Xcel Energy 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

79

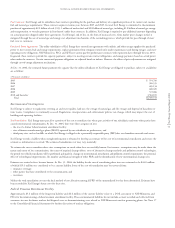

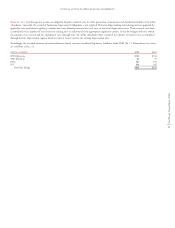

Xcel Energy Inc. Securities Class Action Litigation On July 31, 2002, a lawsuit purporting to be a class action on behalf of purchasers of Xcel Energy’s

common stock between Jan. 31, 2001, and July 26, 2002, was filed in the U.S. District Court for the District of Minnesota. The complaint named

Xcel Energy and current and former Xcel Energy and NRG executives as defendants. Among other things, the complaint alleged violations of Section

10(b) of the Securities Exchange Act and Rule 10(b-5) related to allegedly false and misleading disclosures concerning various issues including but not

limited to “round trip” energy trades, the nature, extent and seriousness of liquidity and credit difficulties at NRG and the existence of cross-default

provisions (with NRG credit agreements) in certain of Xcel Energy’s credit agreements. After filing the lawsuit, several additional lawsuits were filed

with similar allegations and all have been consolidated. On Jan. 14, 2005, the District Court issued an order of preliminary approval for a settlement

reached by the parties. Under the terms of the settlement, the plaintiffs are to receive $80 million, with Xcel Energy’s insurance carriers paying

$62.5 million, and Xcel Energy paying $17.5 million. Xcel Energy’s portion of the settlement payment was accrued at Dec. 31, 2004. A hearing to

consider final approval of the settlement is scheduled for April 1, 2005.

Xcel Energy Inc. Shareholder Derivative Action – Edith Gottlieb vs. Xcel Energy Inc. et al.; Essmacher vs. Brunetti; McLain vs. Brunetti In August 2002,

a shareholder derivative action was filed in the U.S. District Court for the District of Minnesota (Gottlieb), purportedly on behalf of Xcel Energy,

against the directors and certain present and former officers, citing allegedly false and misleading disclosures concerning various issues and asserting

breach of fiduciary duty. This action has been consolidated for pre-trial purposes with other similar securities class actions and an amended complaint

was filed. A settlement in the federal derivative lawsuit was reached in December 2004 and given preliminary approval by the District Court in an order

dated Jan. 14, 2005. Under the terms of the settlement, Xcel Energy agreed to adopt certain corporate governance measures and pay plaintiff’s attorneys’

fees and expenses in an amount not to exceed $125,000. A hearing to consider final approval of this settlement is scheduled for April 1, 2005.

Xcel Energy Employee ERISA Actions – Newcome vs. Xcel Energy Inc.; Barday vs. Xcel Energy Inc. On Sept. 23, 2002, and Oct. 9, 2002, two essentially

identical actions were filed in the U.S. District Court for the District of Colorado, purportedly on behalf of classes of employee participants in Xcel Energy’s

and its predecessors’ 401(k) or ESOP plans, from as early as Sept. 23, 1999, forward. The complaints in the actions name as defendants Xcel Energy,

its directors, certain former directors and certain present and former officers. The complaints allege violations of the ERISA in the form of breach of

fiduciary duty in allowing or encouraging purchase, contribution and/or retention of Xcel Energy’s common stock in the plans and making misleading

statements and omissions in that regard. On Jan. 14, 2005, the District Court issued an order of preliminary approval related to a settlement reached by

the parties. Under the terms of the settlement, plaintiffs are to receive a payment of $8 million, which will be paid by Xcel Energy’s insurance carrier.

Xcel Energy also agreed, subject to the provisions of the applicable collective bargaining agreement, to undertake to amend the Xcel Energy 401(k)

savings plan and its predecessor plans and the New Century Energies employees’ and stock ownership plan for bargaining unit and former nonbargaining

unit employees, by permitting certain diversification of Xcel Energy stock held in participants’ accounts in portions of these plans. A hearing is scheduled

for April 1, 2005, to consider final approval of this settlement.

SchlumbergerSema, Inc. vs. Xcel Energy Inc. (NSP-Minnesota) Under a 1996 data services agreement, SchlumbergerSema, Inc. (SLB) provides automated

meter reading, distribution automation and other data services to NSP-Minnesota. In September 2002, NSP-Minnesota issued written notice that

SLB committed events of default under the agreement, including SLB’s nonpayment of approximately $7.4 million for distribution automation assets.

In November 2002, SLB demanded arbitration and asserted various claims against NSP-Minnesota totaling approximately $24 million for alleged breach

of an expansion contract and a meter purchasing contract. In the arbitration, NSP-Minnesota asserted counterclaims against SLB, including those related

to SLB’s failure to meet performance criteria, improper billing, failure to pay for use of NSP-Minnesota owned property and failure to pay $7.4 million

for NSP-Minnesota distribution automation assets, for total claims of approximately $41 million. NSP-Minnesota also sought a declaratory judgment

from the arbitrators that would terminate SLB’s rights under the data services agreement. In August 2004, the U.S. Bankruptcy Court for the District

of Delaware ruled that claims related to use of certain equipment are barred unless NSP-Minnesota can establish a basis for the claims in SLB’s conduct

subsequent to the time of the assumption of this contract by SLB. If NSP-Minnesota can establish that basis, the decision would reduce NSP-Minnesota’s

damage claim by approximately $5.5 million.

Texas-Ohio Energy, Inc. vs. Centerpoint Energy et al. On Nov. 19, 2003, a class action complaint filed in the U.S. District Court for the Eastern District

of California by Texas-Ohio Energy, Inc., was served on Xcel Energy naming e prime as a defendant. The lawsuit, filed on behalf of a purported class of

large wholesale natural gas purchasers, alleges that e prime falsely reported natural gas trades to market trade publications in an effort to artificially

raise natural gas prices in California. The case has been conditionally transferred to U.S. District Judge Pro in Nevada, who is supervising western

areas wholesale natural gas marketing litigation. A motion is currently pending to transfer the case back to the Eastern District of California. The case

is in the early stages, there has been no discovery and Xcel Energy intends to vigorously defend against these claims.

Cornerstone Propane Partners, L.P. et al. vs. e prime inc. et al. On Feb. 2, 2004, a purported class action complaint was filed in the U.S. District Court

for the Southern District of New York against e prime and three other defendants by Cornerstone Propane Partners, L.P., Robert Calle Gracey and

Dominick Viola on behalf of a class who purchased or sold one or more New York Mercantile Exchange natural gas futures and/or options contracts

during the period from Jan. 1, 2000, to Dec. 31, 2002. The complaint alleges that defendants manipulated the price of natural gas futures and options

and/or the price of natural gas underlying those contracts in violation of the Commodities Exchange Act. In February 2004, the plaintiff requested that

this action be consolidated with a similar suit involving Reliant Energy Services. In February 2004, defendants, including e prime, filed motions to

dismiss. In September 2004, the U.S. District Court denied the motions to dismiss. The case is in the early stages, there has been little discovery and

Xcel Energy intends to vigorously defend against these claims.