Xcel Energy 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION and ANALYSIS

Xcel Energy Annual Report 2004

29

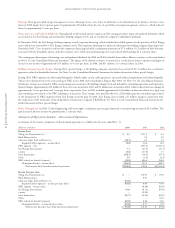

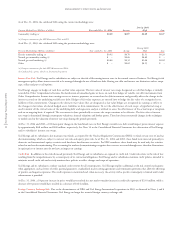

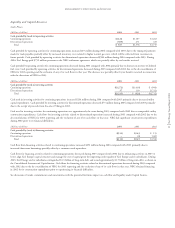

The regulated utilities expect to incur approximately $221 million in capital expenditures for compliance with environmental regulations and environmental

improvements in 2005 and approximately $980 million of related expenditures during the period from 2006 through 2009. Approximately $171 million

and $787 million of these expenditures, respectively, are related to modifications to reduce the emissions of NSP-Minnesota’s generating plants located in

the Minneapolis-St. Paul metropolitan area pursuant to the metropolitan emissions reduction project, which are recoverable from customers through cost-

recovery mechanisms. See Notes 16 and 17 to the Consolidated Financial Statements for further discussion of Xcel Energy’s environmental contingencies.

Impact of Nonregulated Investments

In the past, Xcel Energy’s investments in nonregulated operations have had a significant impact on its results of operations. As a result of the divestiture

of NRG and other nonregulated operations, Xcel Energy does not expect that its investments in nonregulated operations will continue to have such a

significant impact on its results. Xcel Energy does not expect to make any material investments in nonregulated projects. Xcel Energy’s remaining

nonregulated businesses may carry a higher level of risk than its traditional utility businesses.

Inflation

Inflation at its current level is not expected to materially affect Xcel Energy’s prices or returns to shareholders.

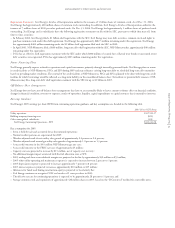

Critical Accounting Policies and Estimates

Preparation of the Consolidated Financial Statements and related disclosures in compliance with GAAP requires the application of appropriate technical

accounting rules and guidance, as well as the use of estimates. The application of these policies necessarily involves judgments regarding future events,

including the likelihood of success of particular projects, legal and regulatory challenges and anticipated recovery of costs. These judgments, in and of

themselves, could materially impact the Consolidated Financial Statements and disclosures based on varying assumptions, which may be appropriate to

use. In addition, the financial and operating environment also may have a significant effect, not only on the operation of the business, but on the results

reported through the application of accounting measures used in preparing the Consolidated Financial Statements and related disclosures, even if the

nature of the accounting policies applied have not changed. The following is a list of accounting policies that are most significant to the portrayal of

Xcel Energy’s financial condition and results, and that require management’s most difficult, subjective or complex judgments. Each of these has a higher

potential likelihood of resulting in materially different reported amounts under different conditions or using different assumptions. Each critical

accounting policy has been discussed with the audit committee of the Xcel Energy board of directors.

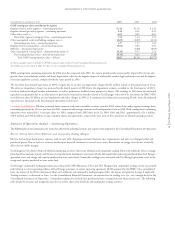

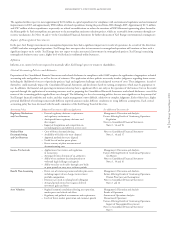

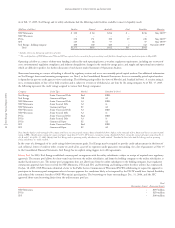

Accounting Policy Judgments/Uncertainties Affecting Application See Additional Discussion At

Regulatory Mechanisms – External regulatory decisions, requirements Management’s Discussion and Analysis:

and Cost Recovery and regulatory environment Factors Affecting Results of Continuing Operations

– Anticipated future regulatory decisions and Regulation

their impact Notes to Consolidated Financial Statements

– Impact of deregulation and competition on Notes 1, 16 and 18

ratemaking process and ability to recover costs

Nuclear Plant – Costs of future decommissioning Notes to Consolidated Financial Statements

Decommissioning – Availability of facilities for waste disposal Notes 1, 16 and 17

and Cost Recovery – Approved methods for waste disposal

– Useful lives of nuclear power plants

– Future recovery of plant investment and

decommissioning costs

Income Tax Accruals – Application of tax statutes and regulations Management’s Discussion and Analysis:

to transactions Factors Affecting Results of Continuing Operations

– Anticipated future decisions of tax authorities Tax Matters

– Ability of tax authority decisions/positions to Notes to Consolidated Financial Statements

withstand legal challenges and appeals Notes 1, 10 and 16

– Ability to realize tax benefits through carry backs

to prior periods or carry overs to future periods

Benefit Plan Accounting – Future rate of return on pension and other plan assets, Management’s Discussion and Analysis:

including impacts of any changes to investment Factors Affecting Results of Continuing Operations

portfolio composition Pension Plan Costs and Assumptions

– Discount rates used in valuing benefit obligation Notes to Consolidated Financial Statements

– Actuarial period selected to recognize deferred Notes 1 and 12

investment gains and losses

Asset Valuation – Regional economic conditions affecting asset operation, Management’s Discussion and Analysis:

market prices and related cash flows Results of Operations

– Regulatory and political environments and requirements Statement of Operations Analysis–

– Levels of future market penetration and customer growth Discontinued Operations

Factors Affecting Results of Continuing Operations

Impact of Nonregulated Investments

Notes to Consolidated Financial Statements

Note 3