Xcel Energy 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

54

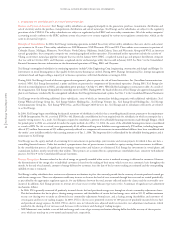

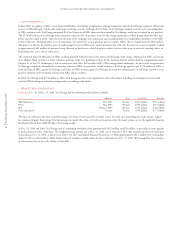

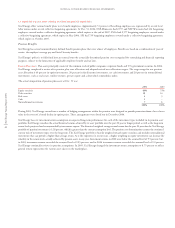

Nonregulated Subsidiaries – All Other Segment

On Sept. 27, 2004, Xcel Energy’s board of directors approved management’s plan to pursue the sale of Seren Innovations, Inc., a wholly owned broadband

communications services subsidiary. Seren delivers cable television, high-speed Internet and telephone service over an advanced network to approximately

45,000 customers in St. Cloud, Minn., and Concord and Walnut Creek, Calif. An after-tax impairment charge, including disposition costs, of $143 million,

or 34 cents per share, was recorded in 2004. Xcel Energy expects to complete the sale in mid-2005.

Xcel Energy International and e prime In December 2003, the board of directors of Xcel Energy approved management’s plan to exit the businesses

conducted by its nonregulated subsidiaries Xcel Energy International and e prime. The exit of all business conducted by e prime was completed in 2004.

Results of discontinued nonregulated operations in 2004 include the impact of the sale of the Argentina subsidiaries of Xcel Energy International. The sales

took place in a series of three transactions with a total sales price of approximately $31 million. Approximately $15 million of the sales price was placed

in escrow, which is expected to remain in place until at least the end of the first quarter of 2005, to support Xcel Energy’s customary indemnity

obligations under the sales agreement. In addition to the sales price, Xcel Energy also received approximately $21 million at the closing of one

transaction as redemption of its capital investment. The sales resulted in a gain of approximately $8 million, including the realization of approximately

$7 million of income tax benefits realizable upon sale of the Xcel Energy International assets.

Results of discontinued nonregulated operations in 2003, other than NRG, include an after-tax loss expected on the disposal of all Xcel Energy International

assets of $59 million, based on the estimated fair value of such assets. The fair value represents a market bid or appraisal received that is believed to best reflect

the assets’ fair value at Dec. 31, 2003. Xcel Energy’s remaining investment in Xcel Energy International at Dec. 31, 2003, was approximately $39 million.

Losses from discontinued nonregulated operations in 2003 also include a charge of $16 million for costs of settling a Commodity Futures Trading

Commission trading investigation of e prime.

Tax Benefits Related to Investment in NRG With NRG’s emergence from bankruptcy in December 2003, Xcel Energy divested its ownership interest

in NRG. Xcel Energy has recognized tax benefits related to the divestiture. These tax benefits, since related to Xcel Energy’s investment in discontinued

NRG operations, also are reported as discontinued operations.

During 2002, Xcel Energy recognized tax benefits of $706 million. This benefit was based on the estimated tax basis of Xcel Energy’s cash and stock

investments already made in NRG, and their deductibility for federal income tax purposes. Based on the results of a 2003 study, Xcel Energy recorded

$105 million of additional tax benefits in 2003, reflecting an updated estimate of the tax basis of Xcel Energy’s investments in NRG and state tax

deductibility. Upon NRG’s emergence from bankruptcy in December 2003, an additional $288 million of tax benefit was recorded to reflect the deductibility

of the settlement payment of $752 million, uncollectible receivables from NRG, other state tax benefits and further adjustments to the estimated tax

basis in NRG. Another $11 million of state tax benefits were accrued earlier in 2003 based on projected impacts. In 2004, the NRG basis study was

completed and previously recognized tax benefits were reduced by $16 million.