Xcel Energy 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION and ANALYSIS

Xcel Energy Annual Report 2004

37

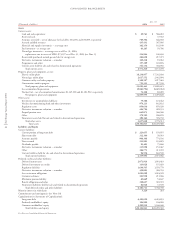

Registration Statements Xcel Energy’s Articles of Incorporation authorize the issuance of 1 billion shares of common stock. As of Dec. 31, 2004,

Xcel Energy had approximately 400 million shares of common stock outstanding. In addition, Xcel Energy’s Articles of Incorporation authorize the

issuance of 7 million shares of $100 par value preferred stock. On Dec. 31, 2004, Xcel Energy had approximately 1 million shares of preferred stock

outstanding. Xcel Energy and its subsidiaries have the following registration statements on file with the SEC, pursuant to which they may sell, from

time to time, securities:

– In February 2002, Xcel Energy filed a $1 billion shelf registration with the SEC. Xcel Energy may issue debt securities, common stock and rights to

purchase common stock under this shelf registration. Xcel Energy has approximately $482.5 million remaining under this registration. Xcel Energy

has approximately $400 million remaining under the $1 billion shelf registration filed with the SEC in 2000.

– In April 2001, NSP-Minnesota filed a $600 million, long-term debt shelf registration with the SEC. NSP-Minnesota has approximately $40 million

remaining under this registration.

– PSCo has an effective shelf registration statement with the SEC under which $800 million of secured first collateral trust bonds or unsecured senior

debt securities were registered. PSCo has approximately $225 million remaining under this registration.

Future Financing Plans

Xcel Energy generally expects to fund its operations and capital investments primarily through internally generated funds. Xcel Energy plans to renew

its credit facilities at NSP-Minnesota, PSCo and SPS during 2005 and may refinance existing long-term debt or scheduled long-term debt maturities

based on prevailing market conditions. The renewal of the credit facilities at NSP-Minnesota, PSCo and SPS is planned to be done with long-term credit

facilities for which borrowings would be reflected as a long-term liability on the consolidated balance sheet. To facilitate its potential debt issuances, NSP-

Minnesota may file a long-term debt shelf registration statement with the SEC for up to $1 billion in 2005.

Off-Balance-Sheet Arrangements

Xcel Energy does not have any off-balance-sheet arrangements that have or are reasonably likely to have a current or future effect on financial condition,

changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

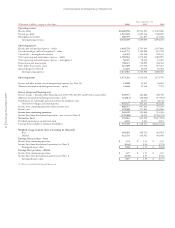

Earnings Guidance

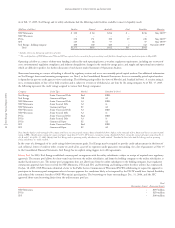

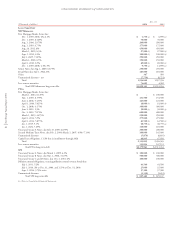

Xcel Energy’s 2005 earnings per share (EPS) from continuing operations guidance and key assumptions are detailed in the following table.

2005 Diluted EPS Range

Utility operations $1.27–$1.37

Holding company financing costs (0.11)

Other nonregulated subsidiaries 0.02

Xcel Energy Continuing Operations – EPS $1.18–$1.28

Key assumptions for 2005:

– Seren is held for sale and accounted for as discontinued operations;

– Normal weather patterns are experienced for 2005;

– Weather-adjusted retail electric utility sales growth of approximately 2.0 percent to 2.4 percent;

– Weather-adjusted retail natural gas utility sales growth of approximately 1.0 percent to 1.3 percent;

– A successful outcome in the $9.9 million NSP-Minnesota gas rate case;

– A successful outcome in the FERC rate case of approximately $5 million;

– Capacity costs are projected to increase by $15 million, net of capacity cost recovery;

– No additional margin impact associated with the fuel allocation issue at SPS;

– 2005 trading and short-term wholesale margins are projected to decline by approximately $30 million to $55 million;

– 2005 other utility operating and maintenance expense is expected to increase between 2 percent to 3 percent;

– 2005 depreciation expense is projected to increase approximately 7 percent to 8 percent;

– 2005 interest expense is projected to increase approximately $10 million to $15 million;

– Allowance for funds used during construction-equity is projected to be relatively flat;

– Xcel Energy continues to recognize COLI tax benefits of 9 cents per share in 2005;

– The effective tax rate for continuing operations is expected to be approximately 28 percent to 31 percent; and

– Average common stock and equivalents of approximately 426 million shares in 2005, based on the “If Converted” method for convertible notes.