Xcel Energy 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

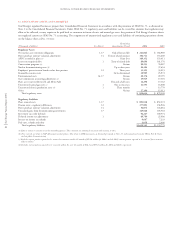

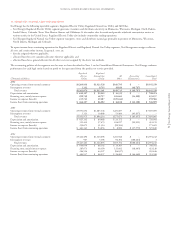

NOTES to CONSOLIDATED FINANCIAL STATEMENTS

Xcel Energy Annual Report 2004

80

Fairhaven Power Company vs. Encana Corporation et al. On Sept. 14, 2004, a class action complaint was filed in the U.S. District Court for the Eastern

District of California by Fairhaven Power Co. and subsequently served on Xcel Energy. The lawsuit, filed on behalf of a purported class of natural gas

purchasers, alleges that Xcel Energy falsely reported natural gas trades to market trade publications in an effort to artificially raise natural gas prices in

California and engaged in a conspiracy with other sellers of natural gas to inflate prices. The case is in the early stages, there has been no discovery and

Xcel Energy intends to vigorously defend against these claims.

Utility Savings and Refund Services LLP vs. Reliant Energy Services Inc. On Nov. 29, 2004, a class action complaint was filed in the U.S. District

Court for the Eastern District of California by Utility Savings and Refund Services LLP and subsequently served on Xcel Energy. The lawsuit, filed on

behalf of a purported class of natural gas purchasers, alleges that Xcel Energy falsely reported natural gas trades to market trade publications in an effort

to artificially raise natural gas prices in California and engaged in a conspiracy with other sellers of natural gas to inflate prices. The case is in the early

stages, there has been no discovery and Xcel Energy intends to vigorously defend against these claims.

Abelman Art Glass vs. Ercana Corporation et al. On Dec. 13, 2004, a class action complaint was filed in the U.S. District Court for the Eastern District

of California by Abelman Art Glass and subsequently served on Xcel Energy. The lawsuit, filed on behalf of a purported class of natural gas purchasers,

alleges that Xcel Energy falsely reported natural gas trades to market trade publications in an effort to artificially raise natural gas prices in California

and engaged in a conspiracy with other sellers of natural gas to inflate prices. The case is in the early stages, there has been no discovery and Xcel

Energy intends to vigorously defend against these claims.

Hill et al. vs. PSCo et al. In late October 2003, there were two wildfires in Colorado, one in Boulder County and the other in Douglas County. There

was no loss of life, but there was property damage associated with these fires. Parties have asserted that trees falling into Xcel Energy distribution lines may

have caused one or both fires. On Jan. 14, 2004, an action against PSCo relating to the fire in Boulder County was filed in Boulder County District

Court. There are now 46 plaintiffs, including individuals and insurance companies, and three co-defendants, including PSCo. The plaintiffs assert that

they are seeking in excess of $35 million in damages. Xcel Energy believes it has insurance coverage to mitigate the liability in this matter. The ultimate

financial impact to PSCo is not determinable at this time.

Other Contingencies

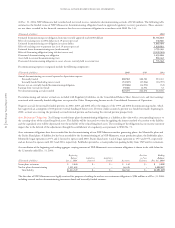

Tax Matters PSCo’s wholly owned subsidiary, PSRI, owns and manages permanent life insurance policies, known as COLI policies, on some of

PSCo’s employees. At various times, borrowings have been made against the cash values of these COLI policies and deductions taken on the interest

expense on these borrowings. The IRS has challenged the deductibility of such interest expense deductions and has disallowed the deductions taken

in tax years 1993 through 1999.

After consultation with tax counsel, Xcel Energy contends that the IRS determination is not supported by tax law. Based upon this assessment,

management believes that the tax deduction of interest expense on the COLI policy loans is in full compliance with the law. Accordingly, PSRI has

not recorded any provision for income tax or related interest or penalties that may be imposed by the IRS and has continued to take deductions

for interest expense related to policy loans on its income tax returns for subsequent years.

In April 2004, Xcel Energy filed a lawsuit in U.S. District Court for the District of Minnesota against the IRS to establish its entitlement to deduct

policy loan interest for tax years 1993 and 1994. In December 2004, Xcel Energy filed suit in U.S. Tax Court in Washington D.C. for tax years 1995

through 1997. Xcel Energy expects to request that the tax court stay its petition pending the decision in the District Court litigation. The litigation

could require several years to reach final resolution. Although the ultimate resolution of this matter is uncertain, it could have a material adverse effect

on Xcel Energy’s financial position and results of operations. Defense of Xcel Energy’s position may require significant cash outlays, which may or may

not be recoverable in a court proceeding.

Should the IRS ultimately prevail on this issue, tax and interest payable through Dec. 31, 2004, would reduce earnings by an estimated $311 million.

In 2004, Xcel Energy received formal notification that the IRS will seek penalties. If penalties (plus associated interest) also are included, the total exposure

through Dec. 31, 2004, is approximately $368 million. Xcel Energy estimates its annual earnings for 2004 would be reduced by $36 million, after tax,

which represents 8 cents per share, if COLI interest expense deductions were no longer available.

Accounting for Uncertain Tax Positions In late July 2004, the FASB discussed potential changes or clarifications in the criteria for recognition of tax

benefits, which may result in raising the threshold for recognizing tax benefits, which have some degree of uncertainty. The FASB has not issued any

proposed guidance, but an exposure draft may be released in the first quarter of 2005. Xcel Energy is unable to determine the impact or timing of

any potential accounting changes required by the FASB, but such changes could have a material financial impact.

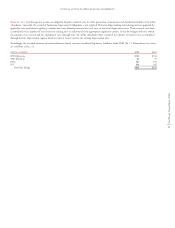

SPS Retail Fuel Cost Recovery Fuel and purchased energy costs are recovered in Texas through a fixed fuel and purchased energy recovery factor. In

May 2004, SPS filed with the PUCT its periodic request for fuel and purchased power cost recovery for electric generation and fuel management

activities for the period from January 2002 through December 2003. SPS requested approval of approximately $580 million of Texas-jurisdictional

fuel and purchased power costs for the two-year period. Intervenor and PUCT staff testimony was filed in October 2004 and hearings were held in

December 2004. Intervenor testimony contained objections to SPS’ methodology for assigning average fuel costs to wholesale sales, among other things.

Recovery of $49 million to $86 million of the requested amount was contested by multiple intervenors. SPS has recorded its best estimate of any

potential liability related to the impact of this proceeding. In January 2005, SPS filed its post-hearing briefs disputing the intervenor objections.

Reply briefs were filed on Feb. 15, 2005, the administrative law judge is expected to issue his recommended proposal for decision by the end of

April 2005, and PUCT action is expected by the end of May 2005. SPS is pursuing a settlement agreement with the parties involved.