Xcel Energy 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

50

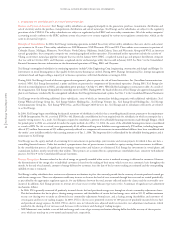

proceeds. If several designated responsible parties exist, only Xcel Energy’s expected share of the cost is estimated and recorded. Any future costs of

restoring sites where operation may extend indefinitely are treated as a capitalized cost of plant retirement. The depreciation expense levels recoverable

in rates include a provision for removal expenses, which has the latitude to compensate for final remediation costs. Removal costs recovered in rates

are classified as a regulatory liability.

Legal Costs Litigation settlements are recorded when it is probable Xcel Energy is liable for the costs and the liability can be reasonably estimated. Legal

accruals are recorded net of insurance recovery. Legal costs related to settlements are not accrued, but expensed as incurred.

Income Taxes Xcel Energy and its domestic subsidiaries file consolidated federal income tax returns. NRG and its domestic subsidiaries were included

in Xcel Energy’s consolidated federal income tax returns prior to NRG’s March 2001 public equity offering. Xcel Energy and its domestic subsidiaries

file combined and separate state income tax returns. NRG and one or more of its domestic subsidiaries were included in some, but not all, of these

combined returns in 2002 and 2003. NRG will not be consolidated or combined in any of Xcel Energy’s income tax returns after 2003.

Federal income taxes paid by Xcel Energy, as parent of the Xcel Energy consolidated group, are allocated to the Xcel Energy subsidiaries based on separate

company computations of tax. A similar allocation is made for state income taxes paid by Xcel Energy in connection with combined state filings. In

accordance with PUHCA requirements, the holding company also allocates its own net income tax benefits to its direct subsidiaries based on the positive

tax liability of each company.

Xcel Energy defers income taxes for all temporary differences between pretax financial and taxable income, and between the book and tax bases of assets

and liabilities. Xcel Energy uses the tax rates that are scheduled to be in effect when the temporary differences are expected to turn around, or reverse.

Due to the effects of past regulatory practices, when deferred taxes were not required to be recorded, the reversal of some temporary differences are accounted

for as current income tax expense. Investment tax credits are deferred and their benefits amortized over the estimated lives of the related property. Utility

rate regulation also has created certain regulatory assets and liabilities related to income taxes, which are summarized in Note 18 to the Consolidated

Financial Statements.

Use of Estimates In recording transactions and balances resulting from business operations, Xcel Energy uses estimates based on the best information

available. Estimates are used for such items as plant depreciable lives, tax provisions, uncollectible amounts, environmental costs, unbilled revenues,

jurisdictional fuel and energy cost allocations and actuarially determined benefit costs. The recorded estimates are revised when better information

becomes available or when actual amounts can be determined. Those revisions can affect operating results. The depreciable lives of certain plant assets

are reviewed or revised annually, if appropriate.

Cash and Cash Equivalents Xcel Energy considers investments in certain debt instruments with a remaining maturity of three months or less at the time

of purchase to be cash equivalents. Those debt instruments are primarily commercial paper and money market funds.

Restricted cash in 2003 consisted primarily of funds received from NRG to be used to collateralize in full existing agreements of Xcel Energy to indem-

nify NRG, which continued after the divestiture of NRG. Restricted cash is classified as a current asset as all restricted cash is designated for interest

and principal payments due within one year.

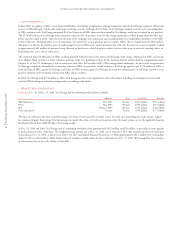

Inventory All inventory is recorded at average cost, with the exception of natural gas in underground storage at PSCo, which until 2004 was recorded using

last-in-first-out pricing (LIFO). Effective Jan. 1, 2004, PSCo changed its method of accounting for the cost of stored natural gas for its local distribution

operations from the LIFO pricing method to the average cost pricing method. This change in accounting was approved by the CPUC and was accounted

for as a cumulative effect in accordance with the CPUC authorization. The average cost method has historically been used for pricing stored natural gas

by both NSP-Minnesota and NSP-Wisconsin, as well as by PSCo for natural gas stored for use in its electric utility operations.

The cumulative effect of this change in accounting principle resulted in an increase to natural gas storage inventory and a corresponding decrease to the

deferred natural gas cost accounts of approximately $36 million as of Jan. 1, 2004. Of this amount, $33 million related to current natural gas storage

inventory and $3 million related to long-term natural gas storage inventory. As natural gas costs are 100 percent recoverable for PSCo’s local natural gas

distribution operations under PSCo’s natural gas cost-adjustment mechanism, the cumulative effect of this change had no impact on net income or

earnings per share. Prior period financial statements were not restated since the CPUC authorized this change effective Jan. 1, 2004. Under the natural

gas cost-adjustment mechanism, the decrease in the cost of natural gas reduced rates to retail natural gas customers in Colorado during 2004.

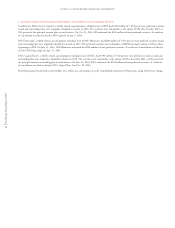

Regulatory Accounting Our regulated utility subsidiaries account for certain income and expense items in accordance with SFAS No. 71 – “Accounting

for the Effects of Certain Types of Regulation.” Under SFAS No. 71:

– certain costs, which would otherwise be charged to expense, are deferred as regulatory assets based on the expected ability to recover them in future

rates; and

– certain credits, which would otherwise be reflected as income, are deferred as regulatory liabilities based on the expectation they will be returned to

customers in future rates.

Estimates of recovering deferred costs and returning deferred credits are based on specific ratemaking decisions or precedent for each item. Regulatory

assets and liabilities are amortized consistent with the period of expected regulatory treatment. See more discussion of regulatory assets and liabilities

at Note 18 to the Consolidated Financial Statements.