Energy portfolio is heavily weighted toward equity securities and includes nontraditional

investments that can provide a higher-than-average return. As is the experience in recent years, a higher weighting in equity investments can increase the

volatility in the return levels actually achieved by pension assets in any year. Investment returns in 2002 were below the assumed level of 9.5 percent, but

in 2003 investment returns exceeded the assumed level of 9.25 percent, and in 2004 investment returns exceeded the assumed level of 9.0 percent.

Xcel Energy continually reviews its pension assumptions. In 2005, Xcel Energy changed the investment-return assumption to 8.75 percent to reflect

general return expectations for various asset classes in the marketplace.